Caterpillar doesn’t make giant earthmoving machinery. Exxon Mobil doesn’t sell gas. Home Depot doesn’t provide lumber and lawn mowers. Rather, they build relationships with customers — and solve people’s problems.

We correlated data on 90 billion installs and 4.5 billion ratings of more than 13,000 Fortune 1000 company apps to stock market valuations over time to learn how.

Get this full report in PDF for free

Increasingly, it’s via mobile.

In fact, mobile leaders in the F1000 grow market value 15% faster than mobile laggards, and are 1.9X more likely to be financially successful. Caterpillar has 355,000 mobile-app-using customers; Exxon Mobil, over 400,000. And Home Depot? A massive 17.7 million. These companies are financial winners, capturing outsized stock price growth.

Why?

They connect with customers one-on-one at scale, giving them unmediated and instant communication channels: an unparalleled advantage over their competitors.

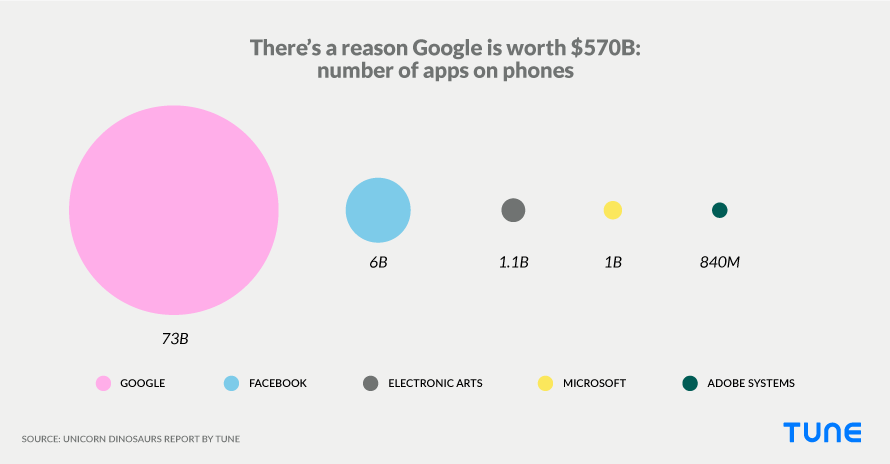

Sure, Google, Facebook, and Amazon lead the pack.

Google has over 73 billion mobile users in aggregate, and Facebook has just over 6 billion. Both grew fast in 2016: 18.5% and 35.4%, respectively. And Amazon, with more than 4X the number of mobile users than the entire rest of the retail industry, captured almost $102 billion more stock price growth than its competitors.

Google has 81% of all Fortune 1000 mobile app users, when aggregated by app

But some “old school” retail and manufacturing companies are winning, too.

Best Buy isn’t just bricks and mortar; the company has 50 million mobile users. Lowe’s has 6 million, and Costco is not far behind, as both companies transition existing customers to mobile. GM and Ford are not just competing to sell cars — they’re competing to connect to customers at scale, with almost 40 million mobile users between them.

All of these companies understand one thing: Winning at mobile means winning.

Table of contents

This is a 20,000-word blog post, essentially a full data-driven research report. Use this table of contents to get around quickly. No time to read now? Get this full report in PDF for free.

- Executive summary

- What is a unicorn dinosaur?

- Mobile success to $$$ success: strong correlation

- Drilling deeper: key companies and categories

- Category examples: planes, trains, and automobiles

- What is MobileBest?

- Becoming MobileBest: How brands can achieve it

- Appendices

What is a unicorn dinosaur?

Hot startups with billion-dollar valuations are unicorns. Old companies with conventional business models are dinosaurs. But some are neither.

In fact, they’re both.

Many Fortune 1000 companies have been around the block. They make actual, real, physical products. Their products are industrial, B2B, or resource-based. And yet, these companies have a modern mindset. They think deeply about technology. They build and deliver modern mobile apps. They ensure their websites work great on mobile devices.

In short, they understand MobileBest, even though they are not mobile first.

Mobile success to $$$ success: strong correlation

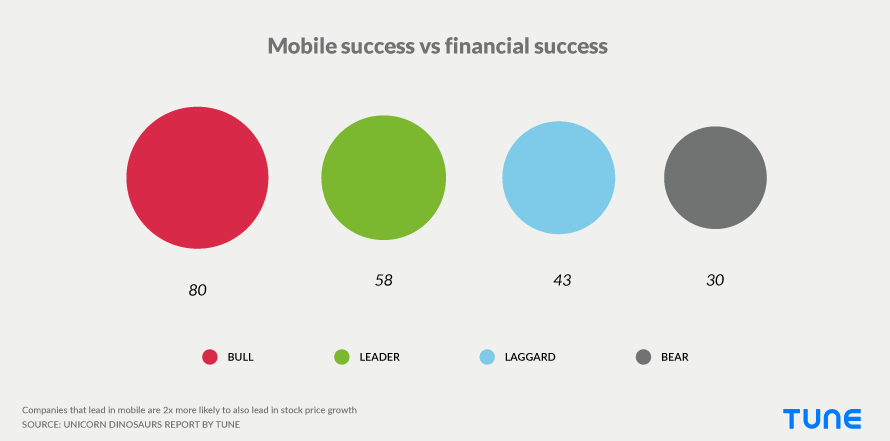

To probe the correlation between mobile success and financial success and find the Unicorn Dinosaurs, we gathered stock prices for Fortune 1000 firms in February, June, and October of 2016. We analyzed change from three to six-month performance, and we calculated each firm’s results over the mean. Finally, we sorted all Fortune 1000 companies into four categories based on relative financial performance.

After subtracting the 110 firms that are private or were acquired during the period of the study, here’s what we found:

- Bulls: 211 companies

- Leaders: 255 companies

- Laggards: 241 companies

- Bears: 183 companies

Next, we looked for all the apps for all Fortune 1000 companies, including 2,800 of their named subsidiaries. We found about 13,000 apps; then we determined the number of their users via the download bracket that Google Play publicizes, adding a representative additional number for iOS.

By degree of mobile success, we sorted companies into these categories:

- Bulls: 268 companies

- Leaders: 258 companies

- Laggards: 175 companies

- Bears: 189 companies

In addition, we used TUNE’s App Store Analytics data to find the number of reviews for each of those apps in order to judge engagement levels.

Then we compared the categories.

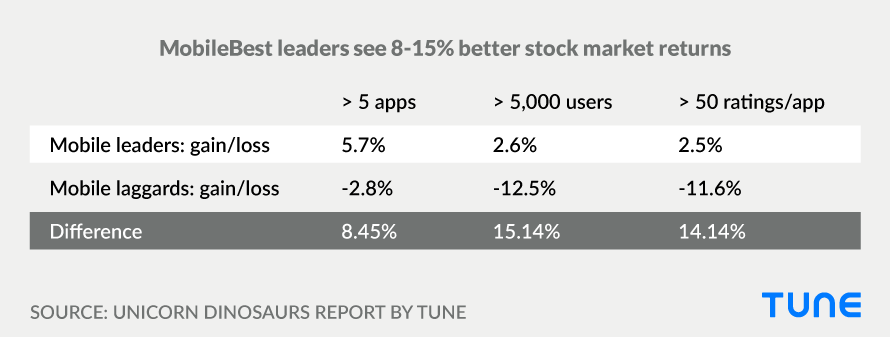

Mobile leader valuations outpace mobile laggards 8-15%

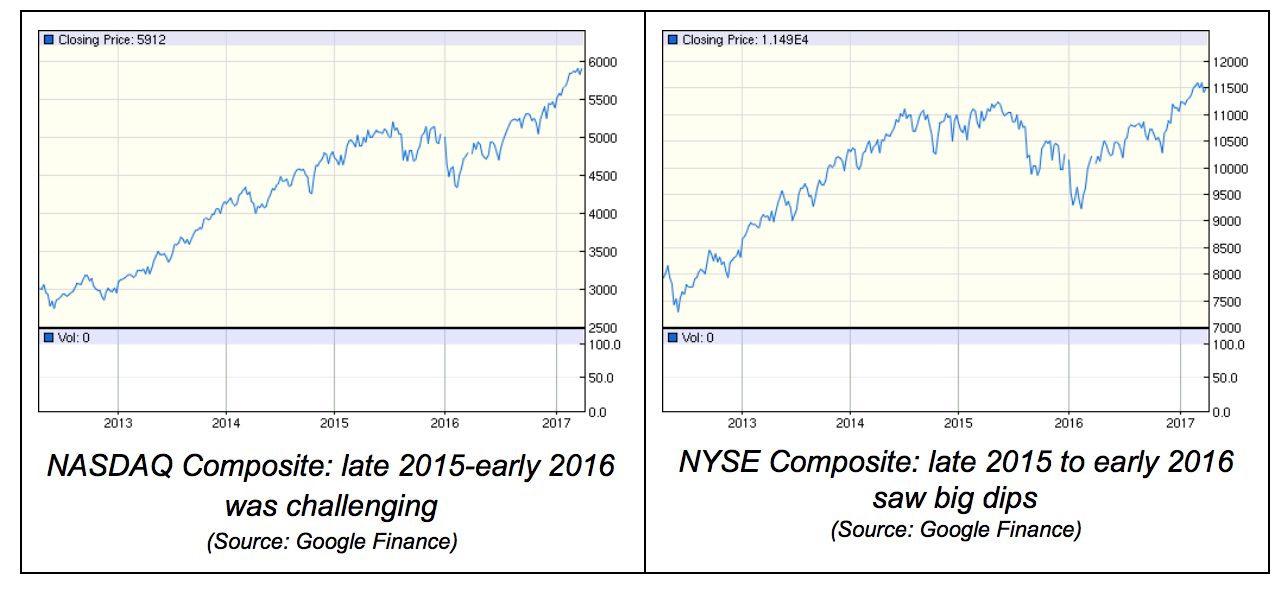

From our research, it’s clear that MobileBest companies are financially successful. In fact, Fortune 1000 companies that are top 10 in their business category in number of mobile customers significantly outperformed the market.

For the 12-month period ending in October 2016, average Fortune 1000 stock market valuation change was a very slight lift: 3.3%. In other words, late 2015 and early 2016 was a fairly tough time, economically speaking, before the stock market rebounded mid-year:

But companies that outperformed competitors at mobile customer acquisition fared considerably better.

For example, Fortune 1000 firms that led in mobile customers (with a minimum floor of 5,000) beat competitors by 15.1% in terms of stock market value. Brands with at least 50 ratings per app — not a huge task, one would think — beat brands who didn’t engage well with customers on mobile by 14.1%.

And companies that simply had more than five apps outperformed others by 8.5%.

There are some industries, such as retail, internet services, news, and other consumer-oriented categories where this aligns easily with common sense. The smartphone is our collective gateway to global culture, information, services, and supplies, and winning on this platform should have a strong impact on winning with customers.

However, there is no compelling reason to suppose that consumer mobile penetration should be aligned with business success in many other Fortune 1000 business categories. For example, being MobileBest is not obviously an important priority for companies in chemical, energy, engineering/construction, metals, and mining businesses.

And yet, likely because investing in new technology is a reasonable proxy for businesses that are successful, we still see alignment.

Mobile bulls: 193% more likely to be $$$ bulls

If a company is succeeding in mobile, it’s not a guarantee of financial success.

However, the firm is almost 2X more likely to be a financial bull or leader, compared to mobile bears. In fact, 65.4% of companies that demonstrate financial success are also leading their business category in mobile customers.

Examples include 3M, Amazon, AT&T, and Best Buy. Joining Best Buy in the retail space is CDW, and there are resource companies such as Exxon Mobil here as well. Interestingly, Exxon Mobil has over 400,000 mobile customers.

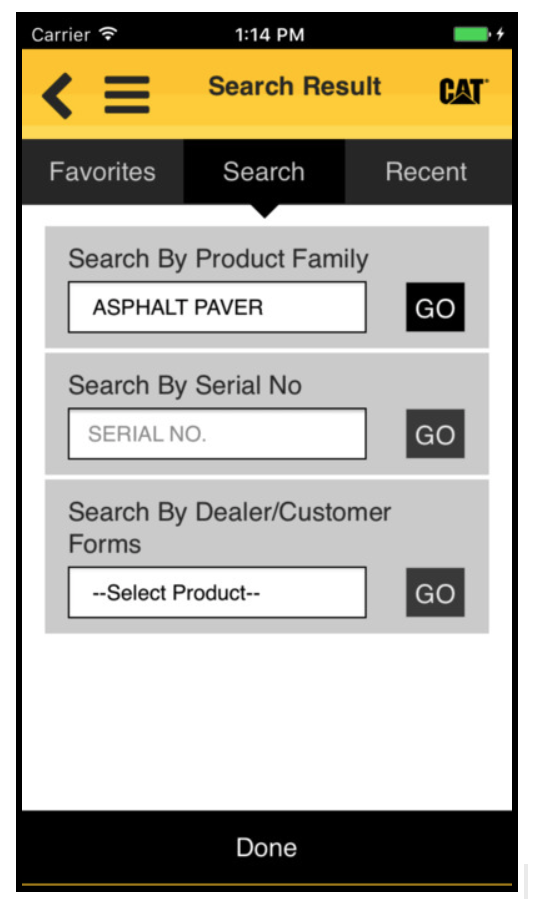

Along with Exxon Mobil, perhaps one of the more unlikely examples is Caterpillar, which combines serious heavy-duty engineering with mobile apps for service, sales, and support. About 355,000 people are using Caterpillar apps on their phones, which they use not only to order parts, but also to inspect machinery for defects and servicing requirements.

