The app reinstall is a sleeping giant in the mobile marketing industry. And it’s about to wake up.

Until now, mobile marketing experts have lacked a definitive means to measure app reinstalls, and consequently have remained widely unaware of them. The prevalence of reinstalls worldwide coupled with a new capability to measure them will massively impact how mobile marketers approach retention, engagement, and user acquisition.

TUNE measured a sample of more than 3.1 billion app installs between November 2017 and May 2018.

This report shares highlights of what we found, including:

- in some app categories, reinstall percentages are as high as 75%

- 98% of smartphone owners have reinstalled an app

- search drives 65% of all app reinstall behavior

- games are reinstalled 55% more frequently than non-game apps

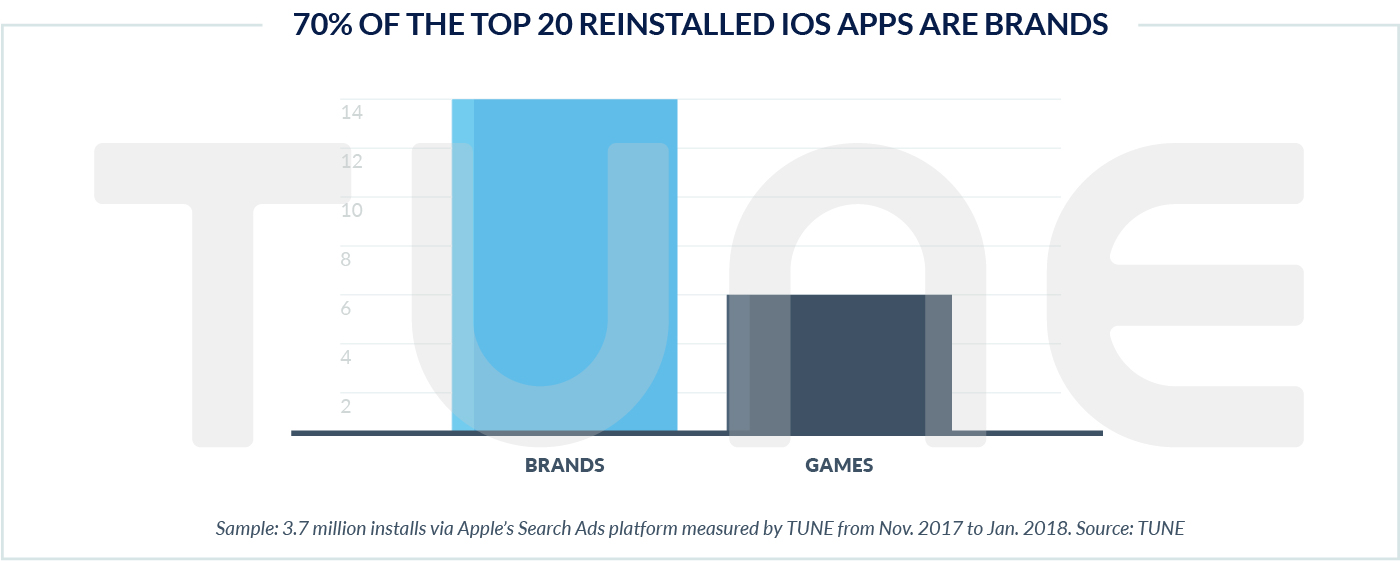

- large brands own 70% of the most-reinstalled apps on the iOS App Store

Simply stated, mobile app reinstalls are the single most significant and overlooked factor in the $10 billion mobile user acquisition ecosystem.

App Reinstalls and Mobile User Acquisition

Mobile user acquisition is a big business, raking in $10 billion to $15 billion globally in 2017 alone. It has also changed significantly in the past year.

User acquisition used to be just about getting installs. Today, it’s all about finding and acquiring engaged customers. Engaged mobile customers sign up, register, return regularly, and spend significant amounts of their time and money in apps. This engagement is driving the digital economy: By 2020, it’s estimated that mobile apps will generate almost $200 billion in revenue just though advertising and in-app purchases of virtual goods, with trillions more at stake in m-commerce.

What doesn’t come up when marketers talk about user acquisition is reinstalls — or the possibility that reinstalls could be more valuable than initial installs.

An app reinstall occurs when a user re-installs a previously downloaded and installed app.

Most user acquisition specialists aren’t aware of app reinstalls, how often they occur, or how important they are because deterministic app uninstall data is not easily or commonly reported.1 As a result, app reinstalls have long been incorrectly classified as “opens” from users who have otherwise been considered dormant.

That mistake is costing mobile publishers billions of dollars:

- at 10% of all app installs, reinstalls could account for $1 billion per year in user acquisition advertising, and close to $20 billion in app revenue

- at 20%, that’s $2 billion in ads, and $40 billion in revenue

This is clearly an opportunity worth paying attention to and worth understanding.

To date, so little has been written on the subject that if you Google “app reinstalls,” the big brain in the cloud asks if you meant “app installs.” Based on the data we’re seeing in early releases of TUNE’s new app reinstall measurement feature, reinstalls are in fact a huge hidden component of the mobile ecosystem.

Let’s take a closer look.

The Big Picture: Reinstalls Are Everywhere

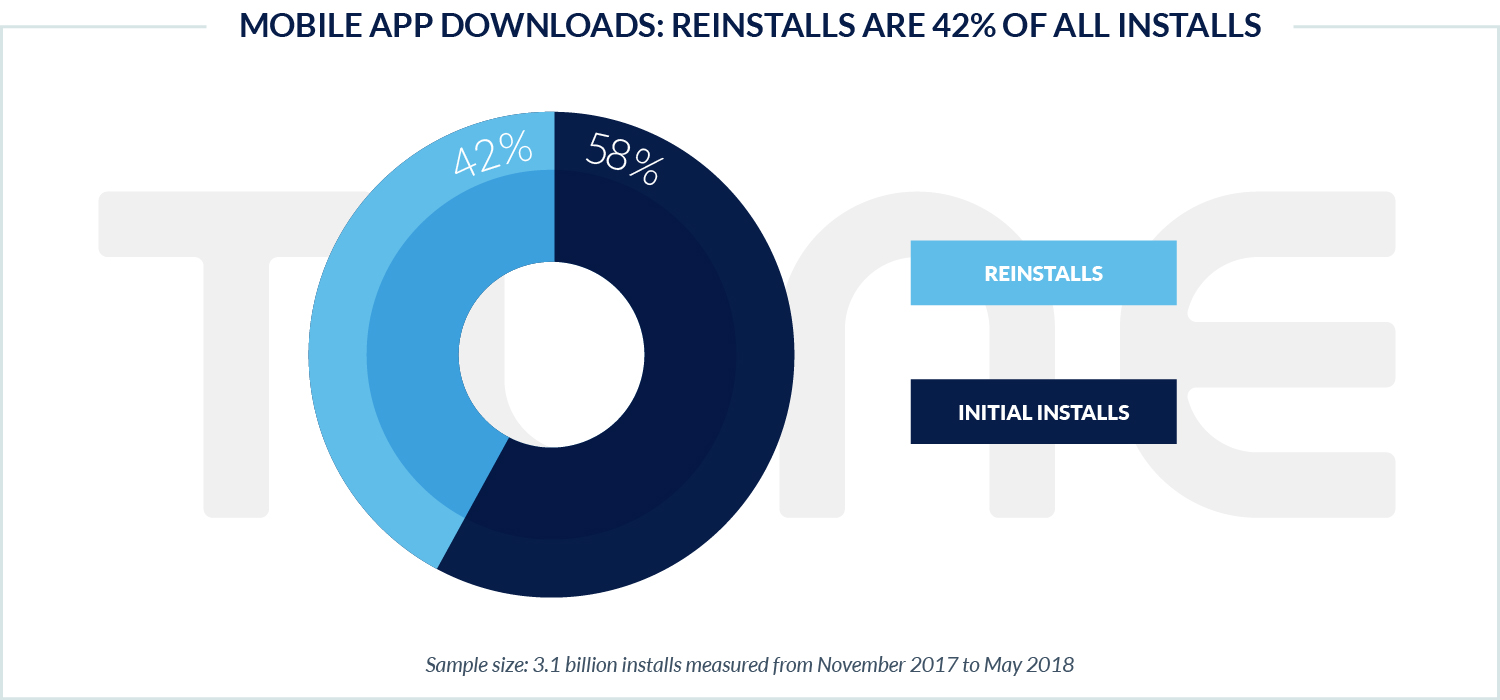

TUNE Data: 42% of All Installs Are Actually Reinstalls

App reinstalls are more prevalent than most mobile experts perceive. Because the functionality to measure them is brand new, it’s likely that most user acquisition professionals are not aware the capability exists.

For app installs that TUNE measured between November 2017 and May 2018, 42% turned out to be reinstalls.

Important caveat: The data contained in this report refers only to installs measured by TUNE customers. It is not the entire mobile ecosystem. One way this impacts the data is that TUNE customers skew higher across app charts than most mobile publishers and, as noted later in this report, more popular publishers and apps have higher percentages of reinstalls.

However, with a sample size of 3.1 billion downloads, these findings are broad enough to be significant and directionally accurate for mobile marketers.2

Reinstalls Are About More Than Cheap Phones

The first question about the nature of reinstalls is obvious: Are they simply the result of lower-end phones with insufficient memory that force users to delete apps for space, then reinstall them later when more space is available?

The answer is no.

