Smart, Managed Growth

Building smart, sustainable growth is the goal for most mobile acquisition marketers, advertising managers, and ad network managers. Hard to believe at this early stage, but the mobile landscape is quickly maturing and businesses are getting smarter about what constitutes good volume, versus growing at all costs. The cost of unmanaged growth is high, as it translates into loss of trust, relationships, and time. Today’s best mobile marketers approach growth with an eye toward value, as they shift from a purely acquisition-focused mindset to a longer-term mindset.

All growth comes with an element of risk — and advertising fraud is one of the biggest risks that marketers will face. In 2016, Forrester estimated that advertisers spent $7.4 billion on low-quality ads, with over half the budget wasted on fraudulent or unviewable inventory. They further predict that the number of wasted budgets will grow to $10.9 billion by 2021. It is a huge problem, and fraud continues to grow in spite of widely publicized efforts to eliminate it. While completely eliminating fraud is nearly impossible, there is much you can do to prevent it.

Left Unmanaged, We All Lose

The inherent problem with fraud prevention is that most third-party solutions have been built for single players, and not for the larger ecosystem. To dial down fraud successfully, it takes a village — and all sides need to truly understand the data, align incentives, and operate with a high level of transparency. Today’s third-party tools that attempt to tackle fraud do so from only one angle, with only half the picture, and often within a black box, which only exacerbates the situation.

Why? These third-party solutions only reinforce the problem, as fraud relies on opacity, conjecture, and distrust to survive. More concerning is that as mobile marketers are faced with evolving systems and new form factors, you can be sure the fraud picture will grow murkier. Without significant change, everyone loses.

While most traditionally think of marketers as the ones with the most to lose, the truth is fraud hurts everyone:

- Impact on marketers: Perhaps most obviously, marketers lose money to invalid traffic sources. And they lose time clawing back from partners. Most damaging, they lose trust with distribution partners.

- Impact on advertising partners: As marketers report clawbacks, ad partners are not compensated for the traffic they drive via the publisher (good or bad). Partners lose money, and (ultimately) they lose publishers’ business. This is true whether or not the true root cause of fraud was identified. Often, the root cause is a single sub-publisher versus an entire network. Even so, this bad experience tarnishes the reputation of the ad partner as a whole.

Without proper precision and granularity, high-quality traffic is discarded with the bad. Heard the expression, “Throwing the baby out with the bath water”? That is largely the effect of using blunt instruments on your most precious relationships. Fraud prevention requires a more thoughtful set of precision tools to help each side of the relationship fulfill the jobs that they aspire to do. This means drilling below the ad partner, geographic, and campaign levels. Best practice means marketers take the time to isolate the issue, build trusting relationships with their partners, communicate rules of the road, and collaborate together to distill the good from the bad.

Types of Fraud

While mobile ad fraud is not new, it’s complicated. Beyond install-related fraud, organic traffic is getting hijacked by publishers that play no role in driving the traffic. This translates into distorted, inflated ROI metrics, because super-valuable organic users are claimed by these fraudulent publishers.

Let’s quickly review the most common types of advertising fraud:

- Click fraud (e.g., click injections, click spamming):

- Fake click, genuine user

- Install fraud (e.g., bots, farms, invalid receipts):

- Fake click, fake user

- Compliance fraud (e.g., context, incentivized):

- Genuine click, genuine user, wrong user geography/profile/etc.

In addition, there are multiple kinds of non app-install mobile fraud, including:

- Viewability fraud:

- Stacked, off-screen, not viewable

- Targeting/compliance fraud:

- Served to real people, but not the audience a marketer wants

- Bot fraud:

- Served to bots or software agents, not real people; the bots may or may not click (tap) on the ads

As businesses assess their acquisition programs, gaining clarity on which traffic is truly incremental and organic is more and more critical. Having the tools to get a handle on fraud requires expertise in performance marketing, mobile marketing, and big data to be able to identify patterns of fraud as they emerge.

TUNE’s Vision

TUNE is an end-to-end mobile marketing stack that seamlessly connects marketers to their ad partners. Our complete solution helps marketers and their partners measure and manage growth with precision. As such, our vision is to provide both sides of the ecosystem with the data, tools, and intelligence that empower businesses to take control of their marketing.