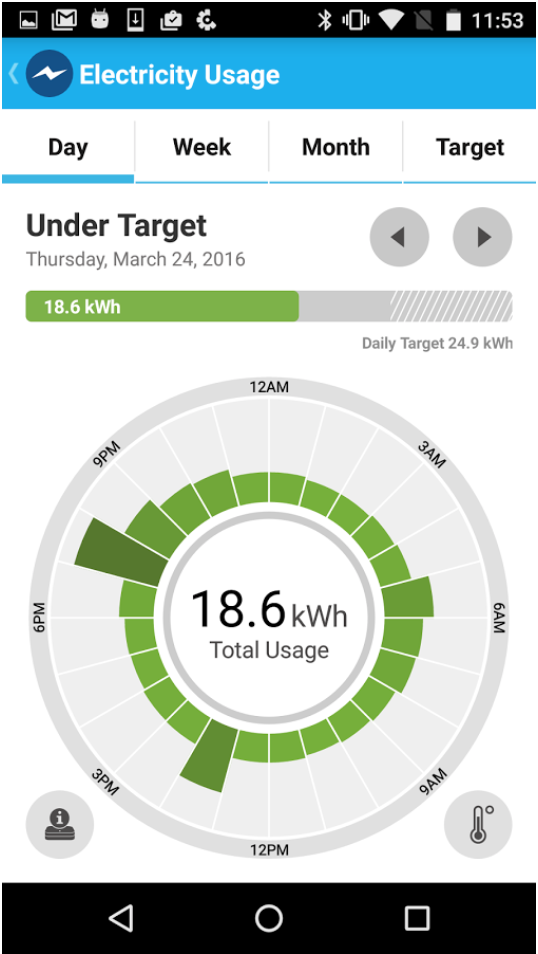

Another example that breaks the typical mold of mobile-first companies like Uber or Facebook is DTE Energy, a Detroit-based power company.

This utility’s app, called DTE Inspect, allows customers to see their power consumption in real time, set and track monthly electricity usage goals, and test ways to reduce power consumption.

Successfully reaching customers on mobile doesn’t guarantee success, but it certainly improves a company’s odds.

The opposite does happen, but about half as often. Only 34.6% of companies combine mobile failure and financial success, indicating that mobile success and financial success relative to your competition tend to go hand in hand.

Interestingly, a company does not have to be a complete category dominator in mobile to see strong financial benefits. Our classification into Bulls, Leaders, Laggards, and Bears shows that even leaders in their categories get almost the same degree of benefit. In fact, 65.1% of companies that fell into the financial leadership category also place in the top and second ranks of mobile success.

Mobile bears: 20% chance of being $$$ bulls

Companies that are bears in mobile, ranking near the bottom of their categories, have a 19.7% chance of still succeeding at growing shareholder value. That compares unfavorably to mobile bulls, who have a 37.9% chance.

The Fortune 1000 is still heavily weighted to manufacturing, resource, utility, food, and pharmaceutical companies, however, and these are not all obviously improved with mobile technology — or even customer-facing technology. (Although there are clear examples of how, given different structures, they could be. For example, the Pfizer app to help you manage all your medication.)

So it makes sense that even mobile bears still have about a one in five shot of significantly growing shareholder value as a financial bull.

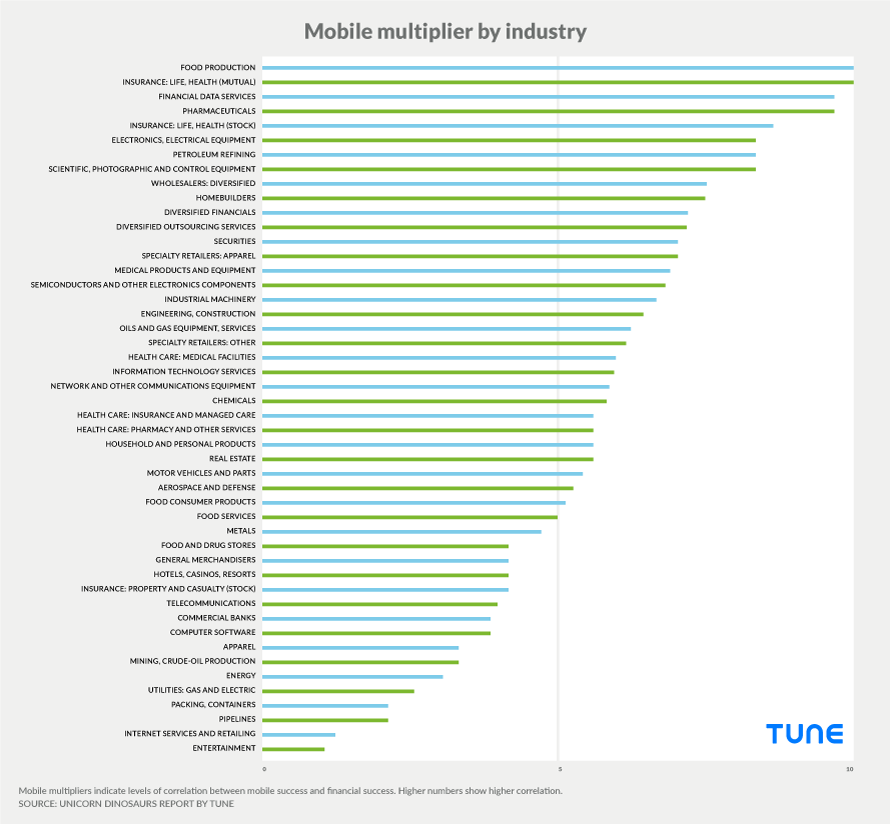

Mobile multipliers by industry

As mentioned earlier, we categorized businesses into one of four groups on both financial and mobile scales:

- Bulls

- Leaders

- Laggards

- Bears

Each business has a 1 in 4 chance of being in any individual category financially, and the same probability for being in any given category for mobile success. That means there’s a 1 in 16 chance, or 6% probability, that a company would land in the same category for both measures … if everything was left up to chance.

However, many companies did land in the exact same category for both measures, meaning that there is some degree of correlation between their mobile efforts and their financial results.

I call that probability the “mobile multiplier.”

Life insurance companies, for instance, have a mobile multiplier of 10, meaning that 60% of companies in the sector exactly match financial to mobile category. Outsourcing services have a 7.14 multiplier, with about a 43% matching rate. And telecoms have a 3.92 mobile multiplier, with a 24% match rate.

The higher the mobile multiplier, the stronger the correlation between mobile success (or failure) and financial success (or failure).

This is a very tough standard to meet, because a mobile bull could be a financial leader, which is close to a financial bull, or a mobile laggard could be a financial bear, and still not match. In fact, only 37% of companies match categories exactly. If we allow fuzzy matches, in which a category “matches” any other category one place away, the match rate increases to a staggering 83%.

Summing up: correlation, not causation

In general, mobile leaders see outsized valuation growth.

More apps, with more users, and particularly more engagement, ultimately results in a better opportunity to connect to customers, distribute digital product, promote real-world goods, understand product-market fit, and promote brand.

The biggest indicator right now is simply: Does a company invest in mobile?

Companies that do realize 8-15% higher stock market returns than companies that do not. Ultimately, that’s not surprising: Investing in technology and investing in customers is generally a smart path to growth.

Clearly, this is correlation, not causation. Taking this relationship too far would be dangerous: companies cannot fix bad product, bad marketing, and bad customer service just by releasing 20 new apps.

But just as clearly, close connections to customers are good for business.

Mobile is the “three-foot device,” the most personal computer that never leaves our sides, even at night. Touching prospects and customers where they are, in the moments that matter, makes good business sense for everyone.

Drilling deeper: key companies and categories

The big picture

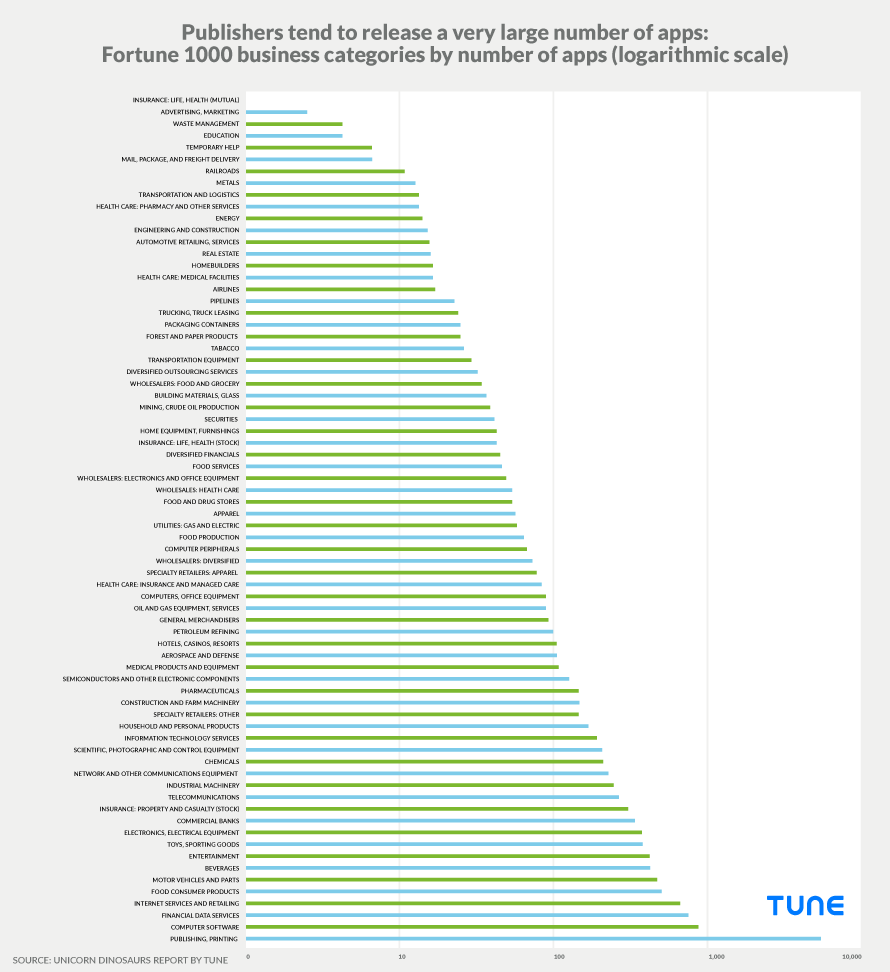

Industries by apps

Perhaps not surprisingly, publishers and printers release a very large number of apps, almost an order of magnitude more than the closest following industries: Computer Software, Financial Data Services, and Internet Services and Retailing.

Mobile apps by Fortune 1000 business categories

This is almost entirely due to Gannett, the largest newspaper publishing company in the U.S., which has published no fewer than 5,729 apps — mostly on Android — for each of its publications, plus apps for myriad niche interests for each of those publications.

Publishing apps, however, is not the same thing as getting users.

For all its efforts, Gannet has amassed an audience of only about 10,000 users per app, totaling just over 60 million. Active engaged audience size is, of course, the key, and that’s what matters most.

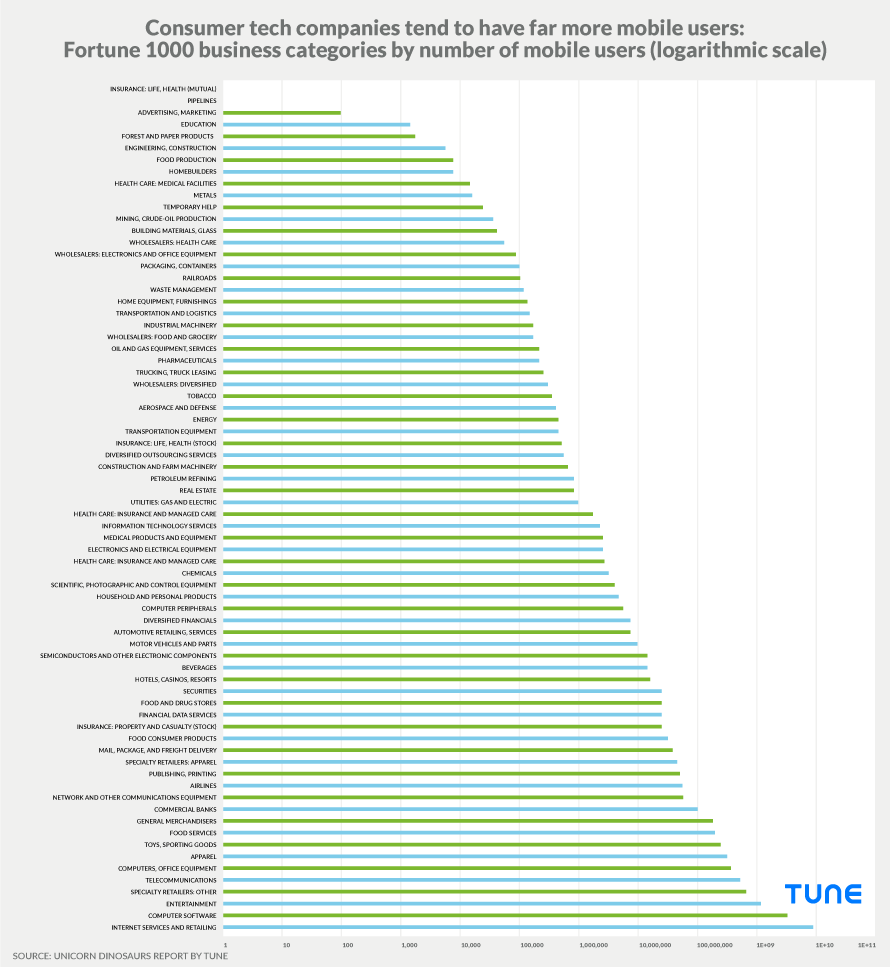

Industries by users

The industry that by far owns mobile users is Internet Services and Retailing. This category contains the behemoths of the mobile ecosystem, Google and Facebook. LinkedIn is here too, as is IAC (InterActiveCorp), Yahoo, eBay, Amazon, and Groupon.

Altogether, this business category has 83 billion aggregated users — 91% of all mobile users for all Fortune 1000 companies. Given what we’ve already seen, it won’t shock you that Google is tops, with 88% of all the mobile users in Internet Services and Retailing, and 81% of all Fortune 1000 mobile app users.

Fortune 1000 business categories by number of mobile users

Note that in this chart, Entertainment, Computer Software, and Internet Services and Retailing are displayed in exponential notation. If they were not, these bars would extend far off the chart.