Reinstalls make up almost 30% of all app downloads in North America, with Mexico at close to 40% reinstalls, Canada at 33.5%, and the United States at 27%. While the U.S. drags down the North American number, its reinstall rate is artificially lowered by a disproportionate number of server-to-server measured apps, which do not return reinstall data like device-level measured apps.

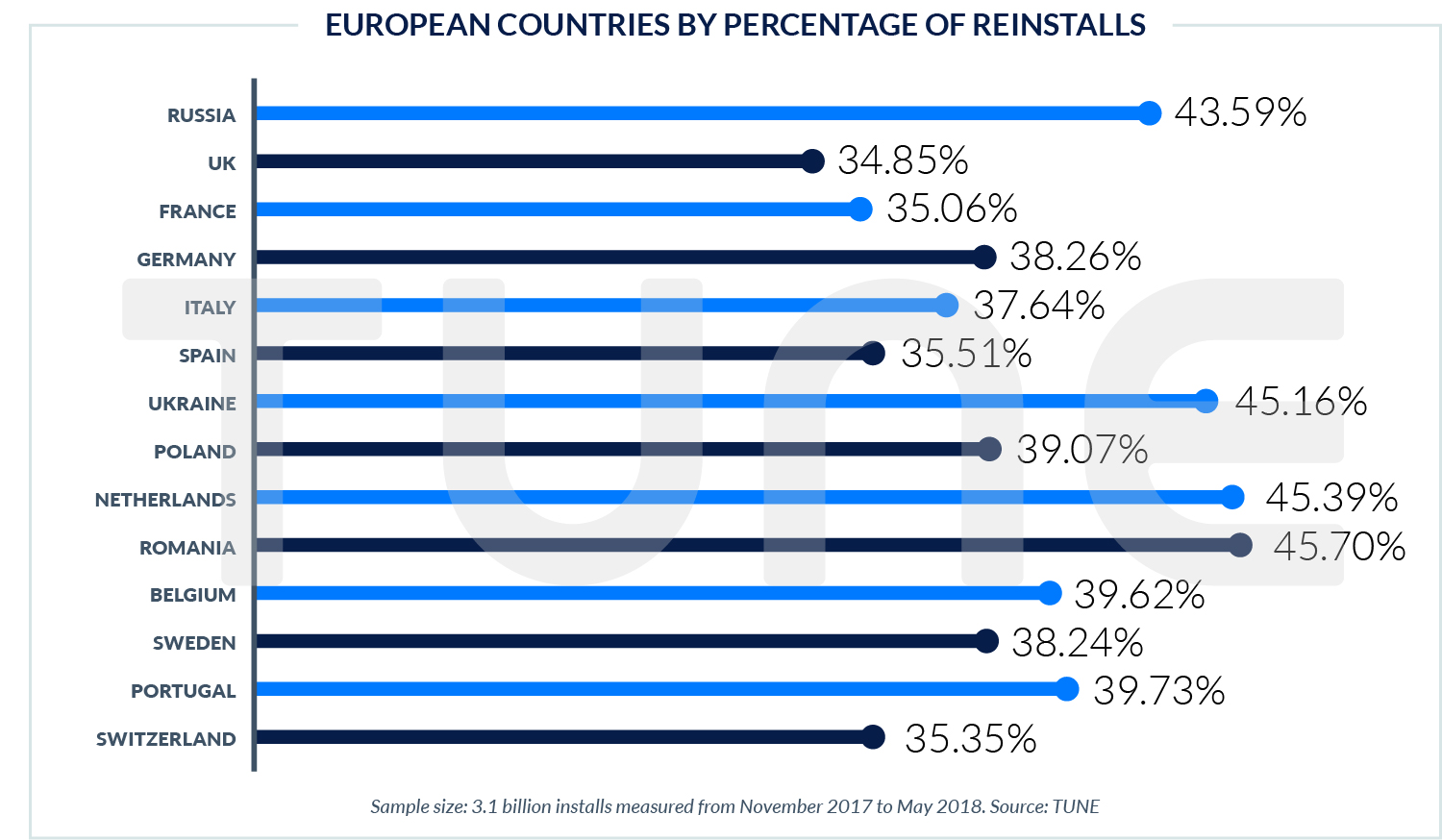

This ratio becomes more compelling in Europe, where the Netherlands, a rich Western European country, has the region’s second-highest reinstall percentage at 45.4%. (Romania has the highest at 45.7%.) Belgium, Sweden, and Germany — also wealthy Western countries — are all near the 40% line.

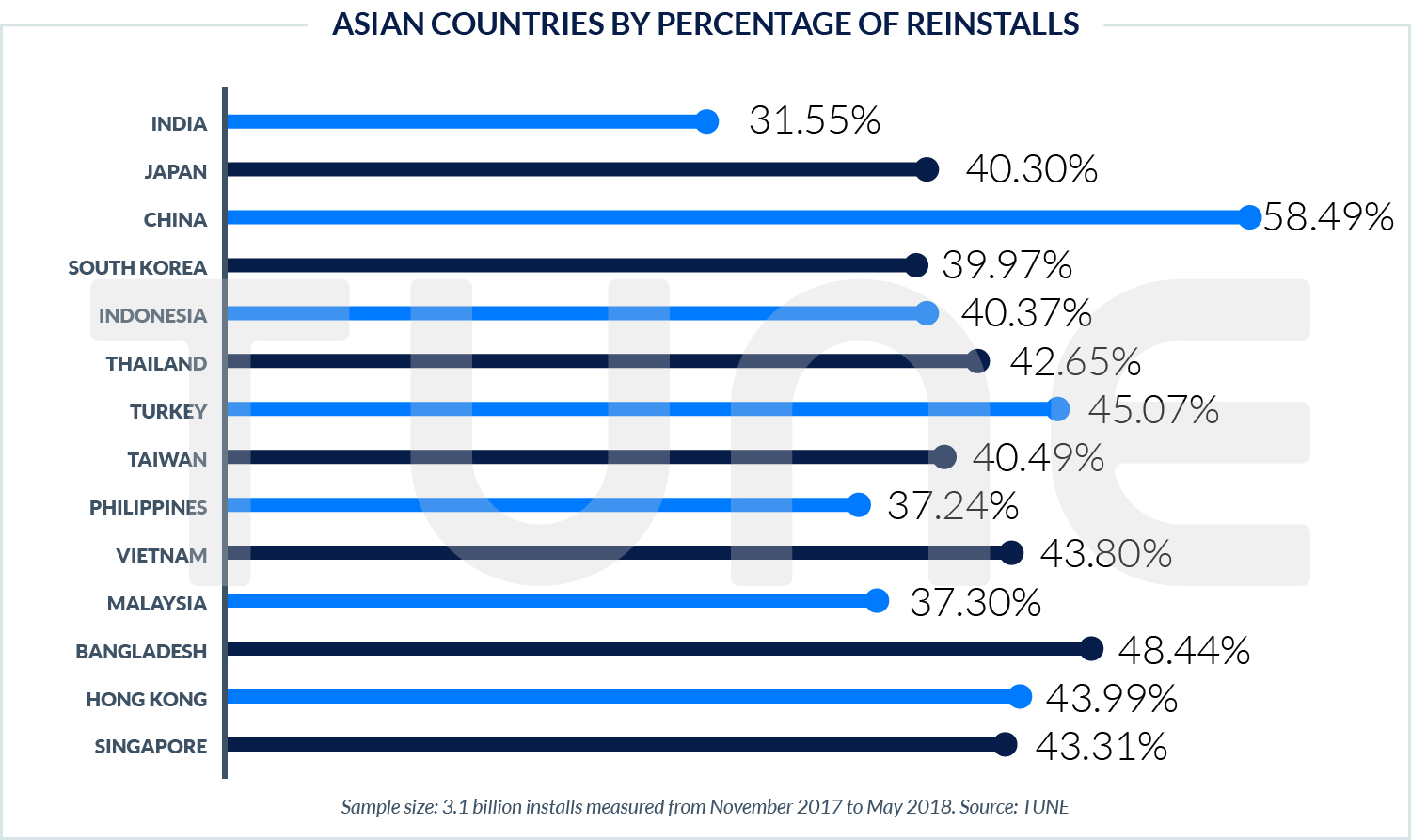

It’s clear that the reinstall phenomenon is not just a byproduct of low-quality phones when you consider data from Asia. While Asia’s reinstall average is on the higher side at 39%, Japan is 40.3%, while India is 31.6%. China is the leader in reinstalls at 58.5%.

Clearly, countries with higher numbers of low-end phones are going to see more reinstall behavior.