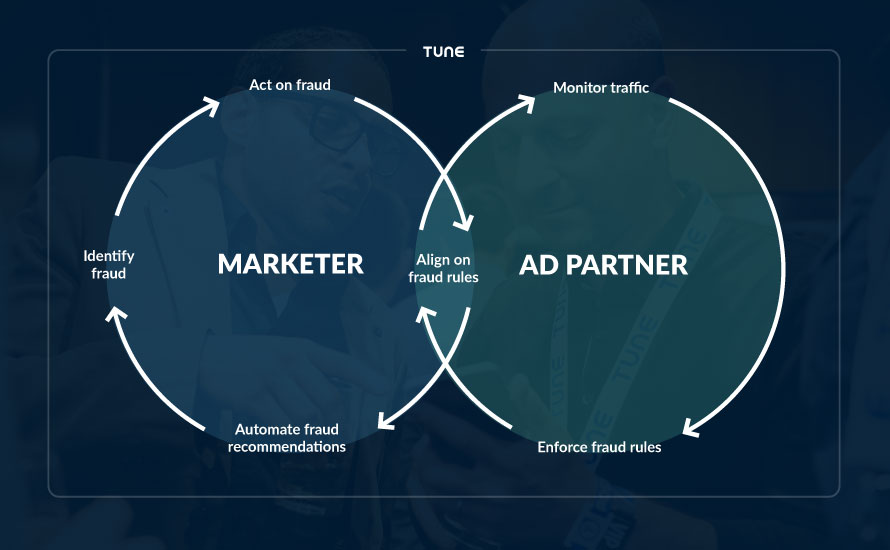

TUNE aspires to make the mobile marketing ecosystem a better place. This means:

- Empowering both sides with the right tools to create accountability

- Creating a virtuous cycle where good ad partners attract good publishers, and drive good value for marketers

- Aligning incentives better through transparency, where marketers’ rules are visible and clear

- Facilitating communication to allow both sides to share feedback so they can adjust and remediate

“With our Fraud Prevention Solution, we want to bring the ecosystem together, not divide it,” said TUNE CTO Dan Koch. “We hope that marketers and advertising partners alike see that we are building solutions to help both parties start an intelligent conversation about fraud.”

The TUNE Fraud Prevention Solution shines a light on the root causes of fraud and gives all parties the information they need to take the right, most granular actions to reduce fraud.

Our solution has four parts:

- IDENTIFY: TUNE Fraud Reports

- Helps marketers and ad partners identify types of fraud and behavior, and pinpoints suspicious activity with industry-leading granularity: down to the sub-publisher and sub-campaign levels.

- Examples include the Partner Fraud Report and the Time-to-Action Report.

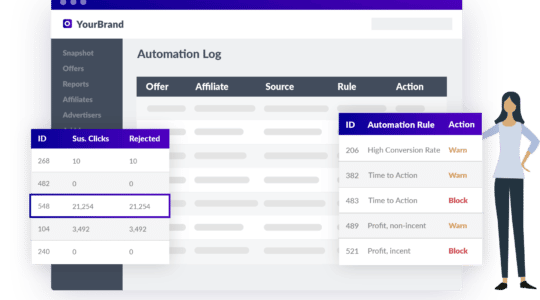

- ACT: TUNE Fraud Rules

- Custom attribution rules (actions, filters, operators) defined and set by marketers for all inbound clicks to award, flag as suspicious, or filter out traffic sources that apply.

- Granularity down to the sub-publisher and sub-campaign levels.

- ALIGN: TUNE Fraud Transparency Insights

- Fraud Rules are made visible to ad partners.

- Reason codes for suspicious installs are itemized to help ad partners take action on particular attribution decisions.

- AUTOMATE: TUNE Proactive Fraud Prevention

- Proprietary predictive analytics engine that surfaces fraud as it happens.

- Monitors and learns key patterns of fraud and operationalizes learnings directly into marketers’ processes.

Our Differentiation

As a neutral, independent attribution solution that measures both supply and demand side, TUNE is in the best position to understand industry data and provide full-picture insights on fraud to both marketers and their ad partners. Most importantly, TUNE’s fraud tools address it with unbiased transparency, helping restore the trust and relationships that lead the industry toward a better future together.

As CEO Peter Hamilton put it, “Marketers and partners trust us implicitly to expose the truth in marketing. Fraud is such a complex topic that it requires a very sophisticated set of tools to separate out the truth from fiction. Far too often without granular data, we over-correct for what should be solvable problems, reducing everyone’s options for scaling growth.”

TUNE provides the industry’s most transparent, granular, and actionable system of tools to help marketers and their ad partners detect, handle, and prevent fraud. It is too easy to make fraud a zero-sum game. The real work is in separating out the nuances that help your businesses thrive. Our hope is to provide sufficient granularity in the data to empower all sides of the ecosystem with the insight they need to surgically remove the bad actors, while shining a light on the relationships that thrive.

Learn more about TUNE’s Fraud Prevention Solution.

Author

Becky is the Senior Content Marketing Manager at TUNE. Before TUNE, she handled content strategy and marketing communications at several tech startups in the Bay Area. Becky received her bachelor's degree in English from Wake Forest University. After a decade in San Francisco and Seattle, she has returned home to Charleston, SC, where you can find her strolling through Hampton Park with her pup and enjoying the simple things in life.

Leave a Reply

You must be logged in to post a comment.