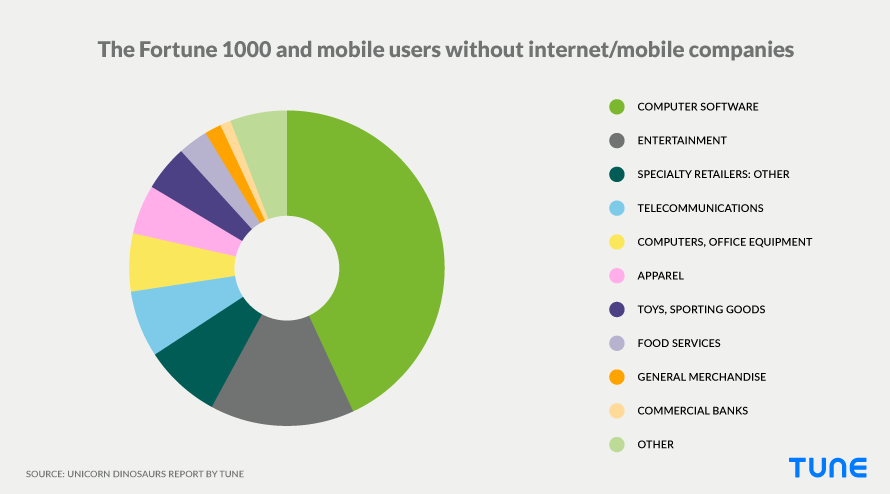

Without the massive Internet Services and Retailing category, here’s what the Fortune 1000 looks like in terms of mobile users by category:

Fortune 1000: mobile users by business category

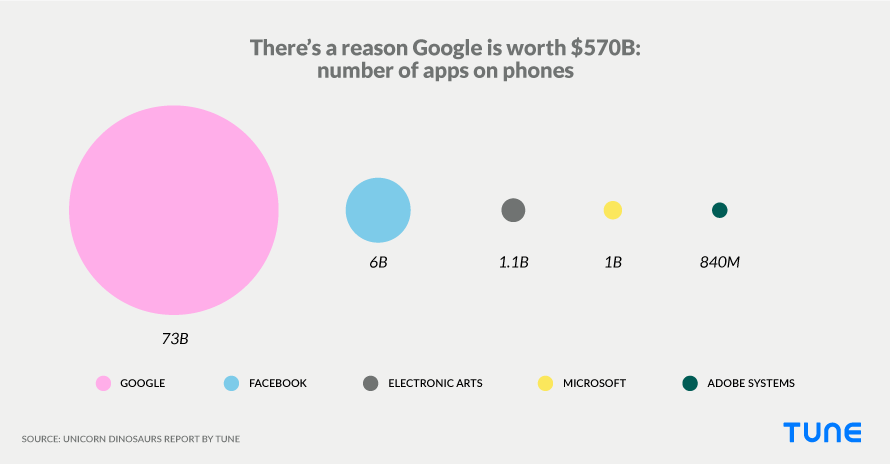

Google, Facebook, Amazon: mobile rulers

Google: one company owns 80% of F1K mobile users

Google, or Alphabet as the company is now known, is the world’s second most valuable company. Depending on Apple’s yet-to-be-released plans in the areas of artificial intelligence, mixed reality, and smarthome/IoT, Google is potentially on track to displace Apple.

There’s a reason for that trajectory.

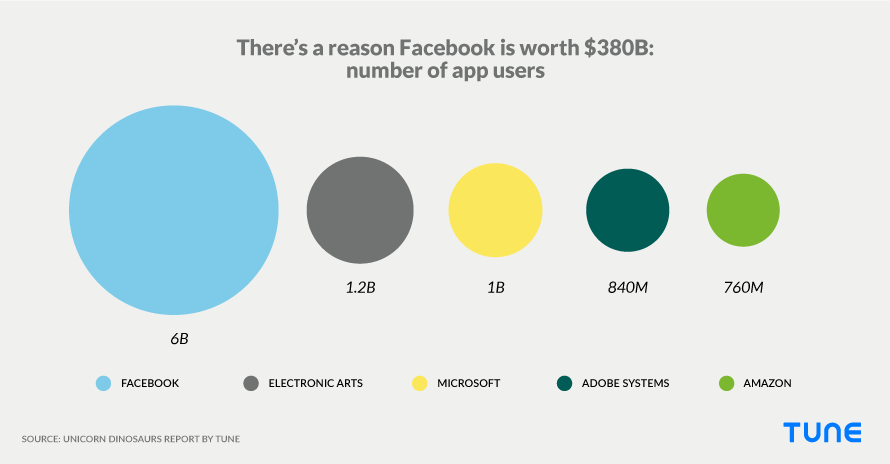

Top F1000 companies by number of mobile users

Google has 12X more apps on phones than its closest rival, Facebook. In fact, if you add up all the apps it has on all phones globally, Google has an aggregated total of 74 billion users before de-duplication. That’s 80.35% of all mobile users for all Fortune 1000 companies.

And that’s one app for every single person on the planet, 10 times over.

(Facebook, on the other hand, concentrates its users into four main apps: Facebook, Messenger, Instagram, and WhatsApp.)

How does Google achieve this massive number?

Simple. The company has at least 334 mobile apps, several of which have more than a billion users each. Average them out, and the typical Google app has 220 million users. This is unprecedented scale and penetration.

It’s good to be king, and it’s good to own the world’s biggest mobile platform. In the period we studied the market, Google grew in valuation by a very healthy 18.47%.

Alphabet Inc’s stock value growth was significant in 2016 (source: Google Finance)

That’s significant for any company, but it’s especially significant for Google. The company’s market capitalization is currently $578 billion. Serious double-digit growth on market caps in the hundred billion dollar and up range is not normal.

Facebook: monetizes 4X better than the best

Facebook doesn’t have anywhere near the number of mobile users, counted per app install, that Google has. Owning the world’s dominant mobile ecosystem has its advantages.

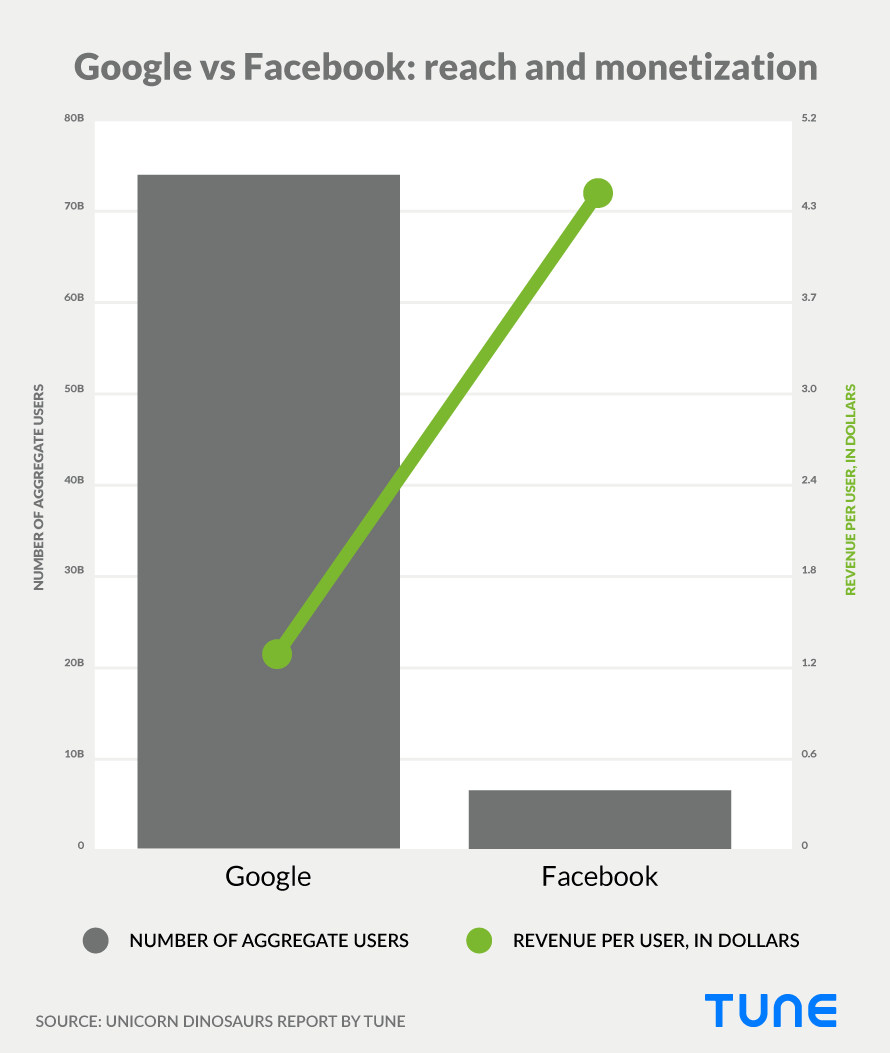

But Facebook currently monetizes much better than Google on its smaller base.

Facebook: number of mobile app users

Facebook currently has about 6.1 billion users for its various apps, primarily Facebook, Messenger, Instagram, and WhatsApp. Google easily has 12X more users, bringing in $90 billion in annual revenue from them.

But Facebook monetizes each user almost 4X better. With its $27.6 billion in revenue, Facebook is making $4.51 in annual revenue per user versus Google’s $1.22. That’s amazing effectiveness via greater efficiency on a smaller base, since Facebook does it with essentially four apps.

Another way of looking at it is that Facebook has developed the ability to connect advertisers and consumers at scale with a level of intimacy that surpasses Google, and Google has to make up the deep engagement factor in Facebook’s few apps by spreading engagement thinner on a wider layer of apps.

Facebook v Google: revenue/user v number of aggregate users

The future winner between Google and Facebook — if indeed it’s a battle — will be decided by Google’s ability to monetize each user better in the thin layers, perhaps by going deeper in some select number of them, and Facebook’s ability to continue to scale its services while not overloading its apps’ ad-serving carrying capacity.

And, of course, by growing its aggregate number of users.

As it is, Facebook grew its market value 35.4% during this study — almost double Google’s rate. Again, the number is significant, but even more significant is that Facebook is not some tiny startup where any growth sends the dial shooting up. Facebook currently has a market capitalization of $408.3 billion. This is no longer a small company.

Facebook’s stock value growth was significant in 2016 (source: Google Finance)

Amazon: 440% more mobile customers than all of its competition combined

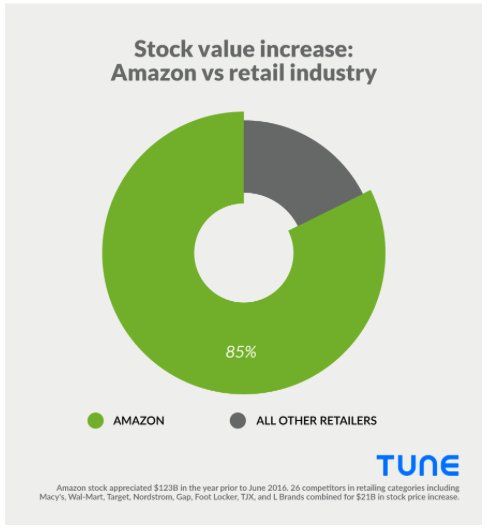

Amazon is a force of nature in commerce. It is eating almost all the growth in retail in multiple categories, and there’s an obvious reason why: more than 700 million mobile users across its entire mobile ecosystem.

That’s 4.4X all of its competitors in the General Merchandising category and the Specialty Retailers: Apparel category.

Amazon v the world: mobile customers

The result has been that Amazon’s stock has appreciated much more than all of its retail competitors.

In fact, in the 12 months of data we gathered for this report, Amazon stock increased in value $102 billion more than all of its competitors and captured almost 6X more value growth.

Amazon v retail: stock value increase

To compete, retail companies are going to have to work harder to reach their customers one-on-one via mobile and provide a better experience.

Amazon has always been a special company on the stock market. Founder Jeff Bezos has had an almost uncanny knack for reinvesting all (and sometimes more than all) of the company’s profits back into product development and market extension, rarely choosing to show the market a profit.

In the past two years, however, the giant’s growth has been too significant to ignore, and investors have decided to reward the company with significant valuation increases. In the period of this study, Amazon stock jumped 43.5% … for a company with a current market cap of $429.8 billion.

Amazon’s stock value growth was impressive in 2016 (source: Google Finance)

Category examples: planes, trains, and automobiles

Aerospace and Defense

We see the investing-in-new-technology proxy in action in the Aerospace and Defense category.

Here, there’s no particular reason why the top five companies in terms of mobile users should also be doing well in the stock market. Virtually no consumers, after all, need Boeing’s app on their phones (although maintenance and repair personnel might).

And yet, there’s strong correlation between mobile investment and business success.

| Company | Apps | Mobile users | Users/app | Financials |

| Rockwell Collins | 16 | 159,978 | 9,999 | WINNING |

| Boeing | 12 | 66,834 | 5,570 | WINNING |

| Raytheon | 13 | 66,030 | 5,079 | WINNING |

| Lockheed Martin | 6 | 34,839 | 5,807 | BULL |

| Northrop Grumman | 4 | 6,555 | 1,639 | BULL |

| Textron | 7 | 4,710 | 673 | LOSING |

| L-3 Communications | 2 | 1,050 | 525 | LOSING |

| AAR | 2 | 30 | 15 | LOSING |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

Car Sales and Service

A category where mobile success is more obviously connected to financial success is Car Sales and Service.

Here, three of the top four companies in terms of mobile penetration are also winning in the stock market, while three of the bottom five are losing.

| Company | Apps | Mobile users | Users/app | Financials |

| CarMax | 3 | 4,871,352 | 1,623,784 | WINNING |

| Avis | 4 | 2,429,696 | 607,424 | BULL |

| AutoNation | 3 | 81,582 | 27,194 | LOSING |

| Sonic Automotive | 1 | 65,412 | 65,412 | WINNING |

| Penske Automotive Group | 0 | 0 | 0 | BULL |

| Group 1 Automotive | 0 | 0 | 0 | LOSING |

| Asbury Automotive Group | 0 | 0 | 0 | BEAR |

| Lithia Motors | 0 | 0 | 0 | WINNING |

| Rush Enterprises | 0 | 0 | 0 | BEAR |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

Financial Data Services

Financial Data Services is a hybrid of both.

Clearly, there are circumstances where personal financial tools on mobile devices can be game-changers. But just as clearly, sheer technological prowess is going to serve a modern financial services company well.

Three of the top four financial services companies in mobile are also winning in stock price growth. Only two of the bottom nine in mobile are also winning financially.

| Company | Apps | Mobile users | Users/app | Financials |

| Western Union | 7 | 6,595,029 | 942,147 | WINNING |

| MasterCard | 64 | 5,411,856 | 84,560 | WINNING |

| Fiserv | 516 | 3,431,010 | 6,649 | BULL |

| Heartland Payment Systems | 32 | 1,286,706 | 40,210 | BULL |

| Equifax | 9 | 951,243 | 105,694 | BULL |

| Visa | 46 | 806,595 | 17,535 | LOSING |

| First Data | 12 | 569,121 | 47,427 | BEAR |

| Vantiv | 6 | 37,350 | 6,225 | WINNING |

| IHS | 18 | 27,069 | 1,504 | BEAR |

| DST Systems | 2 | 16,353 | 8,177 | LOSING |

| Fidelity National Information Services | 1 | 300 | 300 | LOSING |

| Alliance Data Systems | 1 | 30 | 30 | BEAR |

| McGraw Hill Financial | 0 | 0 | 0 | BEAR |

| SunGard Data Systems | 0 | 0 | 0 | BEAR |

| Broadridge Financial Solutions | 0 | 0 | 0 | BULL |

| Global Payments | 0 | 0 | 0 | WINNING |

| Total System Services | 1 | 0 | 0 | LOSING |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

Entertainment

Entertainment is a fairly good example of MobileBest in action.