But to assume this reinstall behavior is only about India, parts of Asia, parts of Africa, Eastern Europe, and portions of rich Western nations would be a significant mistake. This becomes even more apparent when you also take into account additional survey data.3

Reinstall Burst: Not Just a Post-Christmas Rush

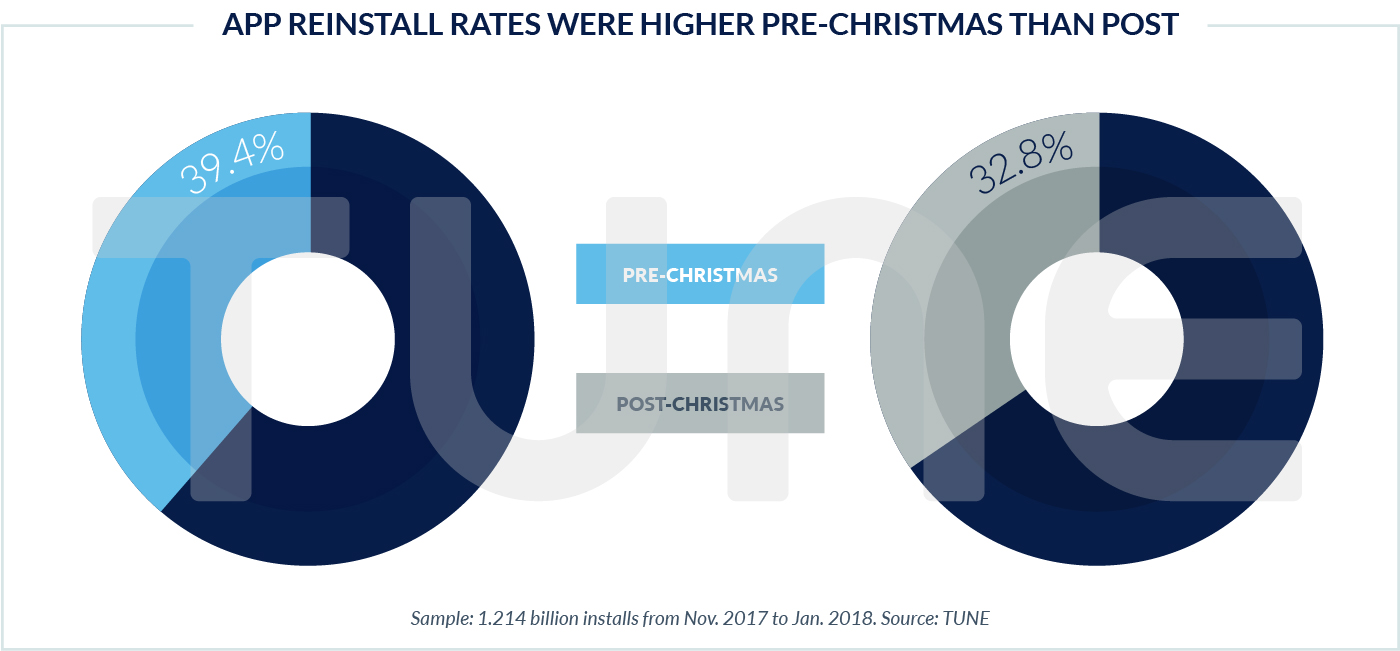

In addition, reinstalls are more than a post-Christmas phenomenon.

(Note: Pre- and post-Christmas data represents 1.2 billion installs measured from November 28, 2017 to January 21, 2018. This is a subset of the full 3.1 billion installs and is the only analysis to reference this subset.)

Even with limited data on this new mobile measurement category, there is enough to squash the notion that all these reinstalls are simply people filling up new devices with already-downloaded apps.

Global pre-Christmas reinstall rates dipped 17% post-Christmas, from 39.4% to 32.8%. (Note: neither number is adjusted for server-to-server measured apps, so these percentages are low.)

This isn’t just an industry average: a quick check of the top 25 apps shows that all but one of them had a higher reinstall rate before Christmas than after Christmas. The only one that didn’t?

A solitaire game.

Zooming In: Uncovering Granular Insights

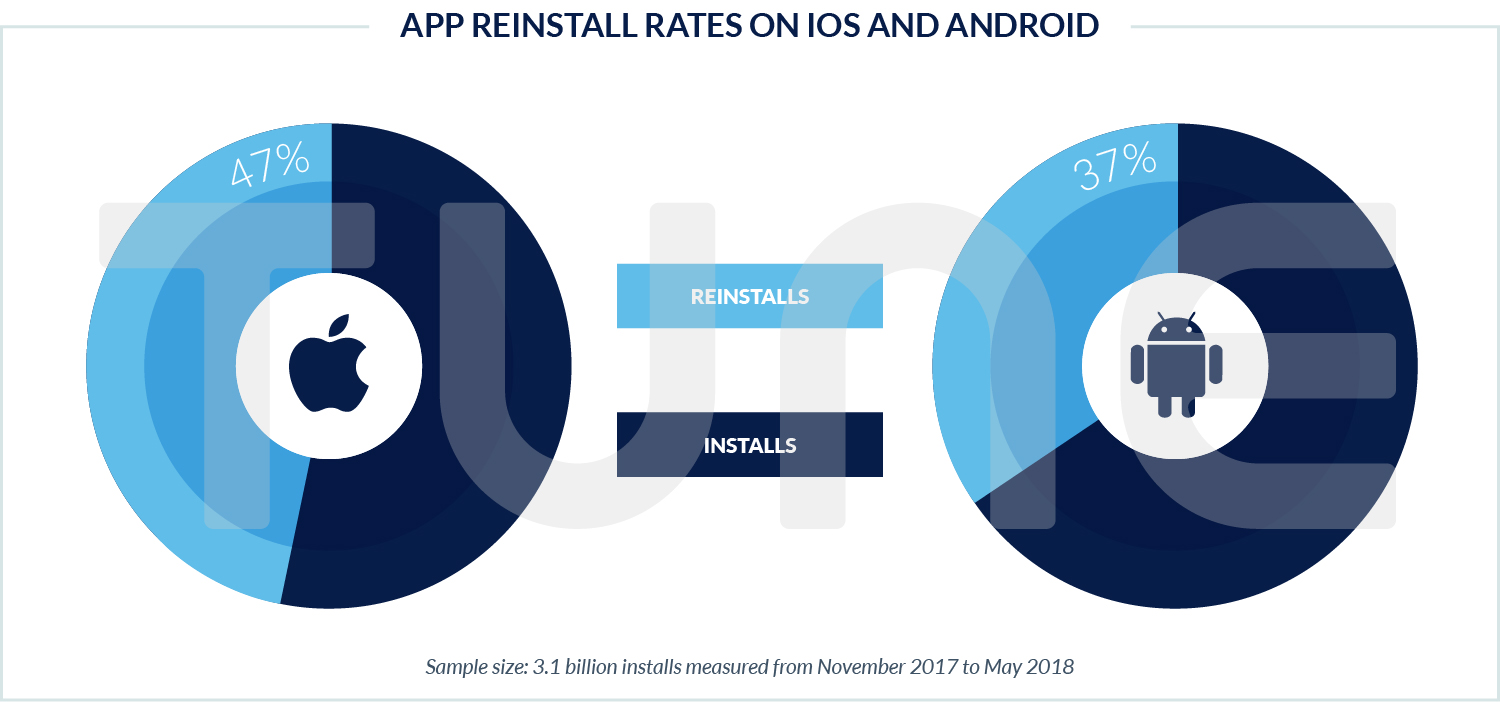

iOS and Android Reinstall Ratios Are Very Different

Proportionately, iOS apps are reinstalled more often than Android apps.

Out of our sample of 3.1 billion installs, 37% of Android installs were reinstalls, while 47% of iOS installs were reinstalls. Essentially, for every iOS fresh install there’s one reinstall, while on Android there is 0.6 of a reinstall for every fresh install.

