In China, cultural traditions suggest that if a dog comes into a home, it signals good fortune. Luckily, strong GDP growth and the second largest economy in the world indicate that China is already poised to receive plenty of good fortune this year — especially in performance marketing and e-commerce.

With the year well underway, keep an eye on the following four performance marketing e-commerce trends in China over the coming months.

1. Increasing Mobile Ad Spend

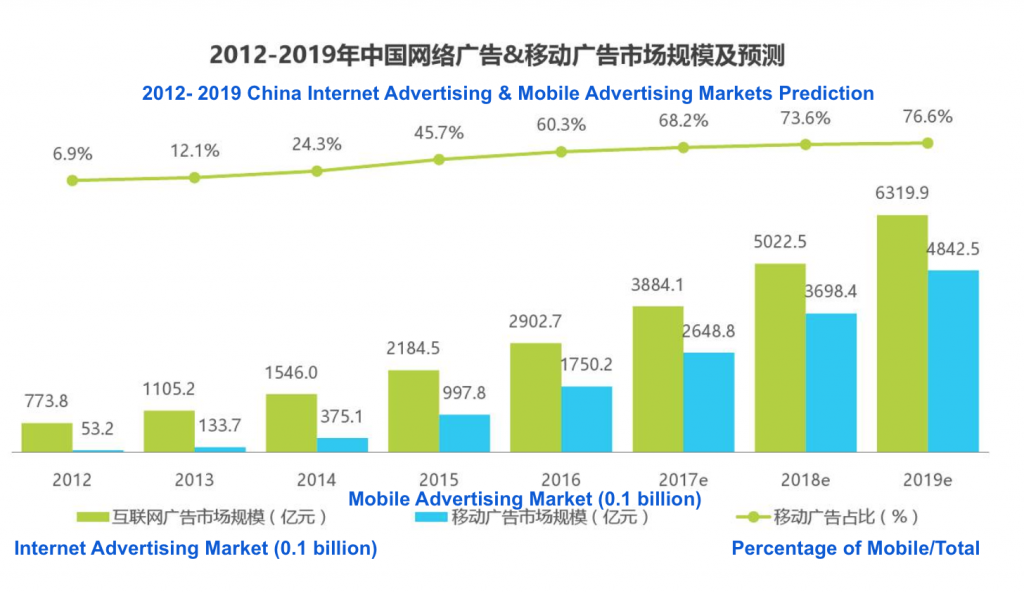

As of June 2017, 96% of all internet users in China — about 724 million people — accessed the internet on mobile devices. Of all internet ad spend, 60% went to mobile ads. That’s 10X growth since 2014, when mobile ads accounted for only 6% of all internet ad spend in the country. And mobile is only expected to grow from there, with iResearch projecting that mobile ads will make up 80% of all internet ad spend in China by 2019.

Source: https://komarketing.com/blog/four-china-digital-marketing-trend-2018/

What’s more, current estimates indicate that 7 out of 10 online purchases in China are now made on mobile devices. With approximately 315 million people in China making purchases online — 6X the number of online purchasers in the U.K., and 2X more than Japan — performance marketers stand to gain a huge audience in the country.

Additionally, Baidu (China’s internet search engine with 75% market share) is adopting more mobile-friendly features. These include call extension and enhanced CPC bidding. The company is likely to continue rolling out new features and tools for marketers, and optimizing its solutions for mobile web.

2. Investing in Lower-Tier Cities

For the first time, third- and fourth-tier cities have surpassed large cities in e-commerce growth in China. (The Chinese government ranks cities on a tier system, where Tier I cities are the biggest and most developed in the country, (e.g., Shanghai or Beijing); Tier II cities are large- or medium-sized; and Tier III and IV cities are small or rural. See our post on the top Chinese cities for performance marketing for more on the tier classification system.)

This change has been driven partly by lower-tier cities gaining access to wealth as the rising GDP tide of China lifts all boats. As Tier III and IV cities generally have less infrastructure, leading retailers are investing in thousands of new delivery and warehouse operations to expand their reach. E-commerce has flourished in these locations as a result.

As supply and delivery infrastructure expands, performance marketers should consider analyzing regional trends and purchase data to select new, less competitive markets in which to test their advertising.

3. Tapping Into the Popularity of “In-Feed Flows”

Mobile in-feed flow ads, or news feed ads for mobile web, gained traction in China in 2017. Research shows that Chinese companies prefer these ads over other formats such as display, interstitial, search, and video, by 55% to 46%, 40%, 31%, and 30%, respectively.

By 2019, estimates are that news feed ads will still be growing at a rate of 56% year-over-year. That kind of sustained growth is a clear sign to jump onboard and take advantage of the top providers in this space, including Baidu. The company launched an AI-powered news feed product in 2016 that beat projections on ad revenue for the fourth quarter of 2017.

“We expect Baidu to be one of the top three players of the mobile news feed ad market together with Toutiao and Tencent,” Jefferies equity analyst Karen Chan said of Baidu’s revenue report. Take note of these three companies — they’re among those you’ll want to consider for news feed ads.

4. Expanding Across Social Media Platforms

Social media drives approximately 50% of e-commerce in many parts of Asia. It is also fundamentally changing the way Chinese people communicate on a daily basis, replacing traditional mobile phones and communication channels in both personal and professional capacities. Many e-commerce brands and retailers — especially those involved in luxury goods — have already figured this out and established lucrative toeholds in the ecosystem. In short, the importance of social media in China cannot be overstated.

As such, Chinese social media companies have begun fighting for superiority by expanding their offerings for both users and advertisers. With more than 1 billion active daily users, the all-in-one app WeChat is leading the way. How? By incorporating stores into their app, allowing for instant payment via a wallet function, enabling services such as booking flights and hailing taxis, and facilitating connections between brands and consumers.

Several of the most popular platforms, including WeChat and QQ (both owned by Tencent), Sina Weibo, Tieba (owned by Baidu), Meituan-Dianping, and Momo have also launched advertising and targeting services that offer global performance marketers a range of social networks and advertising opportunities.

Performance marketers who are unfamiliar with social media in China should assess which platform offers the most upside for their business and consider experimenting with limited budgets until they learn the ropes.

The Future of Performance Marketing in China

The Chinese performance marketing e-commerce space will remain exciting, with changes developing almost as quickly as the country’s overall economy.

To learn more about whether buying a performance marketing platform or building one of your own is right for you, read our post where we break down everything worth considering for the Chinese market.

Then tell us in the comments below — any other trends you’re keeping an eye on in China?

Author

Becky is the Senior Content Marketing Manager at TUNE. Before TUNE, she handled content strategy and marketing communications at several tech startups in the Bay Area. Becky received her bachelor's degree in English from Wake Forest University. After a decade in San Francisco and Seattle, she has returned home to Charleston, SC, where you can find her strolling through Hampton Park with her pup and enjoying the simple things in life.

Leave a Reply

You must be logged in to post a comment.