Five of the top seven MobileBest companies — including Walt Disney and Time Warner — are also financially successful, in terms of stock market valuation growth. Four of the bottom five, including AMC and 21st Century Fox, are challenged.

| Company | Apps | Mobile users | Users/app | Financials |

| Walt Disney | 83 | 570,897,081 | 6,878,278 | BULL |

| Time Warner | 159 | 289,375,000 | 1,819,969 | WINNING |

| iHeartMedia | 7 | 273,488,002 | 39,069,715 | BEAR |

| Viacom | 106 | 191,040,723 | 1,802,271 | WINNING |

| CBS | 19 | 119,028,185 | 6,264,641 | WINNING |

| Discovery Communications | 140 | 35,000,000 | 250,000 | LOSING |

| Liberty Media | 2 | 6,543,000 | 3,271,500 | BULL |

| Scripps Networks Interactive | 18 | 5,670,000 | 315,000 | BULL |

| Regal Entertainment Group | 2 | 4,987,361 | 2,493,681 | BULL |

| Cinemark Holdings | 2 | 4,309,369 | 2154684.5 | LOSING |

| Live Nation Entertainment | 2 | 4,002,820 | 2,001,410 | WINNING |

| Tribune Media | 46 | 4,002,000 | 87,000 | BEAR |

| AMC Networks | 2 | 3,459,731 | 1729865.5 | LOSING |

| Twenty-First Century Fox | 0 | 0 | 0 | LOSING |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

Clearly, however, there’s also a solid middle suite of companies, like Regal, Scripps, and Cinemark, that are not clear mobile winners … but are currently doing very well for their shareholders.

They’d be well-advised to double down on mobile, however, because this is a category under siege from GAFA.

Google, Apple, Facebook, and Amazon (GAFA), all of which are extreme examples of MobileBest, are deeply invading traditional entertainment companies’ space (i.e. music and movies). Relatively recent and small new media competitors like Netflix, Spotify, and Pandora are right on their heels.

What’s significant about Netflix, Spotify, Pandora, and other similar startups? Mobile and connected device apps featuring strong one-to-one relationships with customers who, by using those apps, give these brands broad and deep understanding into their preferences and behavior. Which, of course, those companies invest right back into improving their services.

Breaking that virtuous cycle is hard, and will only get harder over time.

Hotels, Casinos, Resorts

There are counter-examples as well. Or, at least, examples that are not entirely clear-cut.

Hotels, Casinos, and Resorts is one such category.

One the one hand, this industry is an obvious scenario where a one-to-one connection with customers on mobile should lead directly to financial success. Players in this space with significant mobile prowess should be able to understand customers better, meet their needs at a more personal level, and implement high-tech solutions, such as guest access to suites via apps on their phones.

However, that’s not clearly happening here.

| Company | Apps | Mobile users | Users/app | Financials |

| Marriott International | 12 | 11,204,520 | 933,710 | BULL |

| Hilton Worldwide Holdings | 17 | 5,100,897 | 300,053 | LOSING |

| MGM Resorts International | 33 | 2,047,446 | 62,044 | WINNING |

| Starwood Hotels & Resorts | 2 | 1,250,983 | 625,492 | LOSING |

| Wyndham Hotel Group | 14 | 544,124 | 38,866 | LOSING |

| Hyatt Hotels | 2 | 463,321 | 231,661 | WINNING |

| Caesars Entertainment | 1 | 300,000 | 300,000 | BULL |

| Las Vegas Sands | 16 | 86,982 | 5,436 | BULL |

| Wynn Resorts | 4 | 51,450 | 12,863 | WINNING |

| Boyd Gaming | 0 | 0 | 0 | BEAR |

| Penn National Gaming | 0 | 0 | 0 | BEAR |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

While two of the top three by mobile users are financially successful and two of the bottom three are challenged, there’s clearly significant counter-trend examples. Starwood and Hilton experienced some headwinds in 2016 financially, in spite of being fairly high up on the list of mobile success stories.

One positive for Starwood: Although the company was classified as losing in our early to mid-year financial analysis, the firm did manage to pull out an overall positive 2016 on the stock market.

The lesson, however, is simple: Being mobile-savvy specifically and technologically savvy in general is good, but it’s not everything. Macro and micro business conditions matter.

Specialty Retailers: Other

Specialty Retailers: Other is a 43-company category with players like Costco, Home Depot, Best Buy, GameStop, and Netflix. It is 91% aligned (financial success versus mobile leaders).

Highlights include Netflix, with over 500 million mobile users and winning financial performance. Home Depot, with 17.7 million, is also doing extremely well, and GameStop has an extremely robust mobile strategy which has propelled that retailer to success.

Here are the top 15 in the category.

| Company | Apps | Mobile users | Users/app | Financials |

| Netflix | 7 | 509,190,348 | 72,741,478 | WINNING |

| Best Buy | 5 | 49,223,241 | 9,844,648 | BULL |

| Home Depot | 8 | 17,747,949 | 2,218,494 | BULL |

| GameStop | 5 | 6,243,540 | 1,248,708 | WINNING |

| Lowe’s | 13 | 6,047,550 | 465,196 | BULL |

| Costco Wholesale | 4 | 5,685,405 | 1,421,351 | WINNING |

| AutoZone | 2 | 5,036,304 | 2,518,152 | BULL |

| Tiffany | 3 | 4,905,858 | 1,635,286 | LOSING |

| Staples | 11 | 2,233,716 | 203,065 | LOSING |

| RadioShack | 8 | 1,445,128 | 180,641 | BEAR |

| Bed Bath & Beyond | 2 | 825,000 | 412,500 | LOSING |

| Office Depot | 5 | 704,697 | 140,939 | WINNING |

| Cabela’s | 2 | 600,000 | 300,000 | LOSING |

| hhgregg | 8 | 547,374 | 68,422 | WINNING |

| Murphy USA | 2 | 527,907 | 263,954 | BULL |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

Motor Vehicles and Parts

Motor Vehicles and Parts is a 25-company category with 88% alignment between mobile success and financial success. Players include the obvious, like General Motors, Ford, and Tesla, as well as Johnson Controls, WABCO Holdings, and American Axle & Manufacturing.

GM is a highlight here, with an industry-leading 6.2 million mobile users and bullish financial performance. Despite its tiny size, Tesla has the third-most mobile users.

Tesla is also an example of the limits of this kind of purely analytical analysis.

The company is successful in mobile, but its stock valuation trends land it in the losing group. However, anyone familiar with the automotive industry is aware that Tesla is perhaps the most interesting medium to long-term play in the space.

Here are the top 15 in the category.

| Company | Apps | Mobile users | Users/app | Financials |

| General Motors | 200 | 6,202,536 | 31,013 | BULL |

| Ford Motor Company | 49 | 3,188,961 | 65,081 | WINNING |

| Tesla Motors | 2 | 272,658 | 136,329 | LOSING |

| Tenneco | 2 | 33,000 | 16,500 | WINNING |

| Visteon | 18 | 29,862 | 1,659 | BULL |

| Goodyear Tire & Rubber | 25 | 25,557 | 1,022 | BULL |

| Navistar International | 5 | 17,064 | 3,413 | BEAR |

| Johnson Controls | 16 | 9,615 | 601 | WINNING |

| WABCO Holdings | 2 | 3,000 | 1,500 | LOSING |

| Autoliv | 1 | 300 | 300 | BULL |

| Allison Transmission Holdings | 1 | 300 | 300 | LOSING |

| Paccar | 0 | 0 | 0 | WINNING |

| Lear | 0 | 0 | 0 | WINNING |

| BorgWarner | 0 | 0 | 0 | BEAR |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

Specialty Retailers: Apparel

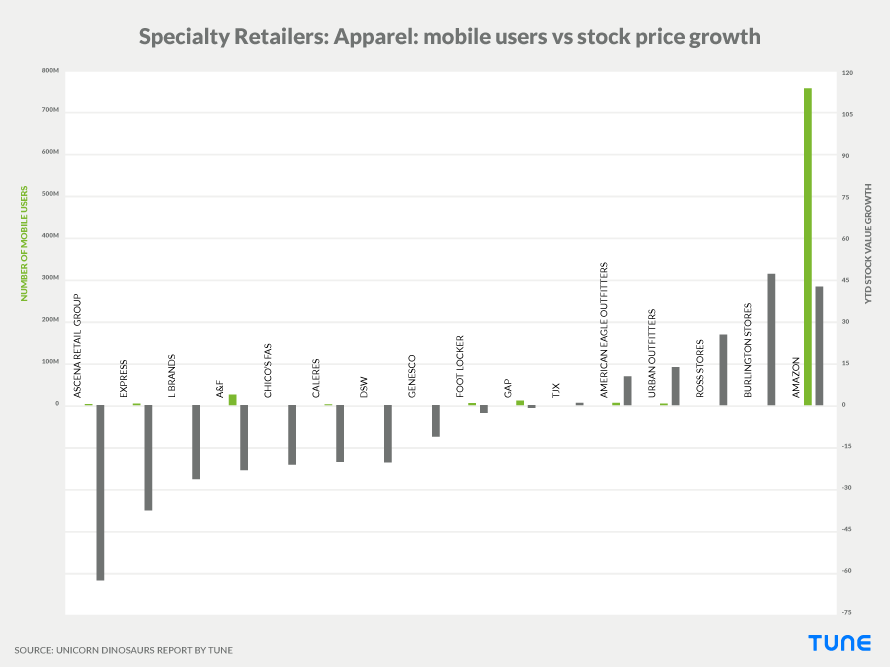

Specialty Retailers: Apparel is an example of what can happen to a category when a black swan event happens.

In a word: disaster.

The industry is tough enough already. Out of 19 companies, 10 lost significant amounts of stock market value over the 12 months of the study, and one was delisted. Two are not traded publicly, and one was acquired, so the available financial data on the majority of these companies is limited.

Only three of the top six are winning mobile customers and outperforming their competition financially.

Here are the top 15 in the category.

| Company | Apps | Mobile users | Users/app | Financials |

| Gap | 6 | 23,393,436 | 3,898,906 | LOSING |

| Abercrombie & Fitch | 4 | 9,932,919 | 2,483,230 | BULL |

| American Eagle Outfitters | 6 | 5,621,249 | 936,875 | LOSING |

| Foot Locker | 2 | 3,333,333 | 1,666,667 | WINNING |

| Urban Outfitters | 3 | 3,044,000 | 1,014,667 | WINNING |

| Caleres | 1 | 295,776 | 295,776 | LOSING |

| Ascena Retail Group | 4 | 150,000 | 22,500 | BEAR |

| Express | 1 | 300 | 300 | WINNING |

| TJX | 0 | 0 | 0 | BULL |

| L Brands | 0 | 0 | 0 | WINNING |

| Ross Stores | 0 | 0 | 0 | BULL |

| Burlington Stores | 0 | 0 | 0 | BULL |

| Genesco | 0 | 0 | 0 | LOSING |

| Chico’s FAS | 0 | 0 | 0 | WINNING |

| DSW | 0 | 0 | 0 | LOSING |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

But the mobile-win-equals-financial-win theory breaks down in Apparel with many of the companies. For instance, while Gap is doing well with mobile, as are American Eagle Outfitters and Caleres, they’re still losing financially.

And bottom-feeders in the mobile world like Burlington, Ross, and TJX have no visible mobile apps and no measureable users, but are outperforming many of their competitors.

Why?

For the same reason as the General Retail category: Amazon. Amazon is eating retail. As visible in the chart, Amazon dwarfs all other specialty retailers in number of mobile users, and has also done extremely well in terms of financial performance.

Specialty retailers: stock price versus mobile users

Bear in mind that while Ross and Burlington look close to Amazon’s performance in this chart, Amazon is close to a $300B company while Ross and Burlington have $22B and $6B market caps, respectively.

In other words, they are barely even comparable.

A $300B company with 43.5% stock price inflation over the course of a single year is nothing short of spectacular.

Burlington, Ross, and TJX are outperforming their apparel retail sector competitors because they are tackling a specific piece of the market: low-end retail. This works well in big-box scenarios, and hits primarily a low-value market segment that isn’t necessarily focused on e-commerce or m-commerce.

So these players, in other words, are avoiding the Amazon effect … for now.

To win, not only does Amazon follow the maxim of “meet your customers where they are,” — which often means mobile — but the retail giant makes it seamless. In addition, Amazon adapts to changing market realities quickly, which some brands such as Aeropostale have failed to do consistently.

Mobile enables not only an intimate, one-to-one brand-to-consumer relationship. It also creates the ability to change strategies more quickly due to more accessible first-party real-time data and analytics on what’s working and what is not working, what is hot and what is passé. Both are particularly important in the fast-paced world of retail.

The result?

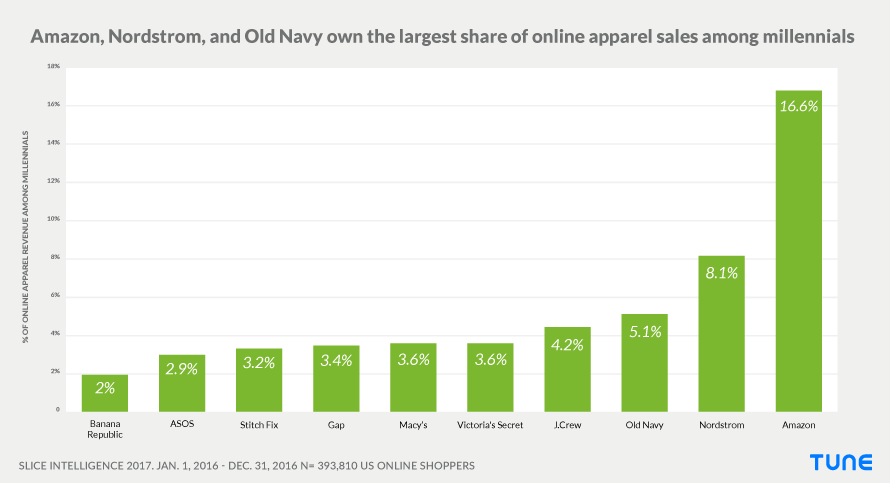

Millennials buy more clothes on Amazon than any other retailer; double what they buy at Nordstrom, and triple what they buy at Old Navy.