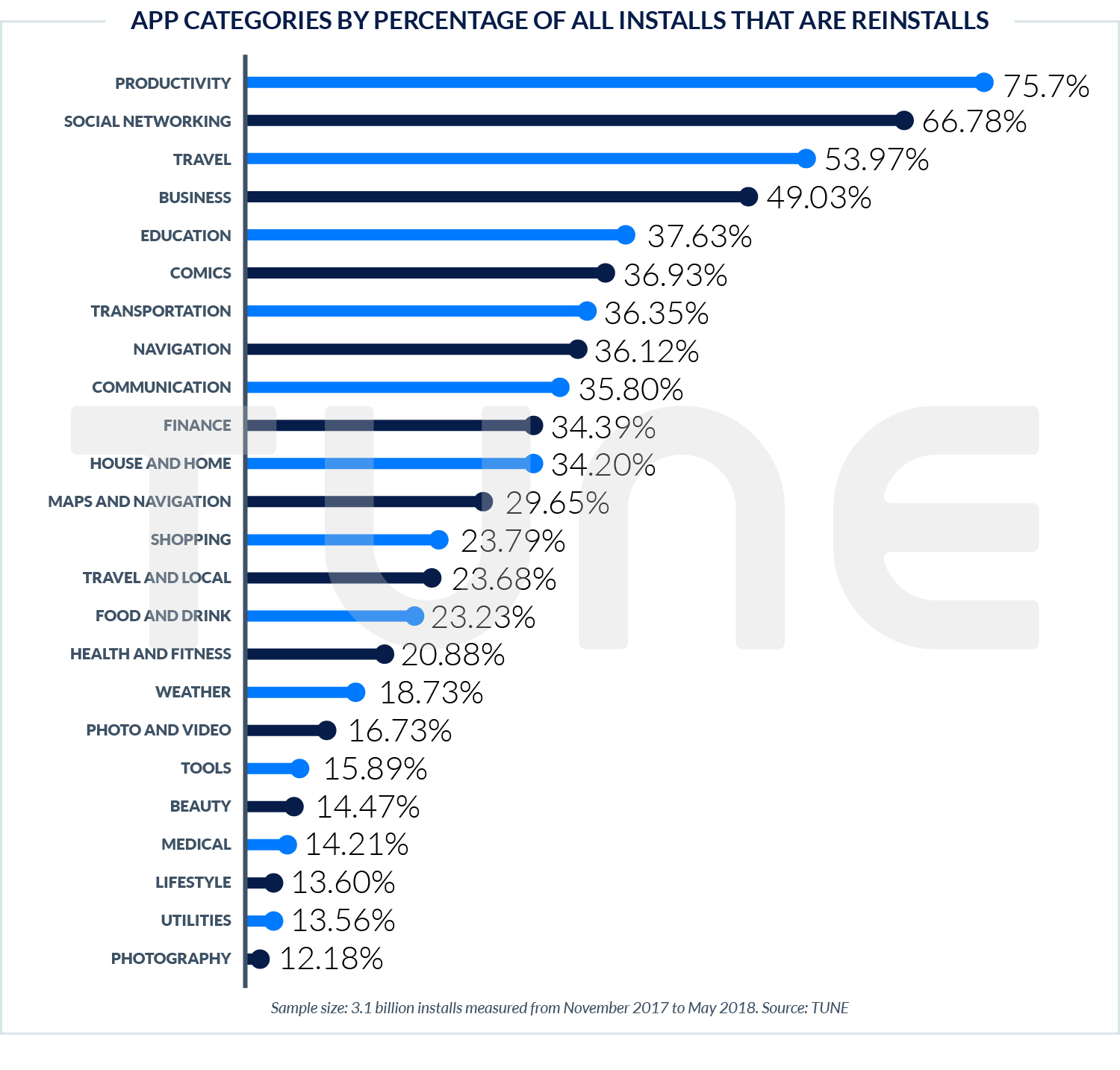

Top Categories: Up to 75% of Installs Are Reinstalls

Some of the top app categories for reinstalls are predictable.

Travel, navigation, and transportation apps are near the top of the list for obvious reasons: You download that London subways app for your trip to London, then delete it. When you go back a year later, maybe you need it again.

Social networking is also high, mostly due to the influx of dating apps. When Mr. Right turns into Mr. Wrong, out comes the dating app again.

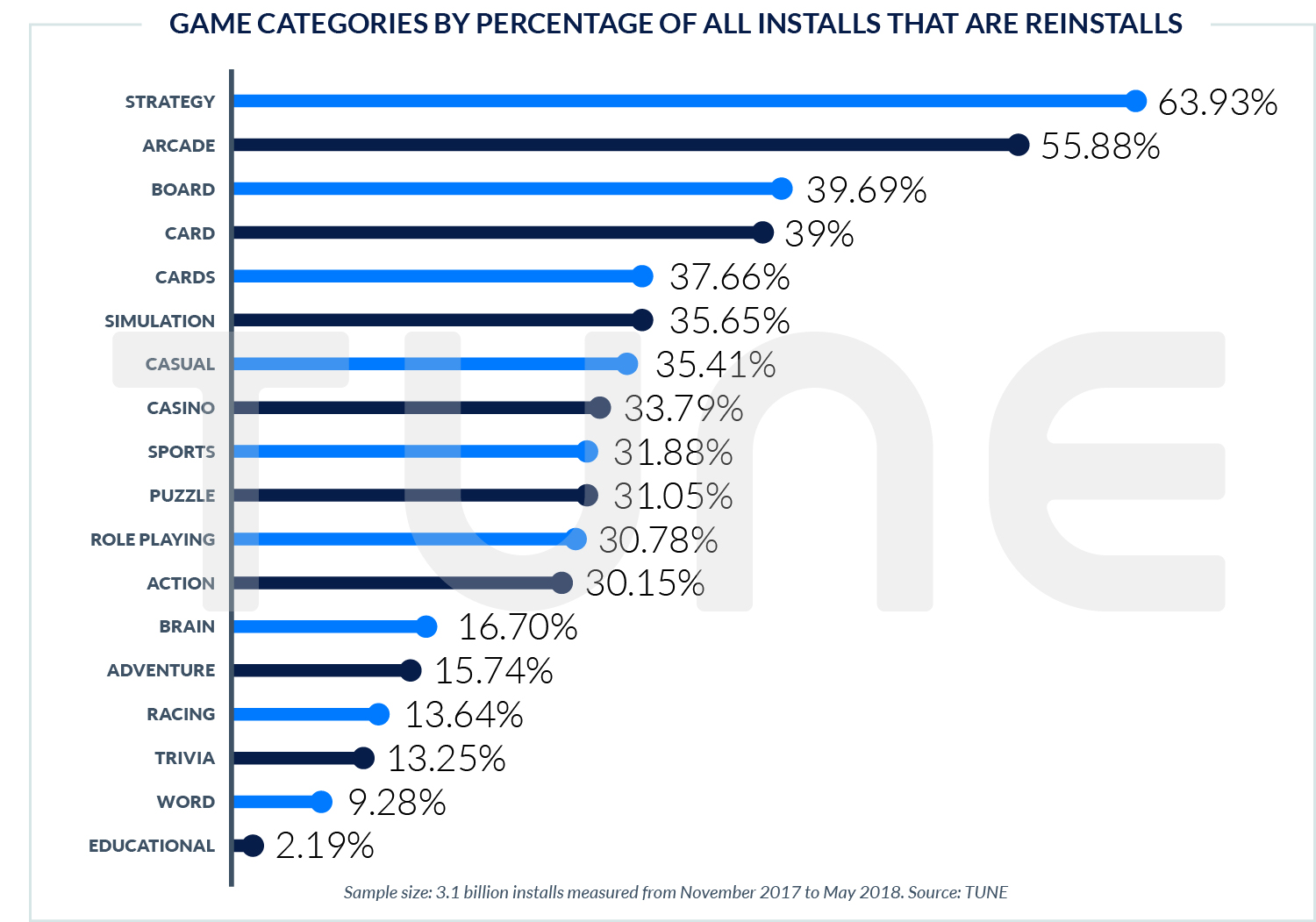

Games Are 55% More Likely to Be Reinstalled Than Non-Game Apps

Mobile game installs are 55% more likely to be reinstalls than non-game app installs.

Games are reinstalled at an average rate of 47.6%, while apps are at 30.5%. (Again, both numbers are not adjusted for server-to-server measured installs, so these numbers are conservative.)

However, gaming categories also include some of the lowest reinstall percentage categories as well. Word games and trivia games are reinstalled at just 9.3% and 13.3%, respectively. That likely speaks to a larger degree of user loyalty.

For gaming, user psychology is a little different than apps.

App reinstalls are often driven by need: to solve a problem, or simplify a process. Game reinstalls are more driven by desire or sentiment: someone gets bored or fed up, or completes a game … but, after leaving it for weeks or months, they may get the itch to play again.

(This is why Search Ads are critical for stimulating reinstall behavior. See below for more.)

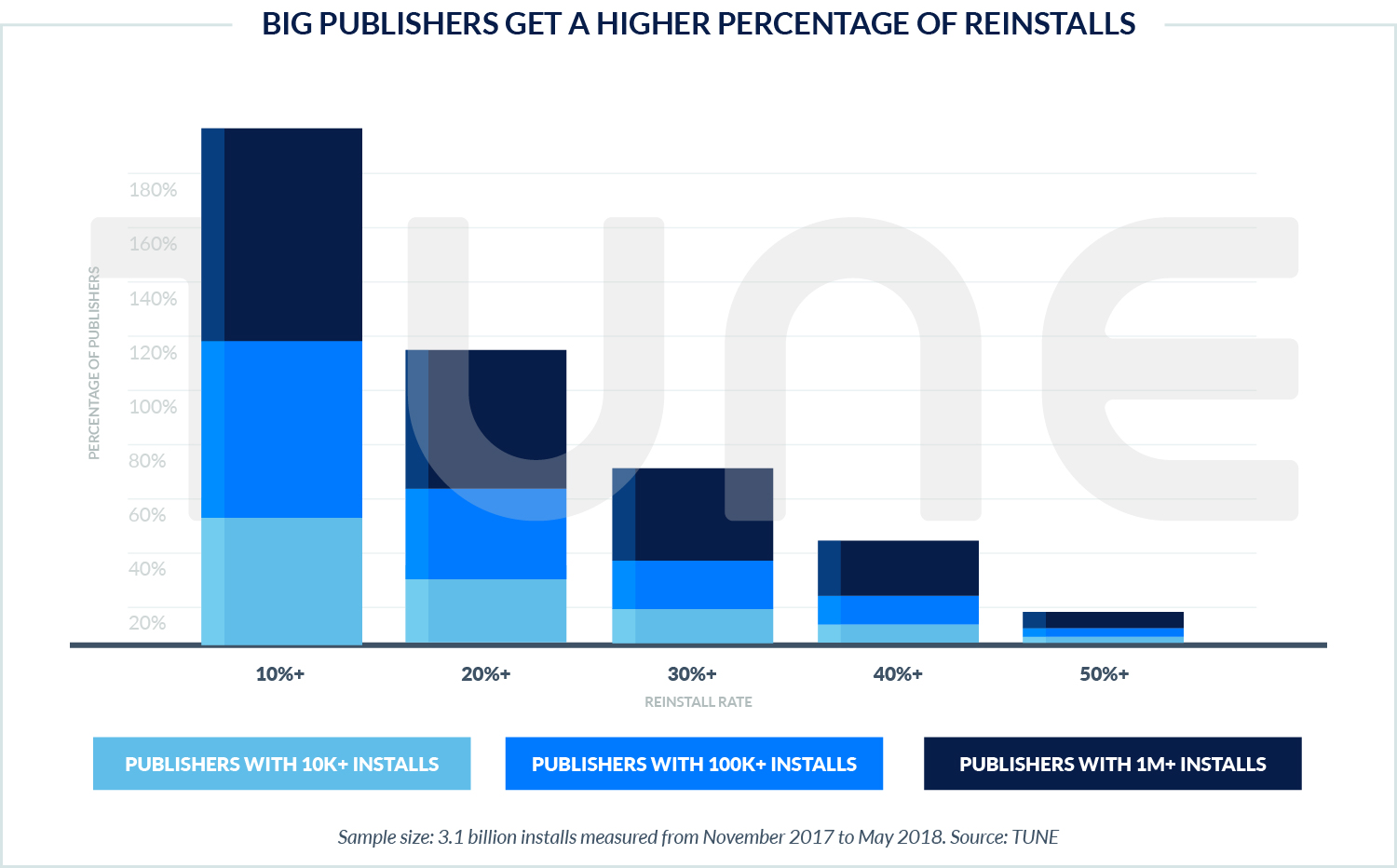

Popular Publishers Get More Reinstalls

The bigger the mobile publisher, the more reinstalls it sees.

