Affiliate Manager extraordinaire, Geno Prussakov, tweeted a screen capture of an advertiser email announcing an affiliate commission reduction to 1% for the remainder of 2012 in order to “maintain budgets.” Geno paired the picture with “Isn’t the very idea of performance-based marketing to be budget-immune?!”

It’s great to see performance marketers thinking about the affiliate channel in relation to budget because the same budget challenges apply in all channels. As an affiliate, I used to get angry every time I got an email telling me an affiliate commission was reduced. Nobody likes being told they are getting less per sale, but I started asking why. Often the answers were incredibly fair. The reality is, there are plenty of valid reasons an affiliate commission isn’t a static number.

Attribution Provides Some Answers

Affiliate marketing doesn’t happen in a vacuum. It’s typically one of several marketing strategies a company is executing in concert. If you look at how each channel plays a role in customer sales, you get a fairly clear picture of which channels should be attributed to each sale. By resolving which channels create a higher cost of customer acquisition, you can optimize to help reduce those customer acquisition costs over time.

Analyzing how each marketing channel is involved in customer acquisition helps determine your overall marketing budget allocation. Affiliates are not immune to this analysis.

How Affiliates Get Credit In Multi-Touch Attribution

Sometimes the affiliate marketing channel is the only marketing channel involved in a purchase. Sales that never touch another channel are the gold of affiliate marketing, because they are the sales you would miss out on without affiliates.

More frequently, the affiliate channel is one of two or more channels involved in the purchase process. To further complicate matters, when the affiliate channel is one of several channels, it can either be the last click or an earlier step in the multi-attribution funnel.

In some cases, the purchaser arrives at a page where the affiliate cookie gets set, then leaves and makes a purchase via the PPC channel sometime before the affiliate cookie expires. Other times, the purchaser may click a PPC link, fail to make a purchase, but later purchase via an affiliate link. In both scenarios, the affiliate marketing channel played a part in the sale, but the role was different.

Regardless of whether the affiliate channel delivered the first, second, fifth or last click, the affiliate channel is just part of the marketing cost in a multi-touch scenario.

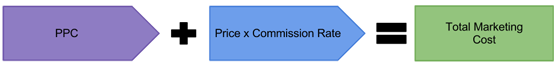

The Total Marketing Cost Formulas

If you are starting from scratch with a brand new product, you may have to guess at what the marketing cost per customer should be. For an established product, you can take historical data and arrive at acceptable marketing costs for each acquired customer. Either way the total cost of marketing involved in the acquisition of a single customer is the sum of all marketing dollars spent acquiring the customer.

If the affiliate channel is the only marketing channel influencing a purchase, the math to calculate the marketing costs per sale is simple:

Affiliate Only

If there are more marketing channels involved in the transaction, the marketing cost is the combined total of all channels. For the sake of simplicity, I’ll use just two channels, PPC and Affiliate.

Affiliate + PPC

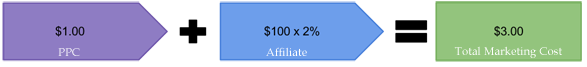

Keeping the numbers in line with the referenced tweet, if you have a $100 product with a 2% commission, formula A becomes:

When you add PPC to the mix, you need to know the price per click. Typically you would need an average of all clicks to find the average dollars spent in PPC to acquire a customer, but to keep the math simple, I’m going to assume that each click results in a sale. Clicks cost $1.

In formula B the costs break down like this:

In this example, when a purchase involves both the affiliate marketing channel and the PPC channel, the total marketing cost is 50% higher.

What if the commission is reduced to 1%, while the PPC costs remain the same?

By reducing the affiliate commission, the company brings their per-sale marketing cost back in line.

Why Affiliate Commissions Are Budget Dependent

While I don’t know the specifics of the affiliate program referenced in the tweet that inspired this article, the timing matches something I’ve seen in past years – when companies increase spending in other marketing channels during the holiday shopping season, they often temporarily decrease affiliate commissions.

In the past, I asked a few affiliate managers why they were decreasing commissions during the holidays. The answer was fairly consistent. The affiliate managers decreased affiliate commissions during periods of increased marketing expenses across all channels because the total cost of acquiring a customer went up significantly if they didn’t.

The general view being that affiliates benefited from the additional advertising happening in PPC channels, via social media, and through various display campaigns. Affiliate were generating more sales, but they were also receiving benefits from the company advertising campaigns.

In one specific case, I generated almost exactly the same revenue with a reduced commission as I had the previous month when I had a 30% higher commission rate. While one instance is certainly too small a sample size to validate the claim, it was refreshing to see that the company hadn’t simply cut my commission for their own gain.

A Better Approach To Balancing Budgets?

There are other alternatives to reducing the affiliate commission. It’s possible to shorten the cookie life, so that the only channel credited with the sale is the last click. The company could opt to only payout the last click, so that an affiliate cookie set prior to the last click receives no credit. A better solution may be to establish weighted payouts to reflect the proximity between the purchase and the affiliate click, but honestly I’m not entirely convinced any of these options is better than reducing the commission. How would you approach the challenges of balancing the marketing budget?

Author

Becky is the Senior Content Marketing Manager at TUNE. Before TUNE, she handled content strategy and marketing communications at several tech startups in the Bay Area. Becky received her bachelor's degree in English from Wake Forest University. After a decade in San Francisco and Seattle, she has returned home to Charleston, SC, where you can find her strolling through Hampton Park with her pup and enjoying the simple things in life.

Great explanation Jake.

I can appreciate the issues a business faces with managing their affiliate program but I’m not convinced adding all the additional complexity into the system would yield a long term benefit.

For example, while on paper using weighted attribution or some other method to better allocate commission to the relevant participants – the longer term view is that overall system complexity increases.

A business might find that while on paper it makes sense, that long term is is detrimental to the affiliate program at large as existing or new affiliates are scared away or are reluctant to sign up because they don’t know what they’ll earn for their efforts.

Trying to explain to two quality affiliates that affiliate A earns more per sale because they were further up the funnel compared to affiliate B who was further down the funnel would be difficult at best, nigh impossible and trying to be transparent with that would also be quite hard.

Next up I’d imagine that very few ecommerce platforms would support paying commissions to several or potentially unlimited participants in a transaction, if you were to walk the weight attribution path.

What experience have you had trying out different possible solutions to this problem?

nice explanation – thank you. It’s the age old problem that many hands often make a sale – and that raises commissions. So there are reasons – I’ve experienced them in other sales channels – see your point. Now – the solution! Will be interesting to follow that discussion.

Perhaps one could reduce the amount they pay Has Offers per month in relation to the profitability of their Affiliate channel? Could be simpler that annoying a few hundred hard working affiliates.

HasOffers doesn’t have any visibility into how profitable any given affiliate program. We track conversions, but it’s up to the individual program to do their own analysis of what is an acceptable cost of acquisition.

Also, HasOffers pricing isn’t based on how much commission is paid out to affiliates.