Amazon sells more clothes to millennials than anyone else

General Merchandisers

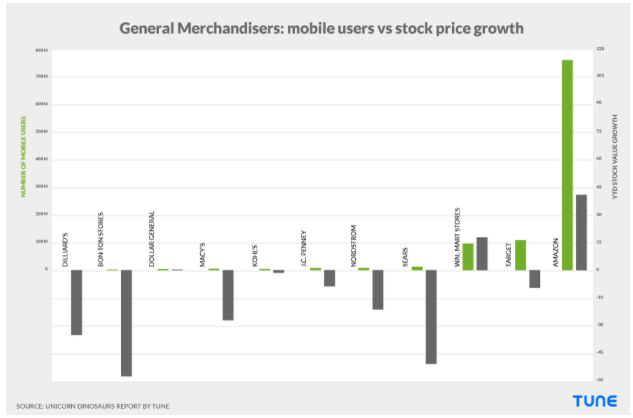

General Merchandisers is a somewhat similar category with 12 competitors who are are even more directly affected by Amazon, since many of them sell packaged goods with little or no differentiation: Walmart, Target, Sears, Nordstrom, JCPenney, and so on.

Almost the only retailers who saw significant stock price valuation growth in 2016 were those who have significant numbers of mobile users. Note, I’ve put Amazon into this category in spite of the fact that Fortune classifies the company as Internet Services and Retailing.

Retailers: stock price v mobile users

Here are the core players:

| Company | Apps | Mobile users | Users/app | Financials |

| Target | 19 | 111,991,422 | 5,894,285 | WINNING |

| Wal-Mart Stores | 15 | 92,421,826 | 6,161,455 | BULL |

| Kohl’s | 2 | 11,250,000 | 5,625,000 | LOSING |

| Sears Holdings | 16 | 10,609,542 | 663,096 | LOSING |

| Nordstrom | 6 | 6,439,119 | 1,073,187 | LOSING |

| Macy’s | 13 | 3,575,257 | 82,712 | WINNING |

| J.C. Penney | 4 | 1,816,939 | 454,235 | BULL |

| Bon-Ton Stores | 14 | 329,151 | 23,511 | BEAR |

| Dollar General | 0 | 0 | 0 | WINNING |

| Family Dollar Stores | 0 | 0 | 0 | BEAR |

| Dillard’s | 0 | 0 | 0 | BULL |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

While Target and Walmart are growing, Kohl’s, Sears, and Nordstrom are struggling. Macy’s has its own challenges, of course, but is still ranked above some of its competitors in financials.

Apparel

You can’t just buy success in mobile when it’s not core to your brand or your product.

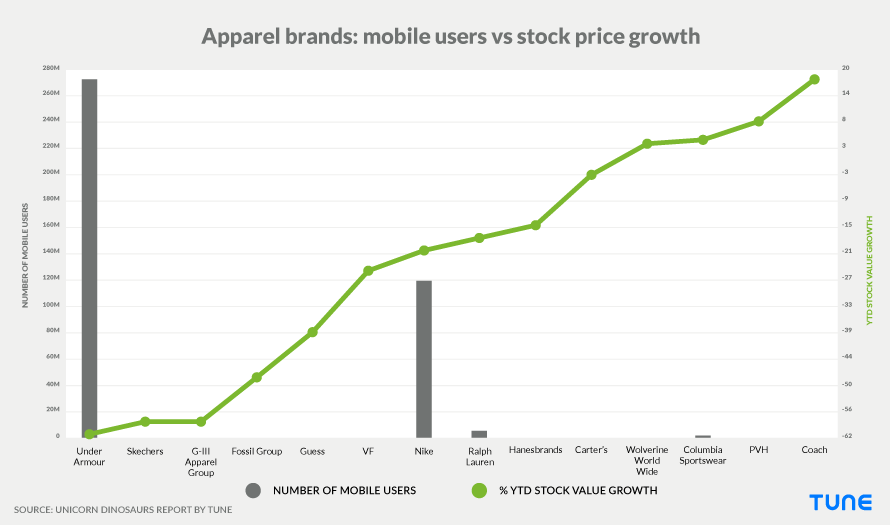

Apparel has had a tough 2016, with only four of 14 Fortune 1000 companies’ stock actually rising. The losers include the two mobile giants of the apparel category, Nike and Under Armour, which are down 21% and 62% respectively, even though both companies appear — on the surface — to be successful on mobile.

The problem is that mobile is not yet core to the value proposition that apparel companies offer to most of their customers.

While Under Armour bought MyFitnessPal in 2015 for $475 million, and has 15 other apps with a total combined audience of well over 200 million users, and Nike has 18 apps with over 100 million users, they are mostly running and fitness apps. The companies’ core brand demographic may actually use them, but many who are in the market for shoes, apparel, and sports equipment do not.

Apparel brands: mobile users v stock price

Mobile apps are not yet core to apparel brands’ customer experiences in the same way that Amazon’s mobile app is to its retail experience. Even app users who might be more likely to choose a Nike shoe because they’re using a Nike app, could easily be seduced into getting a Reebok.

| Company | Apps | Mobile users | Users/app | Financials |

| Under Armour | 16 | 278,410,916 | 17,400,682 | LOSING |

| Nike | 18 | 120,590,034 | 6,699,446 | LOSING |

| Ralph Lauren | 2 | 6,324,345 | 3,162,173 | BEAR |

| Columbia Sportswear | 4 | 640,611 | 160,153 | LOSING |

| Fossil Group | 12 | 365,000 | 30,417 | WINNING |

| Guess | 2 | 137,876 | 68,938 | LOSING |

| Coach | 2 | 49,059 | 24,530 | WINNING |

| PVH | 4 | 30,330 | 7,583 | BEAR |

| VF | 0 | 0 | 0 | BEAR |

| Hanesbrands | 0 | 0 | 0 | BEAR |

| Carter’s | 0 | 0 | 0 | LOSING |

| Wolverine World Wide | 0 | 0 | 0 | LOSING |

| Skechers U.S.A. | 0 | 0 | 0 | WINNING |

| G-III Apparel Group | 0 | 0 | 0 | BEAR |

(Note that financial performance is relative to competitors. Being a “bull” does not necessarily mean the company is doing well in absolute terms.)

An important caveat:

Nike and Under Armour, the only two apparel companies with significant numbers of mobile users, may actually have much better performance than appears in early 2016 comparative data alone. Each company has been on a tear over the past half decade, with Nike producing average annual shareholder returns of 25.5% from 2010 to 2014, and Under Armour producing even better at 58.4% for the same period.

Nothing goes up forever, though; in the tough headwinds of early 2016, these two stocks were hammered.

But it’s likely the fundamentals are still solid.

What is MobileBest?

It’s clear that MobileBest companies are financially successful.

But we should explain what we mean by MobileBest and why it matters, beyond the financials. Very simply, it means what’s best for the customer is what’s best for the brand.

It’s not mobile first, necessarily, and it’s not mobile only.

And it’s not just about apps, either.

Rather, it’s an understanding that mobile is now the primary interface between people and the digital world … and the digital world is becoming a larger and larger portion of our existence, period. It’s a determination to meet customers where they are: to use apps where appropriate, mobile web where it makes sense, integrations into other mobile properties when opportunities present themselves, and desktop when the task demands.

That deserves a little unpacking.

Mobile is not a channel

Email is a channel. Social is a channel. Apps are a channel, as is web, whether mobile or desktop. Display advertising could be considered a channel, and search marketing another.

Outdoor marketing, webinars, events, sales, trade shows — these could all be considered channels.

Mobile is the new ecosystem … with channels living in it

Mobile, on the other hand, is not a channel. Mobile is where these channels live.

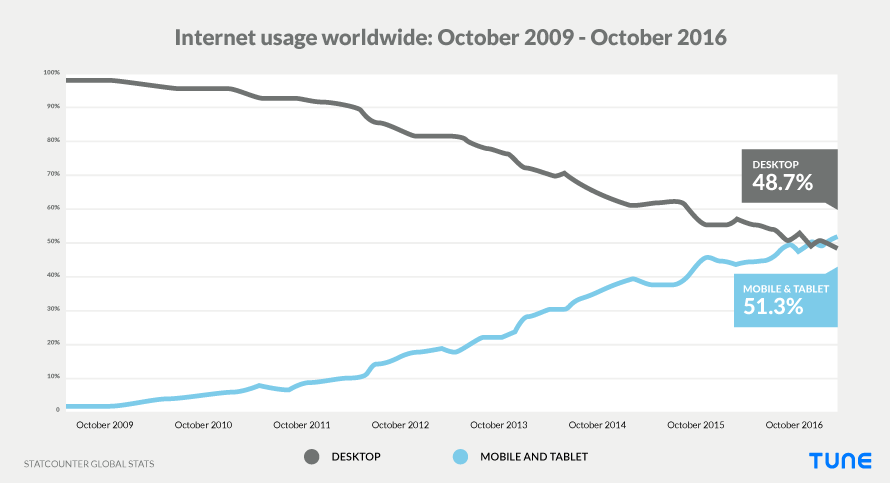

Recent research from CITI indicates that 68% of our digital media time is spent on mobile. That means we’re using apps, sure, but it also means we’re watching video, messaging friends, reading and composing email, and surfing the web … on mobile. And that 68% will be 75% next year, 78% the year after, and so on as it grows.

Mobile is the ecosystem. Channels live inside the mobile universe.

MobileBest is the path to growth

At a recent conference, Seth Godin said that “all the billion-dollar brands of the last decade have a personal one-to-one connection with their customers.”

Those billion-dollar brands include Facebook, Airbnb, Warby Parker, Zappos, PayPal, and Instagram. A quick look at Fortune’s Unicorn List shows similar names: Uber, Snapchat, Flipkart, Didi Kuaidi (China’s Uber), and Pinterest.

How does a company have a one-to-one connection with their customers at scale?

Via mobile: either in-app, or in authenticated, logged-in mobile web.

The most personal computing device of all is the phone, and the phone is the device that’s never more than 3 feet from most people most of the time. The brands that walk alongside their customers and live in their customers’ purses know the most about their customers, have the deepest engagement with them, and the largest share of wallet.

In short: they experience the greatest success, thanks to MobileBest.

Few companies are fully prepared

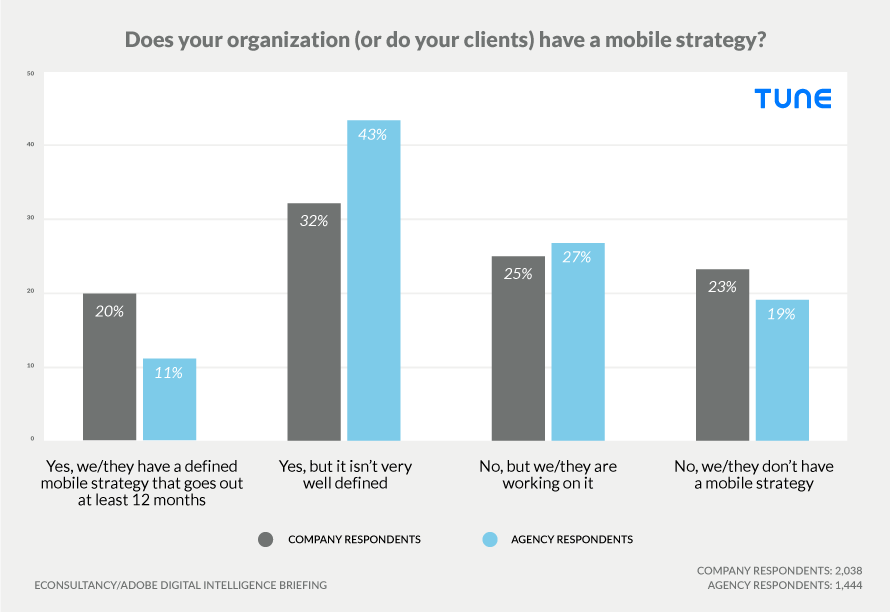

In spite of the massive opportunity mobile represents, many companies are not prepared, and not preparing fast enough. According to an Adobe study of 4,000 marketing pros, only 20% of companies currently have a mobile marketing strategy for the coming year.

Most companies do not have an up-to-date mobile strategy

That’s in spite of the fact that 63% of companies in the Adobe study think the quality of customer experience on mobile is more critical than on desktop … and in spite of the fact that almost half of their digital traffic now comes from mobile.

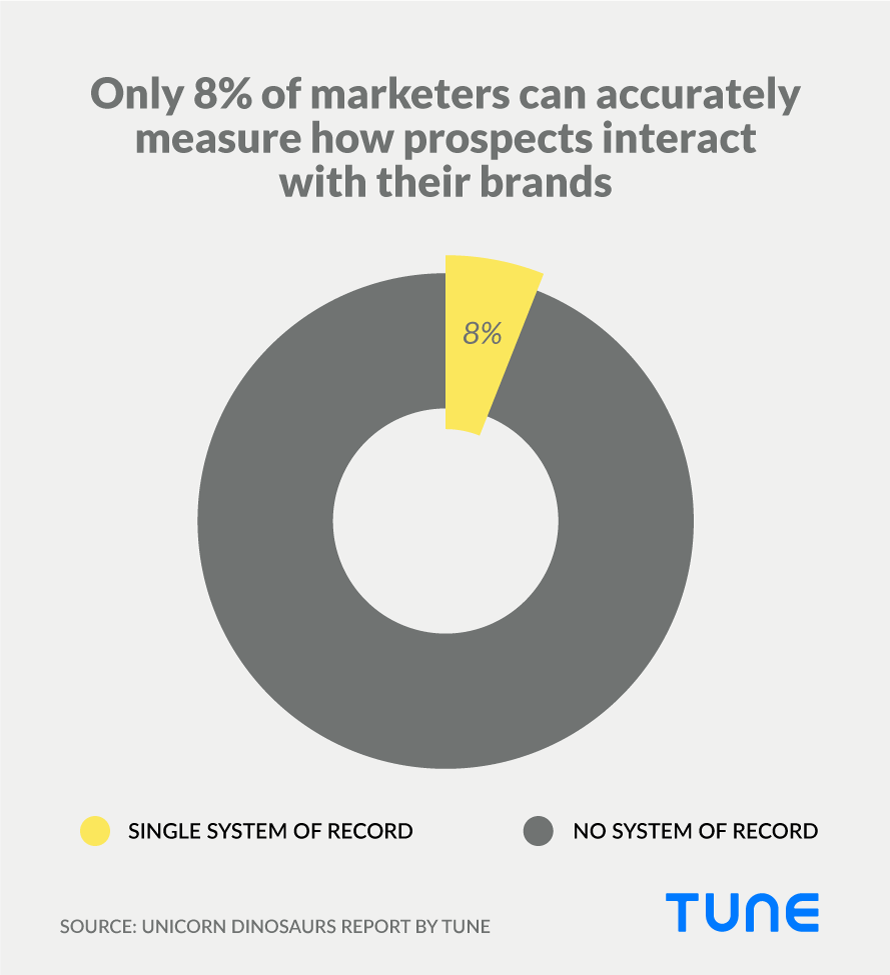

In addition, when TUNE asked a thousand marketers in March of 2017 if they were able to measure and manage all the data on how prospects and customers interact with their brand, only 8% said yes.