While only 13.9% of publishers whose apps were installed between 10,000 and 100,000 times had a 30% or higher reinstall rate, 38.5% of publishers with over a million downloads saw 30% or more reinstalls.

(Important note: This is not all-time app downloads. This is only a sample of app installs between November 28, 2017, and May 5, 2018.)

Another 23.1% of publishers with more than 1 million downloads in the time period saw reinstall rates of over 40%, and 10.3% had app reinstall rates of over 50%.

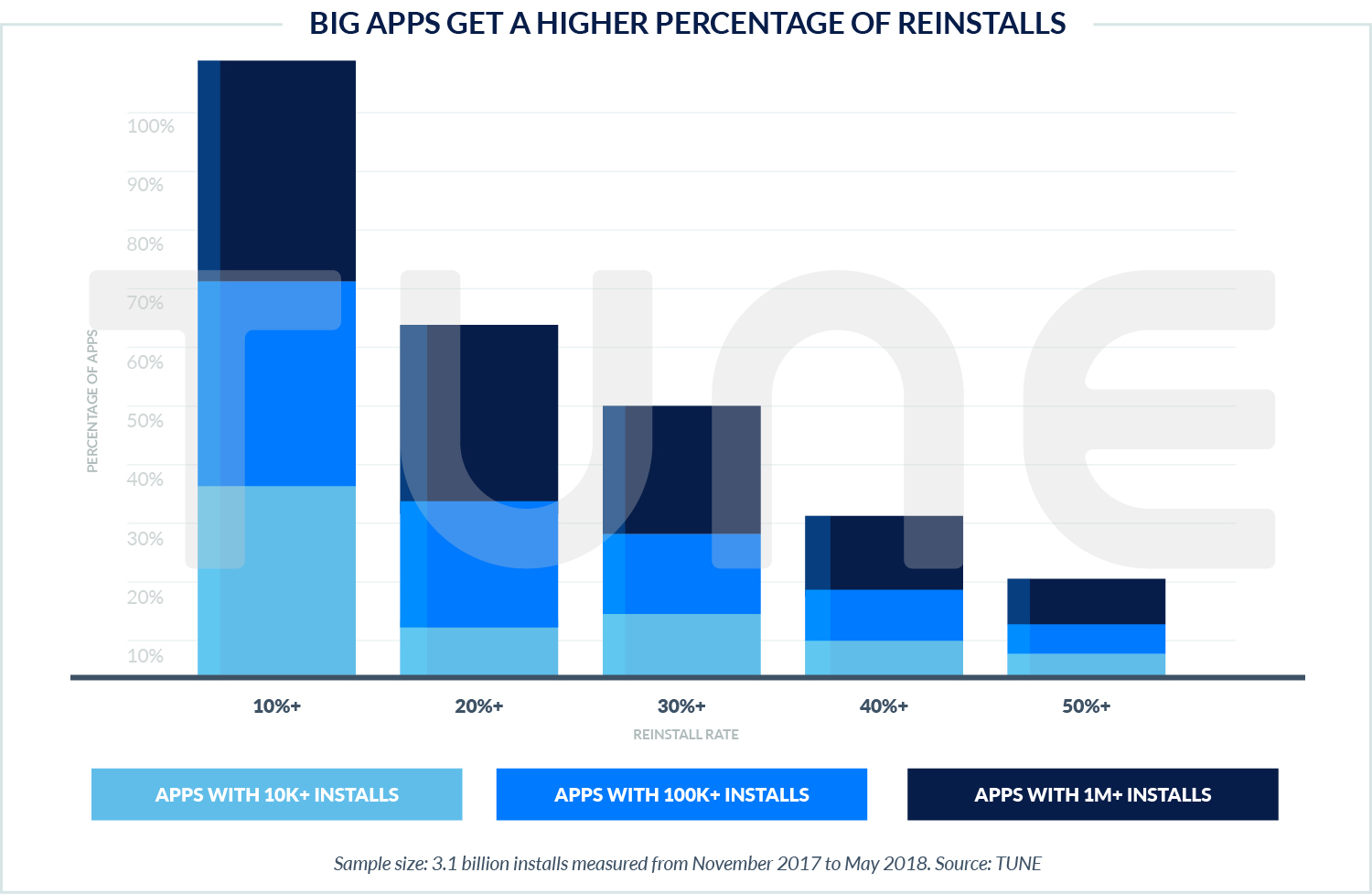

Popular Apps Get More Reinstalls

If bigger publishers see proportionately more reinstalls than smaller, it will come as no surprise the bigger apps also see more reinstalls than smaller apps.

For example, 26.7% of apps with over 1 million installs had reinstalls make up more than 40% of their total installs for the time period, compared to just 13.1% of apps with 10,000 to 100,000 installs.

(Note that all total install numbers are for the designated time period only.)

In addition, while most of the bigger apps (61.9%) had more than 20% reinstalls, only 38.2% of smaller apps had a reinstall rate over 20%.

There’s a simple explanation for this: More popular apps and publishers drive more installs, and therefore have a much better chance of seeing former customers return. In addition, larger apps are much more likely to advertise, which can be a key driver of stimulating reinstall behavior even if it is not the direct cause.

Countries by Percentage of Reinstalls: 18% to 59%

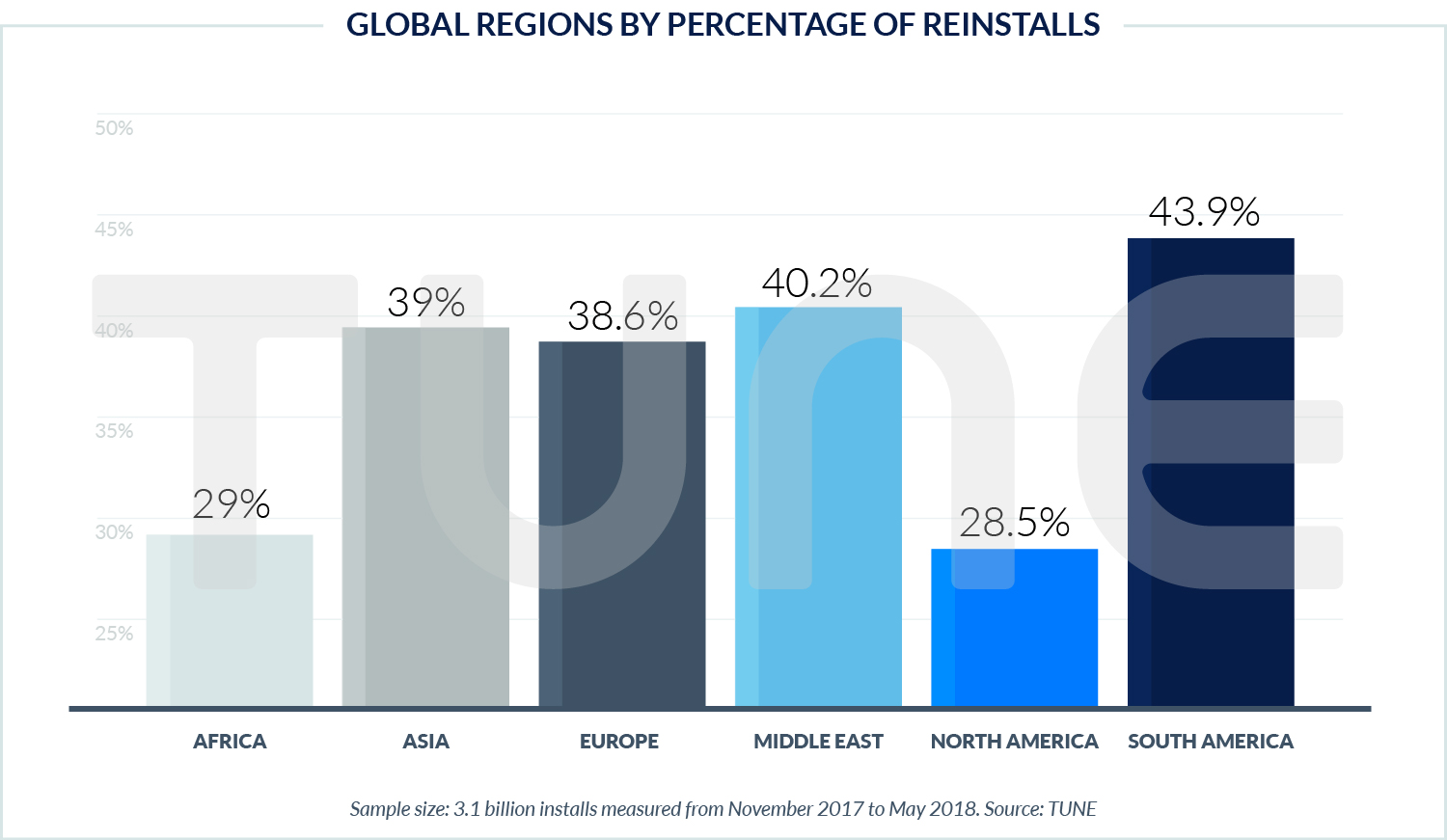

Regionally, South America has the highest average reinstall rate at 44%, while North America has the lowest at 28%.

- Africa - 28.97%

- Egypt - 31.97%

- South Africa - 30.98%

- Nigeria - 17.76%

- Morocco - 17.97%

- Kenya - 24.90%

- Sudan - 47.28%

- Libya - 38.35%

- Asia - 38.98%

- India - 31.55%

- Japan - 40.30%

- China - 58.49%

- South Korea - 39.97%

- Indonesia - 40.37%

- Thailand - 42.65%

- Turkey - 45.07%

- Taiwan - 40.49%

- Philippines - 37.24%

- Vietnam - 43.80%

- Malaysia - 37.30%

- Bangladesh - 48.44%

- Hong Kong - 43.99%

- Singapore - 43.31%

- Europe - 38.96%

- Russia - 43.59%

- United Kingdom - 34.85%

- France - 35.06%

- Germany - 38.26%

- Italy - 37.64%

- Spain - 35.51%

- Ukraine - 45.16%

- Poland - 39.07%

- Netherlands - 45.39%

- Romania - 45.70%

- Belgium - 39.62%

- Sweden - 38.24%

- Portugal - 39.73%

- Switzerland - 35.35%

- Middle East - 40.21%

- Saudi Arabia - 27.41%

- Iran - 57.49%

- Iraq - 54.03%

- Pakistan - 30.95%

- Kazakhstan - 46.03%

- United Arab Emirates - 30.80%

- Syria - 59.46%

- Israel - 37.37%

- North America - 28.45%

- United States - 26.97%

- Mexico - 39.61%

- Canada - 33.52%

- South America - 43.85%

- Brazil - 46.05%

- Argentina - 41.41%

- Colombia - 37.61%

- Chile - 42.78%

- Peru - 38.28%

- Costa Rica - 44.03%

- Ecuador - 36.36%

What Users Are Telling Us

To understand app reinstall behavior from an end-user perspective, we surveyed 1,079 smartphone owners ages 18 and older about app reinstall behavior. While we’ll dive into this data in much more depth in a follow-up report, here’s a quick overview of what we’re seeing.

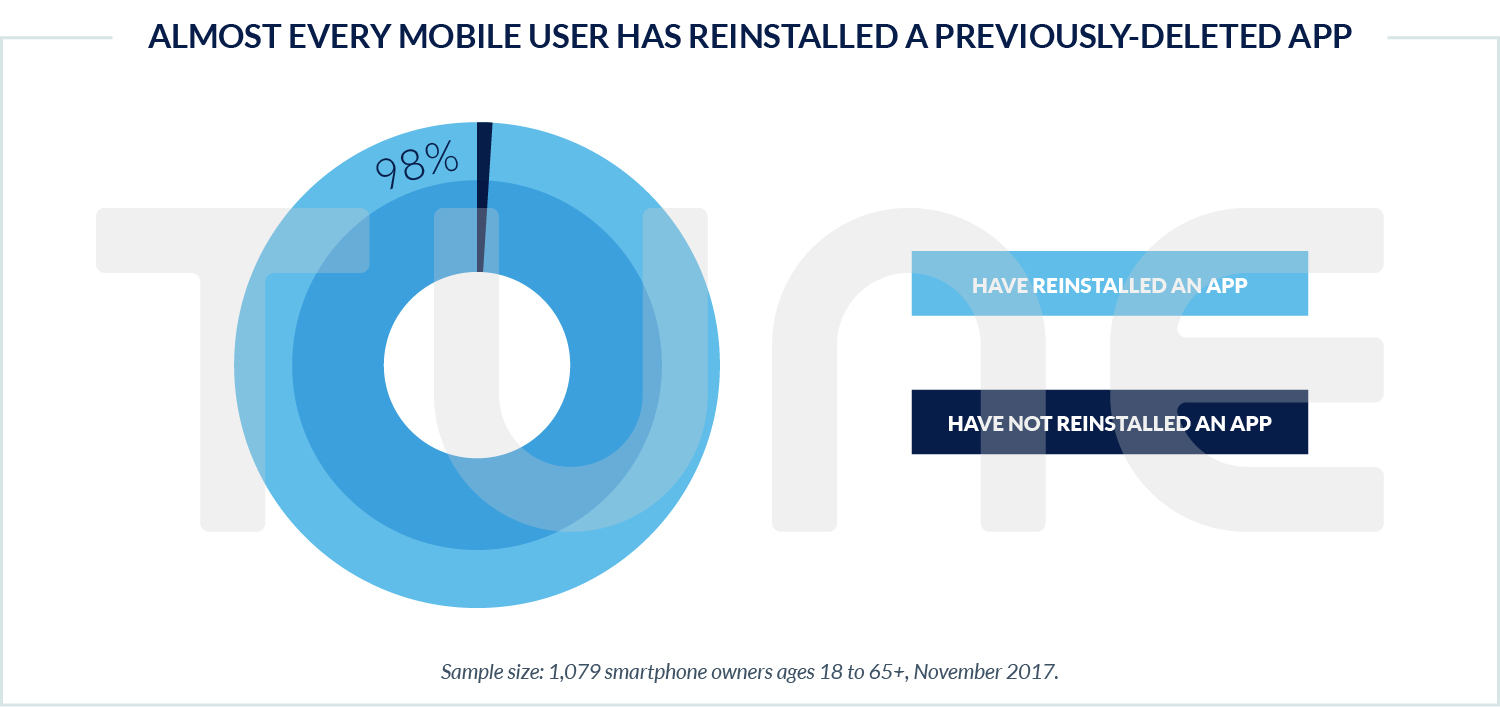

98% of Smartphone Owners Have Reinstalled an App

Almost everyone has reinstalled an app, with only 1.95% of respondents telling us that they have never deleted an app and later reinstalled it.

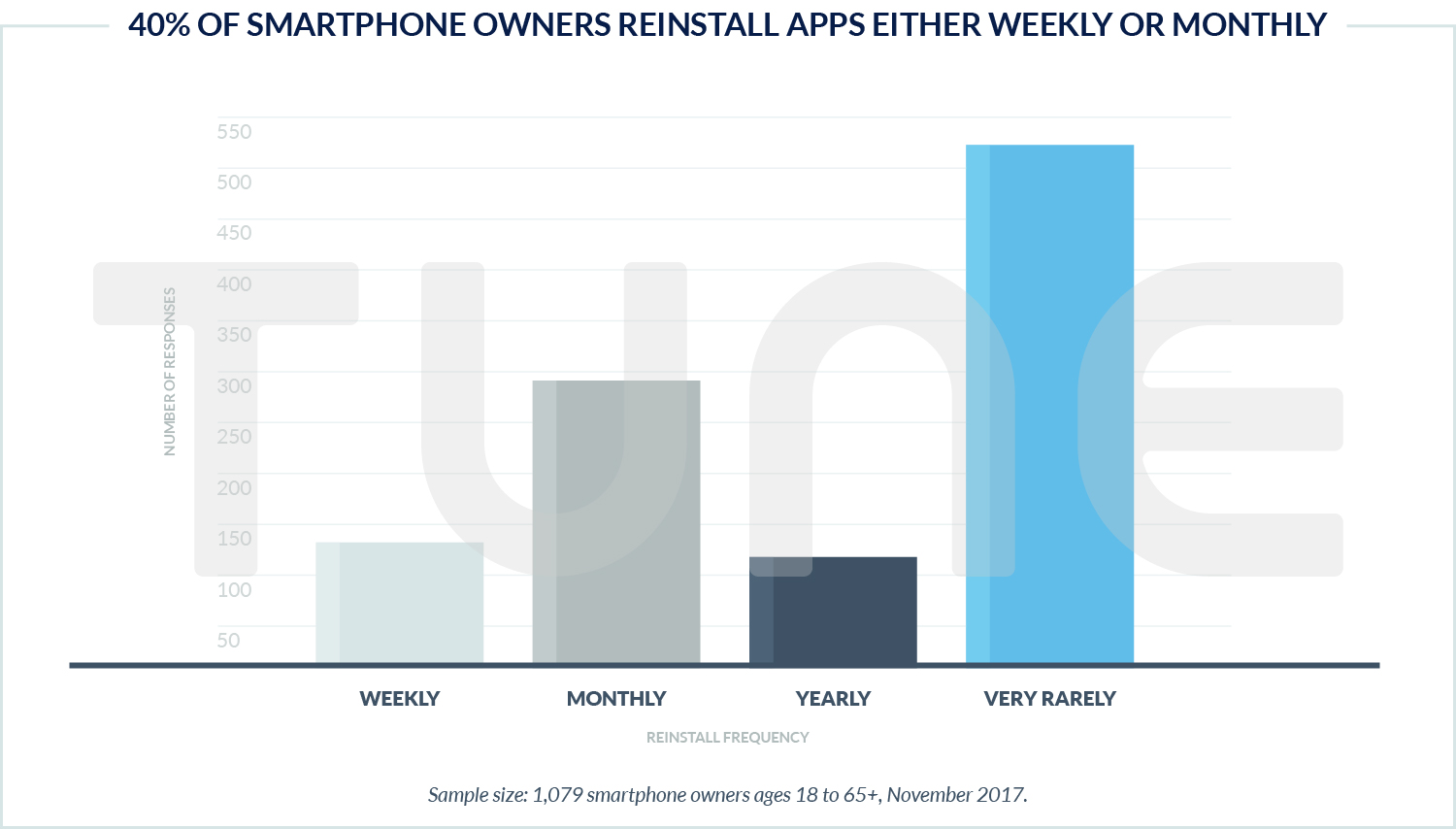

40% of People Reinstall Apps Regularly

A surprising percentage of people say that they reinstall apps regularly, either weekly or monthly. On the other hand, almost 50% of people surveyed say they very rarely reinstall apps.