8% of marketers can measure the customer journey

Companies that want to win will need to address this, and quickly.

Today, every company is a tech company

There used to be technology companies and non-technology companies. Today, almost every company is a tech company, or it’s not in business for long.

Five of the top six companies by market capitalization are currently “tech companies.”

- Apple

- Alphabet (Google)

- Microsoft

- Berkshire Hathaway

- Amazon

But as IBM’s Rob Thomas says, “With the emergence of cloud, digital, machine learning, and analytics … the traditional business models, cash flows, and unit economics are under pressure.”

AngelList’s Naval Ravikant puts it well: “Competing without software is like competing without electricity.”

With the 6 billion global smartphones marker within sight, and the vast majority of human culture moving to digital storage and mobile-centric transmission, we are solidly in the data era. And that has implications.

“This is the end of ‘tech companies.’ The era of ‘tech companies’ is over; there are only ‘companies,’ steeped in technology, that will survive.”

– Rob Thomas, General Manager, IBM Analytics

Reinvestment and change are the only options. Keeping the status quo is the most risky move you can make.

Becoming MobileBest: How brands can achieve it

Mobile success, like financial success, doesn’t happen by accident. MobileBest companies know what to do to make it more likely.

Understand the customer journey

Every brand needs a marketing system of record.

Customers are spending almost three quarters of their digital media time on mobile. They’re time-shifting TV and watching Netflix. And they’re still using laptops during the day for work, or for more in-depth product research at home.

Mobile is growing; desktop is shrinking

Globally, the crossover happened late last year. And it hasn’t slowed down.

Marketing executives need to understand the customer journey in a complex, mobile, multi-device, and multi-platform world. Customers may use your app, or they may visit your mobile-friendly website, or they may reach out via a messaging app. In fact, they’re likely to do all three. They expect you to know them, be responsive to them, and be able to serve them in a contextually rich way, however they choose to connect.

How do you do that?

Via a marketing system of record that measures and manages all the data associated with both prospect and customer connections to your brand.

Here’s how Liz Miller, Senior Vice President of the CMO Council, puts it:

| “We need that open-stack umbrella that will bring all these points into convergence … this is the biggest thing in the next 12 months.

It’s a new category of stack, customer technology, the revtech stack. I have my marketing operations, I have my advertising, now I have to look at revenue … . How do I take all my marketing and advertising, and see how it all turns into revenue, in unified metrics and measurement, with real-time data.” |

Liz Miller is SVP Marketing for the CMO Council, and was formerly SVP at GlobalFluency |

Mobile time and activity is only increasing. Platform, media, and messaging channel complexity is following.

Smart CMOs will get ahead of the change by implementing their own marketing system of record.

Build for your customer

Know when to use apps. Know when to use web.

Understanding the customer journey is step one. Building for it is step two.

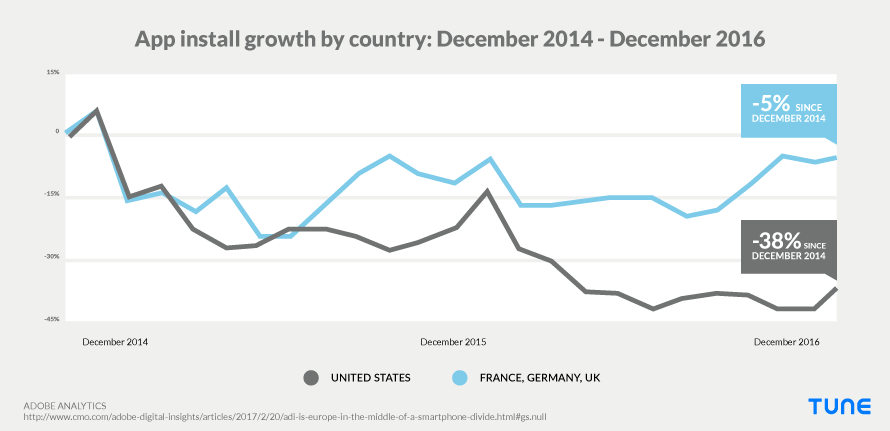

In mature markets like Europe and the U.S., the app gold rush is over. In fact, it probably peaked in late 2014 — an Adobe report suggests that from 2015 on app install velocity has slowed 5% in Europe, and a staggering 38% in the U.S. It is, of course, very important to contextualize that data: it’s from just 1,000 apps, and Adobe customers are likely to be enterprise companies or big brands.

In other words, it’s not representative.

App install velocity has slowed

At the same time, mobile web traffic to those big company websites has jumped considerably: 156% in Europe, and 69% in the U.S.

Apps are still desperately important because there is no other medium available that can deliver customer insights, customer engagement, and customer share-of-wallet the way apps can. There are also very few other ways to provide instant and real-time updates to your customers on a one-to-one basis.

Apps are for your most engaged customers

As the top mobile marketer at GameSpot told me, his mobile-app-using customers are more valuable than top level customers in the company’s loyalty program.

But not everyone is going to install an app for every brand they do business with. In fact, very few will.

So your mobile web experience needs to be top-notch. New technologies such as Google’s Android Instant Apps and Progressive Web Apps are increasingly good options, and Progressive Web Apps now allow for deep integration into Android, including the opportunity to deliver push notifications and to store some data locally for native-like speed and experience.

Mobile web is for prospects, casual customers … and some loyalists.

Three years ago, mobile web was a poor third cousin twice removed of the mobile app: under-powered, unappealing, and neglected. Today it’s clear that web is top-of-funnel, where app is bottom-of-funnel. Web is discovery; app is loyalty. But the web is working its way up, and we’re seeing more customers who prefer to go web-exclusive.

Apps? Yes. Mobile web? You bet.

Experiment and do the best thing for your customers, regardless of the medium? Absolutely.

This is what Scott Brinker has to say about web versus apps:

| “In aggregate it almost doesn’t matter.

What touchpoints are going to be best in context of a specific company and its customers is the question. And the choices will be more than just web and mobile apps … e.g., conversational user interfaces.” |

Scott Brinker is “Chief Martec” as well as CTO and co-founder of Ion Interactive |

Beat the competition

Be easier than the competition. Be more friendly.

Beating the competition is the goal. Ultimately, everything you’ve done to build a unique brand plays to your advantage. Everything you’ve done to differentiate your product boosts your appeal.

Becoming MobileBest is about using those advantages while:

- Being easier to do business with

- Over-indexing on customer centricity

- Getting one-on-one at scale with your customers

Brands can achieve all of these goals by meeting customers where they are: on mobile.

That might mean an app, for your most dedicated customers. That might mean mobile web. It could be an Alexa Skill or a Google Action, excellent voice-first options for helping customers get information and manage services in their homes. It could be via a Siri integration, ensuring that customers can speak their requests to a friendly voice wherever they are.

Easier. Customer-centric. One-on-one.

In the first part of this report, we saw how companies that are mobile leaders improve valuations by 8-15% more than mobile laggards. We also saw that companies that are the best of the best in mobile are almost twice as likely to be extremely successful financially as well, while the worst have only a 20% chance.

There are many things a company needs to be to be successful. Today, mobile is clearly one of them.

Get this entire report, for free, in PDF form

Appendices

Fortune 1000 companies by key financials

| Rank | Company | Industry | 6-month gain/loss: Feb 2016 | 6-month gain/loss: June 2016 | 12-month gain/loss: Oct 2016 |

| 1 | Wal-Mart Stores | General Merchandisers | -9.39% | 17.58% | 16.18% |

| 2 | Exxon Mobil | Petroleum Refining | -4.05% | 10.33% | 5.15% |

| 3 | Chevron | Petroleum Refi

ning |

-5.30% | 11.53% | 10.97% |

| 4 | Berkshire Hathaway | Insurance: Property and Casualty (Stock) | -10.56% | 6.29% | 7.52% |

| 5 | Apple | Computers, Office Equipment | -22.55% | -14.82% | 4.95% |

| 6 | General Motors | Motor Vehicles and Parts | -5.41% | -13.75% | -3.35% |

| 7 | Phillips 66 | Petroleum Refining | -1.61% | -12.13% | -4.48% |

| 8 | General Electric | Diversified Financials | 8.21% | -0.79% | 0.00% |

| 9 | Ford Motor | Motor Vehicles and Parts | -18.35% | -7.43% | -21.30% |

| 10 | CVS Health | Food and Drug Stores | -14.43% | 2.45% | -15.46% |

| 11 | McKesson | Wholesalers: Health Care | -24.53% | 4.79% | -17.53% |

| 12 | AT&T | Telecommunications | 2.59% | 16.12% | 10.79% |

| 13 | Valero Energy | Petroleum Refining | 3.25% | -25.19% | -12.56% |

| 14 | UnitedHealth Group | Health Care: Insurance and Managed Care | -3.28% | 17.19% | 21.17% |

| 15 | Verizon Communications | Telecommunications | 7.27% | 11.89% | 7.83% |

| 16 | AmerisourceBergen | Wholesalers: Health Care | -16.07% | -25.21% | -15.82% |

| 17 | Fannie Mae | Diversified Financials | -42.57% | 11.00% | -30.40% |

| 18 | Costco Wholesale | Specialty Retailers: Other | 3.08% | -8.86% | -2.03% |

| 19 | Hewlett-Packard | Computers, Office Equipment | -67.97% | 4.44% | -52.15% |

| 20 | Kroger | Food and Drug Stores | -3.06% | -6.05% | -17.98% |

| 21 | J.P. Morgan Chase & Co. | Commercial Banks | -16.22% | -2.59% | 9.70% |

| 22 | Express Scripts Holding | Health Care: Pharmacy and Other Services | -20.92% | -12.55% | -19.26% |

| 23 | Bank of America Corp. | Commercial Banks | -24.22% | -14.87% | 3.29% |

| 24 | International Business Machines | Information Technology Services | -23.36% | 10.36% | -0.51% |

| 25 | Marathon Petroleum | Petroleum Refining | -26.21% | -40.05% | -13.77% |

| 26 | Cardinal Health | Wholesalers: Health Care | -0.70% | -10.49% | -6.23% |

| 27 | Boeing | Aerospace and Defense | -17.67% | -12.06% | -1.51% |

| 28 | Citigroup | Commercial Banks | -29.99% | -14.09% | -5.90% |

| 29 | Amazon | Internet Services and Retailing | 11.65% | 5.79% | 43.49% |

| 30 | Wells Fargo | Commercial Banks | -15.94% | -8.21% | -14.71% |

| 31 | Microsoft | Computer Software | 14.67% | -2.99% | 25.62% |

| 32 | Procter & Gamble | Household and Personal Products | -1.26% | 7.56% | 12.60% |

| 33 | Home Depot | Specialty Retailers: Other | 8.70% | -0.60% | 3.14% |

| 34 | Archer Daniels Midland | Food Production | -28.73% | 18.57% | -7.90% |

| 35 | Walgreens Boots Alliance | Food and Drug Stores | -15.01% | -8.53% | -7.45% |

| 36 | Target | General Merchandisers | -10.28% | -6.18% | -9.07% |

| 37 | Johnson & Johnson | Pharmaceuticals | 3.97% | 10.44% | -1.24% |

| 38 | Anthem | Health Care: Insurance and Managed Care | -8.68% | -0.39% | -23.53% |

| 39 | MetLife | Insurance: Life, Health (stock) | -22.03% | -10.18% | -1.03% |

| 40 | Internet Services and Retailing | 11.50% | -3.16% | 18.47% | |

| 41 | State Farm Insurance Cos. | Insurance: Property and Casualty (Mutual) | Private Company | ||

| 42 | Freddie Mac | Diversified Financials | -41.18% | 2.44% | -32.24% |

| 43 | Comcast | Telecommunications | -10.03% | 2.09% | 4.37% |

| 44 | PepsiCo | Food Consumer Products | 0.69% | 1.21% | 5.94% |

| 45 | United Technologies | Aerospace and Defense | -12.36% | 4.04% | 6.10% |

| 46 | American International Group | Insurance: Property and Casualty (Stock) | -12.89% | -8.42% | 0.00% |

| 47 | United Parcel Service | Mail, Package, and Freight Delivery | -4.50% | -1.15% | 3.08% |

| 48 | Dow Chemical | Chemicals | -6.97% | 0.42% | 13.54% |

| 49 | Aetna | Health Care: Insurance and Managed Care | -6.90% | 8.83% | -1.52% |

| 50 | Lowe’s | Specialty Retailers: Other | 4.65% | 3.89% | -2.91% |

| 51 | ConocoPhillips | Mining, Crude-Oil Production | -31.55% | -17.11% | -24.78% |

| 52 | Intel | Semiconductors and Other Electronic Components | 5.91% | 8.39% | 6.39% |

| 53 | Energy Transfer Equity | Pipelines | -69.10% | 37.65% | -29.64% |

| 54 | Caterpillar | Construction and Farm Machinery | -22.68% | 1.04% | 23.91% |

| 55 | Prudential Financial | Insurance: Life, Health (stock) | -21.33% | -7.81% | 4.89% |

| 56 | Pfizer | Pharmaceuticals | -11.04% | 5.55% | -6.45% |

| 57 | Walt Disney | Entertainment | -18.82% | -12.91% | -14.05% |

| 58 | Humana | Health Care: Insurance and Managed Care | -10.74% | 2.87% | -4.57% |

| 59 | Enterprise Products Partners | Pipelines | -23.56% | 7.72% | -7.37% |

| 60 | Cisco Systems | Network and Other Communications Equipment | -16.31% | 5.86% | 6.73% |