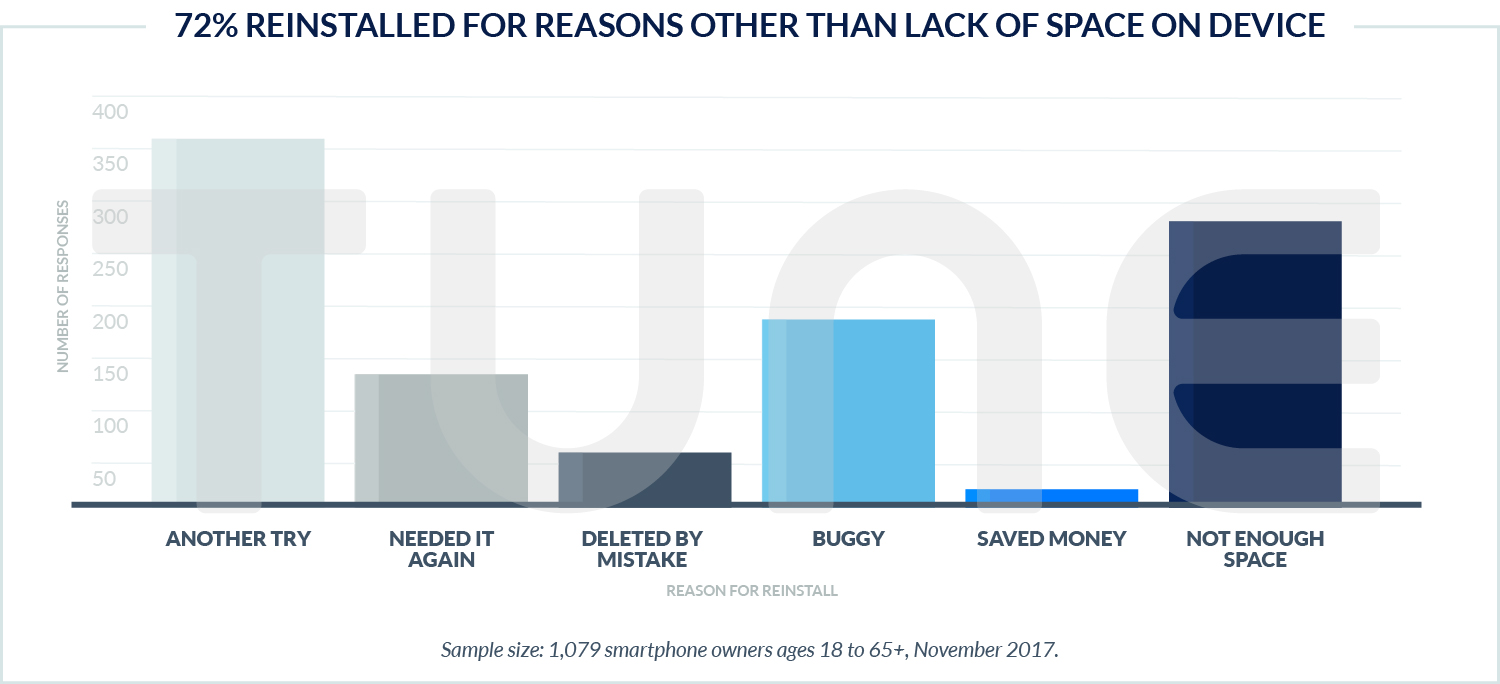

Biggest Driver of Reinstall Behavior: Giving the App Another Try

Contrary to popular mobile expert understanding, the biggest reason for uninstalling and then reinstalling an app is not limited space on low-end devices. In fact, the biggest reason is simply deciding to give the app another try.

While over 34% say that’s the main reason they reinstalled an app, the other categories are instructive as well:

- 18% say they deleted an app because it was buggy, and they reinstalled to force a reset to a better-functioning app

- 13% say they deleted an app that they later found out they needed … and therefore redownloaded it

- 6% say they deleted an app by mistake, and had to reinstall it

- 1% say there was a sale that required purchase via app, so they reinstalled it

Add it all up, and almost three quarters of reinstalls are not due to space issues.

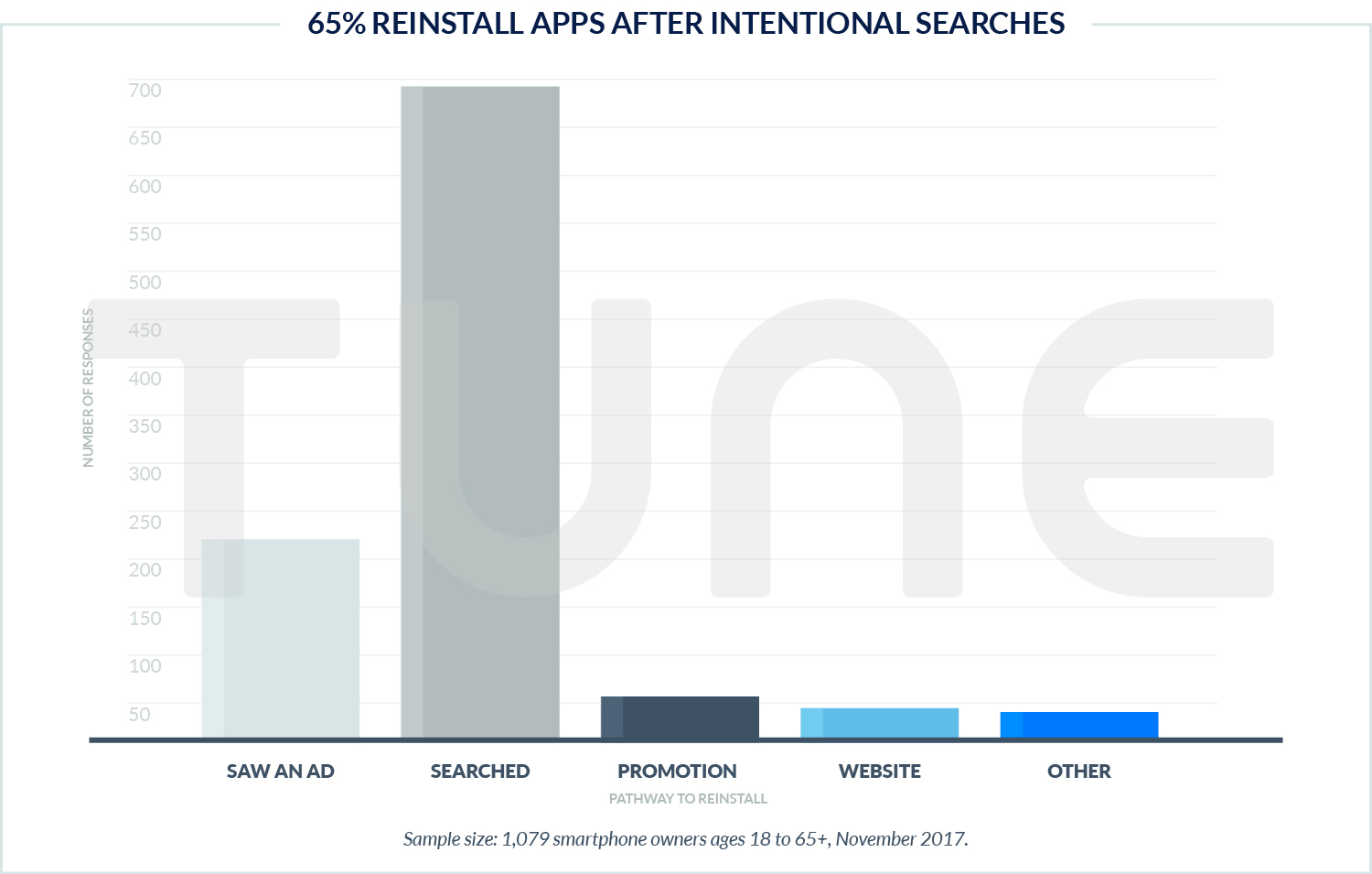

Search Is By Far the Top Vector of Reinstalls

Three times more people reinstall an app via search than via ads. This could be deceiving, however.

When people search for an app, they naturally go to the App Store or Google Play. After searching for a specific app, it’s entirely possible that they see an on-store ad for that app first. In this scenario, search was the primary vector, but an ad was also involved.