| 61 | Sysco | Wholesalers: Food and Grocery | 9.03% | 17.09% | 14.59% |

| 62 | Ingram Micro | Wholesalers: Electronics and Office Equipment | 15.99% | 12.67% | 24.85% |

| 63 | Coca-Cola | Beverages | 3.87% | 3.75% | 0.25% |

| 64 | Lockheed Martin | Aerospace and Defense | 4.72% | 6.28% | 9.89% |

| 65 | FedEx | Mail, Package, and Freight Delivery | -20.89% | 0.24% | 11.62% |

| 66 | Johnson Controls | Motor Vehicles and Parts | -19.48% | -3.50% | 20.83% |

| 67 | Plains GP Holdings | Pipelines | -68.53% | -22.95% | -29.03% |

| 68 | World Fuel Services | Wholesalers: Diversified | -18.61% | 5.23% | 18.12% |

| 69 | CHS | Food Production | 222.00% | 3.39% | -19.08% |

| 70 | American Airlines Group | Airlines | -67.38% | -24.08% | -8.72% |

| 71 | Merck | Pharmaceuticals | -10.74% | 4.65% | 18.90% |

| 72 | Best Buy | Specialty Retailers: Other | -12.51% | 1.75% | 13.72% |

| 73 | Delta Air Lines | Airlines | 4.58% | -8.53% | -16.16% |

| 74 | Honeywell International | Electronics, Electrical Equip. | -4.15% | 9.87% | 12.31% |

| 75 | HCA Holdings | Health Care: Medical Facilities | -27.87% | 11.39% | 12.08% |

| 76 | Goldman Sachs Group | Commercial Banks | -24.37% | -16.24% | -5.70% |

| 77 | Tesoro | Petroleum Refining | -12.57% | -33.06% | -22.02% |

| 78 | Liberty Mutual Insurance Group | Insurance: Property and Casualty (Stock) | Private company | ||

| 79 | United Continental Holdings | Airlines | -15.40% | -20.49% | -0.59% |

| 80 | New York Life Insurance | Insurance: Life, Health (Mutual) | Private company | ||

| 81 | Oracle | Computer Software | -9.30% | 2.27% | 1.50% |

| 82 | Morgan Stanley | Commercial Banks | -33.80% | -18.50% | -1.47% |

| 83 | Tyson Foods | Food Production | 22.59% | 28.72% | 53.51% |

| 84 | Safeway | Food and Drug Stores | 0.95% | 0.06% | 0.06% |

| 85 | Nationwide | Insurance: Property and Casualty (Mutual) | Private company | ||

| 86 | Deere | Construction and Farm Machinery | -19.25% | 1.78% | 13.74% |

| 87 | DuPont | Chemicals | -5.75% | 0.12% | 49.71% |

| 88 | American Express | Commercial Banks | -25.96% | -8.81% | -12.73% |

| 89 | Allstate | Insurance: Property and Casualty (Stock) | -14.59% | 7.65% | 10.36% |

| 90 | Cigna | Health Care: Insurance and Managed Care | -9.74% | -4.79% | -11.77% |

| 91 | Mondelez International | Food Consumer Products | -2.40% | 0.81% | -7.94% |

| 92 | TIAA-CREF | Insurance: Life, Health (Mutual) | Private company | ||

| 93 | INTL FCStone | Diversified Financials | -8.06% | -21.15% | 24.55% |

| 94 | Massachusetts Mutual Life Insurance | Insurance: Life, Health (Mutual) | Private company | ||

| 95 | DirecTV | Telecommunications | -0.22% | -0.22% | Data Not Available |

| 96 | Halliburton | Oil and Gas Equipment, Services | -29.50% | 8.80% | 28.09% |

| 97 | Twenty-First Century Fox | Entertainment | -18.75% | -2.06% | -12.38% |

| 98 | 3M | Miscellaneous | -1.59% | 6.90% | 13.99% |

| 99 | Sears Holdings | General Merchandisers | -20.03% | -39.95% | -51.42% |

| 100 | General Dynamics | Aerospace and Defense | -8.76% | -1.66% | 5.98% |

| 101 | Publix Super Markets | Food and Drug Stores | 3559.00% | Not Publicly Traded | |

| 102 | Philip Morris International | Tobacco | 2.74% | 13.46% | 9.72% |

| 103 | TJX | Specialty Retailers: Apparel | 3.34% | 7.42% | 1.46% |

| 104 | Time Warner | Entertainment | -17.21% | 7.88% | 24.24% |

| 105 | Macy’s | General Merchandisers | -41.79% | -18.18% | -27.66% |

| 106 | Nike | Apparel | 8.45% | -16.34% | -20.65% |

| 107 | Tech Data | Wholesalers: Electronics and Office Equipment | 13.47% | 7.25% | 9.11% |

| 108 | Avnet | Wholesalers: Electronics and Office Equipment | 0.66% | -10.72% | -6.60% |

| 109 | Northwestern Mutual | Insurance: Life, Health (Mutual) | Not Publicly Traded | ||

| 110 | McDonald’s | Food Services | 26.18% | 7.90% | 8.69% |

| 111 | Exelon | Utilities: Gas and Electric | -8.29% | 24.22% | 6.70% |

| 112 | Travelers Cos. | Insurance: Property and Casualty (Stock) | -2.30% | -0.58% | 2.31% |

| 113 | Qualcomm | Network and Other Communications Equipment | -22.52% | 13.86% | 13.39% |

| 114 | International Paper | Packaging, Containers | -31.16% | 0.57% | 11.56% |

| 115 | Occidental Petroleum | Mining, Crude-Oil Production | -3.82% | 1.28% | 0.51% |

| 116 | Duke Energy | Utilities: Gas and Electric | -1.15% | 15.51% | 6.02% |

| 117 | Rite Aid | Food and Drug Stores | -9.90% | -1.53% | 11.39% |

| 118 | Gilead Sciences | Pharmaceuticals | -17.66% | -20.54% | -27.75% |

| 119 | Baker Hughes | Oil and Gas Equipment, Services | -30.59% | -12.77% | -2.75% |

| 120 | Emerson Electric | Electronics, Electrical Equip. | -15.32% | 3.78% | 10.69% |

| 121 | EMC | Computer Peripherals | -7.70% | 9.61% | 4.61% |

| 122 | United Services Automobile Assn. | Insurance: Property and Casualty (Stock) | Not Publicly Traded | ||

| 123 | Union Pacific | Railroads | -23.24% | -1.81% | -2.77% |

| 124 | Northrop Grumman | Aerospace and Defense | 10.75% | 13.80% | 23.43% |

| 125 | Alcoa | Metals | -26.61% | 0.32% | -6.18% |

| 126 | Capital One Financial | Commercial Banks | -19.02% | -6.54% | 0.29% |

| 127 | National Oilwell Varco | Oil and Gas Equipment, Services | -27.76% | -12.66% | -6.17% |

| 128 | US Foods | Wholesalers: Food and Grocery | -7.99% | ||

| 129 | Raytheon | Aerospace and Defense | 13.34% | 2.71% | 22.85% |

| 130 | Time Warner Cable | Telecommunications | -4.66% | 13.12% | 11.05% |

| 131 | Arrow Electronics | Wholesalers: Electronics and Office Equipment | -6.33% | 12.91% | 5.15% |

| 132 | Aflac | Insurance: Life, Health (stock) | -6.78% | 6.52% | 13.11% |

| 133 | Staples | Specialty Retailers: Other | -36.45% | -29.24% | -39.92% |

| 134 | Abbott Laboratories | Medical Products and Equipment | -21.11% | -13.47% | -4.07% |

| 135 | Community Health Systems | Health Care: Medical Facilities | -61.34% | -55.63% | -75.26% |

| 136 | Fluor | Engineering, Construction | -9.49% | 9.09% | 10.88% |

| 137 | Freeport-McMoRan | Mining, Crude-Oil Production | -65.83% | 37.53% | -19.29% |

| 138 | U.S. Bancorp | Commercial Banks | -12.68% | -2.19% | 7.55% |

| 139 | Nucor | Metals | -17.37% | 15.88% | 13.54% |

| 140 | Kimberly-Clark | Household and Personal Products | 11.12% | 6.29% | 1.96% |

| 141 | Hess | Petroleum Refining | -40.49% | 1.91% | -13.55% |

| 142 | Chesapeake Energy | Mining, Crude-Oil Production | -58.84% | -20.91% | -20.48% |

| 143 | Xerox | Information Technology Services | -12.48% | -7.53% | -7.39% |

| 144 | ManpowerGroup | Temporary Help | -16.58% | -12.26% | -8.18% |

| 145 | Amgen | Pharmaceuticals | -7.33% | -4.15% | 3.87% |

| 146 | AbbVie | Pharmaceuticals | -14.42% | 4.50% | 7.87% |

| 147 | Danaher | Scientific, Photographic and Control Equipment | 15.93% | 2.13% | -9.86% |

| 148 | Whirlpool | Electronics, Electrical Equip. | -22.63% | 5.00% | 6.64% |

| 149 | PBF Energy | Petroleum Refining | 15.38% | -35.73% | -37.08% |

| 150 | HollyFrontier | Petroleum Refining | -26.96% | -45.79% | -51.59% |

| 151 | Eli Lilly | Pharmaceuticals | -3.05% | -10.35% | -4.00% |

| 152 | Devon Energy | Mining, Crude-Oil Production | -48.39% | -19.99% | -8.06% |

| 153 | Progressive | Insurance: Property and Casualty (Stock) | -1.35% | 6.84% | -1.97% |

| 154 | Cummins | Construction and Farm Machinery | -31.35% | 13.54% | 16.49% |

| 155 | Icahn Enterprises | Petroleum Refining | -32.19% | -27.86% | -39.17% |

| 156 | AutoNation | Automotive Retailing, Services | -23.73% | -21.50% | -23.52% |

| 157 | Kohl’s | General Merchandisers | -19.97% | -24.88% | -1.92% |

| 158 | Paccar | Motor Vehicles and Parts | -26.48% | 7.31% | 7.54% |

| 159 | Dollar General | General Merchandisers | -6.24% | 38.19% | 1.16% |

| 160 | Hartford Financial Services Group | Insurance: Property and Casualty (Stock) | -15.75% | -0.77% | -9.67% |

| 161 | Southwest Airlines | Airlines | 8.09% | -7.66% | 4.61% |

| 162 | Anadarko Petroleum | Mining, Crude-Oil Production | -50.36% | -15.14% | -13.42% |

| 163 | Southern | Utilities: Gas and Electric | 9.46% | 10.27% | 9.32% |

| 164 | Supervalu | Food and Drug Stores | -43.84% | -33.29% | -37.41% |

| 165 | Kraft Foods Group | Food Consumer Products | 5.48% | 5.48% | 5.78% |

| 166 | Goodyear Tire & Rubber | Motor Vehicles and Parts | -1.64% | -20.17% | -3.30% |

| 167 | EOG Resources | Mining, Crude-Oil Production | -8.42% | -0.55% | 7.29% |

| 168 | CenturyLink | Telecommunications | -11.56% | -0.92% | 5.22% |

| 169 | Altria Group | Tobacco | 10.47% | 10.75% | 8.48% |

| 170 | Tenet Healthcare | Health Care: Medical Facilities | -54.70% | -15.40% | -34.40% |

| 171 | General Mills | Food Consumer Products | -3.16% | 7.62% | 6.62% |

| 172 | eBay | Internet Services and Retailing | -5.60% | -16.49% | 18.37% |

| 173 | ConAgra Foods | Food Consumer Products | -9.26% | 8.72% | 15.16% |

| 174 | Lear | Motor Vehicles and Parts | 2.57% | -6.07% | -1.20% |

| 175 | TRW Automotive Holdings | Motor Vehicles and Parts | 0.51% | 0.52% | Not Publicly Traded |

| 176 | United States Steel | Metals | -60.30% | 77.97% | 58.49% |

| 177 | Penske Automotive Group | Automotive Retailing, Services | -32.84% | -16.32% | -14.27% |

| 178 | AES | Utilities: Gas and Electric | -30.32% | 11.21% | 11.50% |

| 179 | Colgate-Palmolive | Household and Personal Products | -4.21% | 6.05% | 5.66% |

| 180 | Global Partners | Wholesalers: Diversified | 4.29% | -46.21% | -52.60% |

| 181 | Thermo Fisher Scientific | Scientific, Photographic and Control Equipment | -2.78% | 8.70% | 19.19% |

| 182 | PG&E Corp. | Utilities: Gas and Electric | 1.22% | 12.79% | 11.62% |

| 183 | NextEra Energy | Utilities: Gas and Electric | 3.20% | 20.60% | 19.34% |

| 184 | American Electric Power | Utilities: Gas and Electric | 4.75% | 14.96% | 6.73% |

| 185 | Baxter International | Medical Products and Equipment | -2.92% | 14.94% | 42.04% |

| 186 | Centene | Health Care: Insurance and Managed Care | -13.11% | 5.23% | 6.88% |

| 187 | Starbucks | Food Services | 2.37% | -11.31% | -10.51% |

| 188 | Gap | Specialty Retailers: Apparel | -34.29% | -33.77% | -0.83% |

| 189 | Bank of New York Mellon Corp. | Commercial Banks | -15.11% | -3.67% | 6.32% |

| 190 | Micron Technology | Semiconductors and Other Electronic Components | -41.11% | -20.89% | -8.43% |

| 191 | Jabil Circuit | Semiconductors and Other Electronic Components | 0.26% | -25.27% | -5.98% |

| 192 | PNC Financial Services Group | Commercial Banks | -12.81% | -5.49% | 6.06% |