Each of the other methods, such as in-store or email promotions, website suggestions, and “other” add up to only 10% together.

Apple’s Search Ads: A Huge Re-Engagement Opportunity

TUNE has explored app reinstalls largely by working with Apple, whose engineers highlighted the redownload scenario as an interesting and under-reported phenomenon. As part of that collaboration, it became clear that something interesting was happening via Apple’s Search Ads platform.

Briefly, here are some of the highlights we’re seeing ...

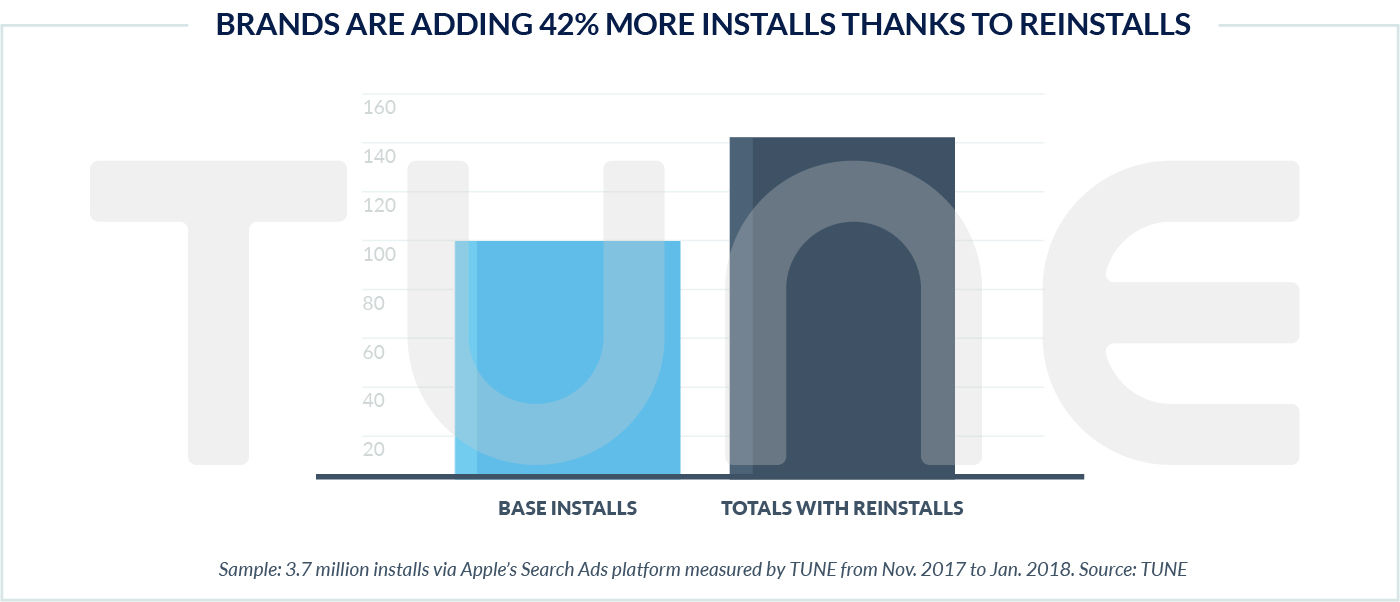

Brands Are Generating 42% More Installs

Brands are boosting app installs via Search Ads by 42% on average, thanks to reinstalls.

On average, 70.4% of the installs brands are getting when using Search Ads are brand-new fresh installs: new customers. However, 29.6% are reinstalls: former customers or app users who are returning to the brand. Winning back former users is a significant victory, as these people are much more likely to not just know the brand and have a relationship with the brand, but also have a specific incentive to re-engage, and potentially become purchasers of goods and services.

The upshot is more relationships with potential customers: 42% more than if reinstalls -- and renewed relationships -- were not happening.

In fact, based on research TUNE recently published on organic uplift4, the total might be much greater than just 42% more app installs. We’ve found that paid marketing boosts organic results, and that organic wins influence lower costs and higher conversions in paid marketing, creating a virtuous circle.

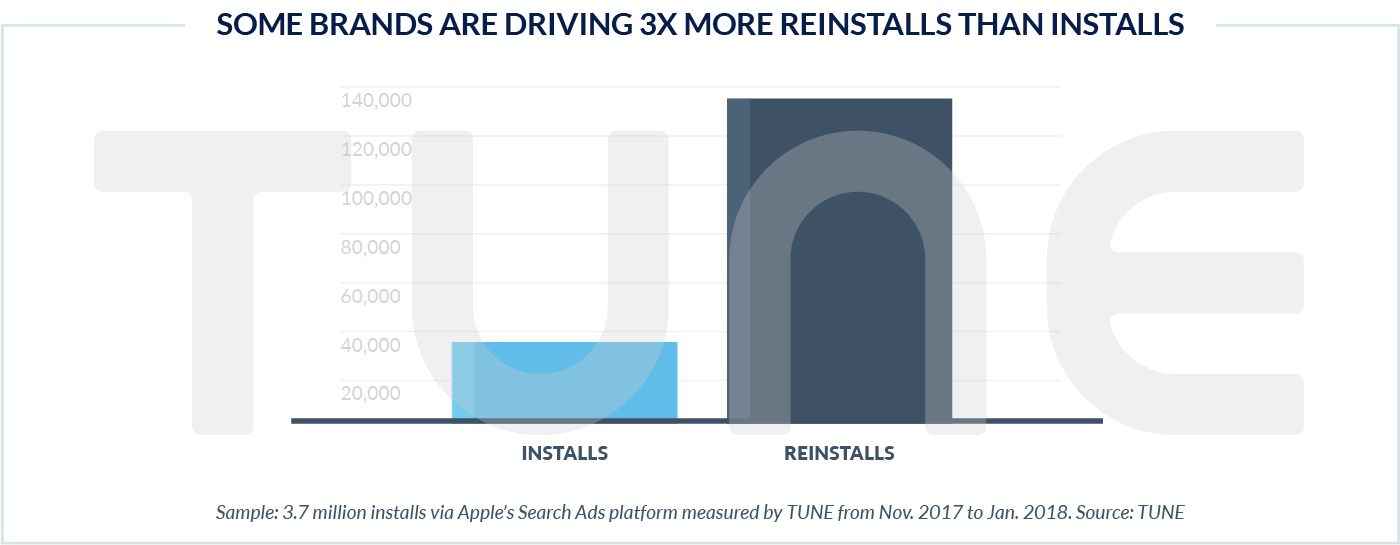

Some Brands: 3X More Installs

While on average brands are seeing a 42% boost in total installs thanks to reinstalls, some brands are seeing much, much more.

One social app, for instance, is getting 367% more installs thanks to reinstalls. In this particular case, while Search Ads is driving tens of thousands of fresh first-time installs, the very same Search Ads are driving well over a hundred thousand redownloads.

That’s a great chance for a brand to reinvigorate its relationship with former customers. In some cases, a buggy release can cause mass user defection, or extended periods of unfavorable news coverage can result in user churn. Refocusing on those lost users when conditions have improved is a smart business strategy.

Apple’s Search Ads, while not developed specifically for retargeting former users or customers, clearly is helping brands renew customer relationships at scale.

70% of the Top 20 Reinstalled iOS Apps Are Brands

Many of the brands we’re seeing have massive success in reinstalls are household names.

Some are e-commerce and m-commerce companies. Some, very surprisingly, are B2B brands. Others are brands with international bricks-and-mortar footprints. Others are travel and transportation companies, and not the big names that you’d expect in ride-sharing categories.

More to Explore: Where We’re Going Next

These are extremely early days in measuring and understanding reinstalls. Every mobile expert I’ve privately shared this data with is surprised by the scale and scope of mobile reinstall behavior.

And this is just the beginning.

There’s more to understand about why this is occurring at such high rates. Perhaps more importantly, there’s more to learn about what this means for brands who are mobile publishers. High reinstall rates have significant implications about why brands should think about retargeting campaigns, and how they execute them.

We’ll be unpacking many of those implications, and more, in further reports.

Data Used in This Report

There are three datasets used in this report.

The first is a sample of 3.1 billion installs and reinstalls that TUNE measured for clients between November 2017 and May 2018. This sample is from 249 countries, states, and geographical regions around the globe.

The second is a survey of 1,079 American smartphone owners ages 18 to 65+ conducted in November 2017. For this survey, 44% of respondents were male and 56% were female; 38% were iPhone owners and 58% were Android phone owners.

The third is a sample of 3.7 million installs and reinstalls that occurred via Apple’s Search Ads that TUNE measured for clients from November 28, 2017 to January 21, 2018.

Footnotes

- Some mobile experts attempt to measure uninstalls in other ways, like storing and querying data that ties distinct device IDs to app IDs. Others attempt to store information on the iOS Keychain, where data persists even after an app deletion. And others simply estimate deletions and reinstalls by analyzing post-install events. None of these are definitive or simple, and they have several significant shortcomings.

- Very soon, mobile marketers will be able to see their apps’ own reinstall ratios in the TUNE Marketing Console.

- Percentage of reinstalls to average number of apps/device is something we need to further investigate, although this data suggests there aren’t huge differences. (India: just under 80 apps/device; USA: just over 90 apps/device).

- https://www.tune.com/blog/channel-synergy-paid-marketing-boosts-organic-organic-marketing-feeds-paid/