| 193 | Kinder Morgan | Pipelines | -57.04% | -25.22% | -34.46% |

| 194 | Office Depot | Specialty Retailers: Other | -33.62% | 47.70% | -54.28% |

| 195 | Bristol-Myers Squibb | Pharmaceuticals | -3.02% | 5.08% | -22.44% |

| 196 | NRG Energy | Energy | -54.29% | 39.24% | -23.30% |

| 197 | Monsanto | Chemicals | -13.67% | 14.74% | 13.45% |

| 198 | PPG Industries | Chemicals | -10.08% | 2.25% | -8.30% |

| 199 | Genuine Parts | Wholesalers: Diversified | -5.23% | 6.80% | 8.78% |

| 200 | Omnicom Group | Advertising, Marketing | 0.21% | 12.12% | 10.49% |

| 201 | Illinois Tool Works | Industrial Machinery | -4.49% | 13.03% | 34.08% |

| 202 | Murphy USA | Specialty Retailers: Other | 3.54% | 13.06% | 23.16% |

| 203 | Land O’Lakes | Food Consumer Products | Not Traded Publicly | ||

| 204 | Western Refining | Petroleum Refining | -27.37% | -52.52% | -33.11% |

| 205 | Western Digital | Computer Peripherals | -41.42% | -27.12% | -33.26% |

| 206 | FirstEnergy | Utilities: Gas and Electric | -0.65% | 4.27% | 2.12% |

| 207 | Aramark | Diversified Outsourcing Services | 2.08% | 0.24% | 18.68% |

| 208 | DISH Network | Telecommunications | -25.24% | -22.39% | -7.43% |

| 209 | Las Vegas Sands | Hotels, Casinos, Resorts | -23.89% | 4.22% | 14.96% |

| 210 | Kellogg | Food Consumer Products | 11.41% | 7.54% | 6.52% |

| 211 | Loews | Insurance: Property and Casualty (Stock) | -6.17% | 7.77% | 12.77% |

| 212 | CBS | Entertainment | -9.27% | 8.10% | 33.53% |

| 213 | Ecolab | Chemicals | -4.93% | -0.48% | -5.18% |

| 214 | Whole Foods Market | Food and Drug Stores | -27.81% | 8.91% | -17.01% |

| 215 | Chubb | Insurance: Property and Casualty (Stock) | -11.74% | 10.55% | 11.89% |

| 216 | Health Net | Health Care: Insurance and Managed Care | -1.05% | 5.18% | 6.35% |

| 217 | Waste Management | Waste Management | 6.44% | 13.74% | 18.61% |

| 218 | Apache | Mining, Crude-Oil Production | -15.64% | 17.93% | 33.68% |

| 219 | Textron | Aerospace and Defense | -8.22% | -11.56% | -0.46% |

| 220 | Synnex | Wholesalers: Electronics and Office Equipment | 10.57% | -4.85% | 13.57% |

| 221 | Marriott International | Hotels, Casinos, Resorts | -17.47% | -7.23% | -9.06% |

| 222 | Viacom | Entertainment | -21.95% | -13.53% | -24.60% |

| 223 | Lincoln National | Insurance: Life, Health (stock) | -31.61% | -15.98% | -3.21% |

| 224 | Nordstrom | General Merchandisers | -37.41% | -33.74% | -19.53% |

| 225 | C.H. Robinson Worldwide | Transportation and Logistics | -0.37% | 9.18% | -4.03% |

| 226 | Edison International | Utilities: Gas and Electric | 2.85% | 5.23% | 10.30% |

| 227 | Marathon Oil | Mining, Crude-Oil Production | -56.31% | -26.03% | -24.07% |

| 228 | Yum Brands | Food Services | -18.75% | 13.20% | 20.52% |

| 229 | Computer Sciences | Information Technology Services | -52.30% | -28.24% | -13.73% |

| 230 | Parker-Hannifin | Industrial Machinery | -16.60% | 9.91% | 22.44% |

| 231 | DaVita HealthCare Partners | Health Care: Medical Facilities | -15.05% | 3.67% | -20.31% |

| 232 | CarMax | Automotive Retailing, Services | -26.90% | -6.65% | -10.91% |

| 233 | Texas Instruments | Semiconductors and Other Electronic Components | 2.28% | 6.03% | 33.10% |

| 234 | WellCare Health Plans | Health Care: Insurance and Managed Care | -4.80% | 21.30% | 31.39% |

| 235 | Marsh & McLennan | Diversified Financials | -10.85% | 19.03% | 20.52% |

| 236 | Consolidated Edison | Utilities: Gas and Electric | 10.26% | 16.93% | 9.18% |

| 237 | Oneok | Pipelines | 1.87% | 45.04% | 30.39% |

| 238 | Visa | Financial Data Services | -2.34% | -0.23% | 8.36% |

| 239 | Jacobs Engineering Group | Engineering, Construction | -5.68% | 15.37% | 28.56% |

| 240 | CSX | Railroads | -26.83% | 10.69% | 10.43% |

| 241 | Entergy | Utilities: Gas and Electric | -1.55% | 14.33% | 7.03% |

| 242 | Internet Services and Retailing | 2.49% | 13.21% | 35.40% | |

| 243 | Dominion Resources | Utilities: Gas and Electric | 1.65% | -14.82% | -0.41% |

| 244 | Leucadia National | Food Production | -30.07% | 0.05% | -8.44% |

| 245 | Toys “R” Us | Specialty Retailers: Other | Not Traded Publicly | ||

| 246 | DTE Energy | Utilities: Gas and Electric | 3.83% | 12.50% | 11.28% |

| 247 | Ameriprise Financial | Diversified Financials | -24.63% | -10.56% | -12.55% |

| 248 | VF | Apparel | -19.69% | -4.48% | -25.04% |

| 249 | Praxair | Chemicals | -13.14% | 2.76% | 9.55% |

| 250 | J.C. Penney | General Merchandisers | -16.87% | -4.26% | -8.11% |

| 251 | Automatic Data Processing | Diversified Outsourcing Services | 1.08% | 1.56% | 0.03% |

| 252 | L-3 Communications | Aerospace and Defense | -7.24% | 10.78% | 32.62% |

| 253 | CDW | Information Technology Services | 14.47% | -4.96% | 0.80% |

| 254 | Guardian Life Ins. Co. of America | Insurance: Life, Health (Mutual) | Not traded publicly | ||

| 255 | Xcel Energy | Utilities: Gas and Electric | 10.77% | 14.79% | 9.66% |

| 256 | Norfolk Southern | Railroads | -15.01% | -11.98% | 18.58% |

| 257 | PPL | Utilities: Gas and Electric | 8.89% | 14.95% | -3.31% |

| 258 | R.R. Donnelley & Sons | Publishing, Printing | -20.04% | 0.43% | -61.44% |

| 259 | Huntsman | Chemicals | -56.64% | 19.19% | 38.31% |

| 260 | Bed Bath & Beyond | Specialty Retailers: Other | -33.66% | -19.66% | -30.61 |

| 261 | Stanley Black & Decker | Home Equipment, Furnishings | -8.41% | 3.75% | 21.52% |

| 262 | L Brands | Specialty Retailers: Apparel | 17.14% | -29.76% | -25.12% |

| 263 | Liberty Interactive | Internet Services and Retailing | -10.61% | 0.97% | -32.52% |

| 264 | Farmers Insurance Exchange | Insurance: Property and Casualty (Mutual) | Not traded publicly | ||

| 265 | First Data | Financial Data Services | -17.02% | -24.69% | -13.12% |

| 266 | Sherwin-Williams | Chemicals | -6.80% | 5.40% | 13.97 |

| 267 | BlackRock | Securities | -12.35% | 1.87% | 4.45% |

| 268 | Voya Financial | Insurance: Life, Health (stock) | -34.82% | -18.17% | -22.34% |

| 269 | Ross Stores | Specialty Retailers: Apparel | 3.86% | 2.39% | 26.04% |

| 270 | Sempra Energy | Utilities: Gas and Electric | -8.76% | 5.71% | 3.19% |

| 271 | Estée Lauder | Household and Personal Products | -4.47% | 7.83% | 2.05% |

| 272 | H.J. Heinz | Food Consumer Products | 13.61% | ||

| 273 | Reinsurance Group of America | Insurance: Life, Health (stock) | -17.04% | 6.94% | 15.70% |

| 274 | Public Service Enterprise Group | Utilities: Gas and Electric | -1.57% | 13.83% | -5.80% |

| 275 | Cameron International | Oil and Gas Equipment, Services | 23.25% | -2.98% | 0.92% |

| 276 | Navistar International | Motor Vehicles and Parts | -60.25% | -23.62% | 66.40% |

| 277 | CST Brands | Specialty Retailers: Other | -3.00% | 2.08% | 37.75% |

| 278 | State Street Corp. | Commercial Banks | -27.53% | -13.01% | 3.46% |

| 279 | Unum Group | Insurance: Life, Health (stock) | -26.06% | 0.08% | 8.80% |

| 280 | Hilton Worldwide Holdings | Hotels, Casinos, Resorts | -31.36% | -10.93% | -5.41% |

| 281 | Family Dollar Stores | General Merchandisers | 1.53% | 0.00% | 1.04% |

| 282 | Principal Financial | Insurance: Life, Health (stock) | -30.35% | -13.63% | 7.54% |

| 283 | Reliance Steel & Aluminum | Metals | -9.97% | 25.96% | 17.30% |

| 284 | Air Products & Chemicals | Chemicals | -8.96% | 3.74% | -3.18% |

| 285 | Assurant | Insurance: Property and Casualty (Stock) | 8.89% | 2.70% | 3.42% |

| 286 | Peter Kiewit Sons’ | Engineering, Construction | Not traded publicly | ||

| 287 | Henry Schein | Wholesalers: Health Care | 1.25% | 10.96% | 5.32 |

| 288 | Cognizant Technology Solutions | Information Technology Services | 1.74% | -3.51% | -23.41% |

| 289 | MGM Resorts International | Hotels, Casinos, Resorts | 10.51% | 0.07% | 21.11% |

| 290 | W.W. Grainger | Wholesalers: Diversified | -18.56% | 13.10% | -1.87% |

| 291 | Group 1 Automotive | Automotive Retailing, Services | -38.42% | -26.44% | -32.45% |

| 292 | BB&T Corp. | Commercial Banks | -21.65% | -5.95% | 6.33% |

| 293 | Rock-Tenn | Packaging, Containers | -1.54% | -1.54% | Not traded publicly |

| 294 | Advance Auto Parts | Specialty Retailers: Other | -9.02% | -5.17% | -25.61% |

| 295 | Ally Financial | Commercial Banks | -27.94% | -10.02% | -5.56% |

| 296 | AGCO | Construction and Farm Machinery | -10.68% | 1.29% | 15.98% |

| 297 | Corning | Network and Other Communications Equipment | -4.01% | 9.33% | 41.03% |

| 298 | Biogen | Pharmaceuticals | -10.51% | -3.55% | 6.71% |

| 299 | NGL Energy Partners | Wholesalers: Diversified | -55.28% | -17.20% | -4.54% |

| 300 | Stryker | Medical Products and Equipment | -4.90% | 13.95% | 13.68% |

| 301 | Molina Healthcare | Health Care: Insurance and Managed Care | -18.91% | -21.65% | -13.77% |

| 302 | Precision Castparts | Aerospace and Defense | 24.46% | 1.44% | 1.54% |

| 303 | Discover Financial Services | Commercial Banks | -11.98% | -0.12% | -0.63% |

| 304 | Genworth Financial | Insurance: Life, Health (stock) | -67.94% | -26.16% | 2.96% |

| 305 | Eastman Chemical | Chemicals | -14.79% | 3.51% | -3.12% |

| 306 | Dean Foods | Food Consumer Products | 14.85% | -2.37% | -9.43% |

| 307 | AutoZone | Specialty Retailers: Other | 10.43% | -2.56% | 0.97% |

| 308 | MasterCard | Financial Data Services | -8.25% | -1.55% | 5.34% |

| 309 | Owens & Minor | Wholesalers: Health Care | 0.94% | -4.88% | -4.39% |

| 310 | Hormel Foods | Food Consumer Products | 34.59% | -7.28% | 14.45% |

| 311 | GameStop | Specialty Retailers: Other | -41.59% | -19.99% | -43.75% |

| 312 | Autoliv | Motor Vehicles and Parts | 14.06% | -1.12% | -13.09% |

| 313 | CenterPoint Energy | Utilities: Gas and Electric | -5.03% | 32.41% | 21.50% |

| 314 | Fidelity National Financial | Insurance: Property and Casualty (Stock) | -20.18% | -3.73% | 1.59% |

| 315 | Sonic Automotive | Automotive Retailing, Services | -18.99% | -28.38% | -17.61% |

| 316 | HD Supply Holdings | Wholesalers: Diversified | -24.75% | 9.32% | 10.54% |

| 317 | Charter Communications | Telecommunications | -6.47% | 17.48% | Not publicly traded |

| 318 | Crown Holdings | Packaging, Containers | -10.09% | 1.00% | 5.66% |

| 319 | Applied Materials | Semiconductors and Other Electronic Components | -0.12% | 31.26% | 79.60% |

| 320 | Mosaic | Chemicals | -46.72% | -17.29% | -30.40% |

| 321 | CBRE Group | Real Estate | -26.17% | -20.84% | -19.05% |

| 322 | Avon Products | Household and Personal Products | -44.19% | 11.88% | 81.72% |

| 323 | Republic Services | Waste Management | 2.43% | 9.56% | 16.58% |

| 324 | Universal Health Services | Health Care: Medical Facilities | -20.63% | 8.11% | -3.82% |

| 325 | Darden Restaurants | Food Services | -14.45% | 18.28% | -3.18% |

| 326 | Steel Dynamics | Metals | -10.28% | 40.86% | 39.12% |

| 327 | SunTrust Banks | Commercial Banks | -19.92% | 0.69% | 14.12% |

| 328 | Caesars Entertainment | Hotels, Casinos, Resorts | 33.26% | -8.78% | -10.56% |

| 329 | Targa Resources | Pipelines | -73.77% | 6.96% | -21.52% |

| 330 | Dollar Tree | Specialty Retailers: Other | 1.13% | 18.46% | 19.30% |

| 331 | News Corp. | Publishing, Printing | -13.86% | -16.42% | -8.09% |

| 332 | Ball | Packaging, Containers | 1.22% | 4.72% | 19.03% |

| 333 | Thrivent Financial for Lutherans | Insurance: Life, Health (Mutual) | Not publicly traded | ||

| 334 | Masco | Home Equipment, Furnishings | 9.84% | 7.83% | 25.25% |

| 335 | Franklin Resources | Securities | -27.84% | -10.15% | -10.37% |

| 336 | Avis | Automotive Retailing, Services | -32.18% | -26.08% | -37.04% |

| 337 | Reynolds American | Tobacco | 20.00% | 7.02% | 13.56% |

| 338 | Becton Dickinson | Medical Products and Equipment | -1.22% | 10.38% | 23.47% |

| 339 | Priceline | Internet Services and Retailing | -9.24% | 2.25% | 9.79% |

| 340 | Broadcom | Semiconductors and Other Electronic Components | 5.71% | 0.09% | 25.60% |