Traditionally, the holiday season is a time for giving — and the millions of new phones and tablets that will be given as gifts create a massive opportunity for developers to capture lots of new loyal users for their apps.

But it’s not all good news.

While the holidays clearly power massive app downloads and in-app purchases, many app developers can’t access their earned revenues quickly enough to invest in critical user acquisition campaigns that will allow them to ride the wave of their success well into the new year.

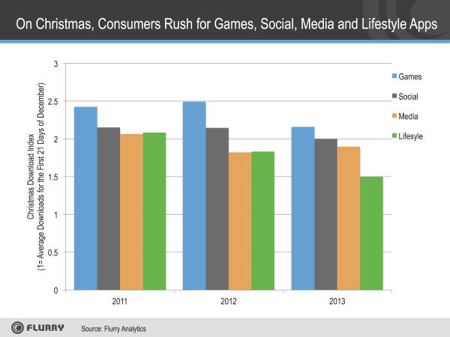

This is a dangerous disconnect if we consider just how important — and lucrative— the holidays season is for your app. When the iPhone 5s was released in 2013, daily app downloads increased by a whopping 70% in the few days after release, a trend that continued well into the holidays. In fact, 2013 was the biggest Christmas yet for mobile app downloads, according to Flurry, a mobile analytics, monetization, and advertising company. It found downloads were up 91% on Christmas day, compared to an average day in December. Overall, app downloads increased by 11% on Christmas 2013 compared to Christmas 2012.

Despite some evidence that the Christmas download spike is diminishing over time as the app market matures and globalizes, analysts are bullish about the outlook for app downloads over the holidays (particularly in view of the successful launches of the iPhone 6 and iPhone 6 Plus, along with the release of Apple’s new mobile operating system iOS 8).

They even expect Apple to set a new sales record during this holiday shopping season. At KGI Securities, analysts are betting Apple will sell 71 million iPhones, while others reckon it will be closer to 65 million as users migrate to the iPhone 6. But even if Apple reach that number, which is larger than the total population of the UK, it is more than enough reason for app developers to be positive about the outlook for their app business over the holiday season. And that’s not even factoring in the tremendous impact from the raft of new Samsung devices on the market.

Connect the dots, and the activity and excitement among new users centered on exploring the wealth of apps for their devices means a boom time for both user acquisition campaigns and click-through rates on mobile ads. It’s why app store analytics companies report mobile click-through rates build throughout the holiday season and peak on New Year’s Day, when CTRs can jump as much as 37 percent over the yearly average.

But, as I said, it’s not all good news.

As the number of apps grows, so does the average cost per install (CPI). App marketing technology provider Fiksu claims that cost of user acquisition is rising through the roof, driven by a variety of market factors that range from the release of Apple’s new mobile operating system iOS 8 to big brands paying big bucks to buy real estate on a consumer smartphone.

As a result, the costs associated with retaining a “loyal user” – that is, someone who opens an app three times or more – is a metric that has jumped 21% to reach $2.25 in September 2014, up from $1.86 in August. Year-over-year, the figure has risen by 34%, and Fiksu says costs are sure to skyrocket during the holiday season ahead — a boom period it notes has become longer and now extends well past the New Year and into February.

But even a longer holiday season can’t help app developers win big if they can’t unlock their revenues to invest rapidly in user acquisition campaigns to achieve and maintain the high visibility needed in the app stores to acquire (and keep) valuable users for the app.

Granted, the holiday season is both the most expensive and rewarding time of the year to market apps. But is also the most challenging as many app developers, waiting up to 60 days to get paid for their app sales or in-app purchases from the leading app stores, run out of steam. Unable to unlock the revenues they have earned and rapidly reinvest these funds into paid advertising campaigns, many app developers must watch as their holiday hits end up on the heap.

In fact, new data (based on internal research by Pollen VC in collaboration with Priori Data, a mobile application market analytics company) shows that both daily downloads and revenues for app developers post-feature fizzle out within a matter of a few weeks. Simply put, app revenues tend to plummet inside of just 30 days — precisely the period that app developers need the liquidity and flexibility to double-down on user acquisition in order to boost their profile and their downloads.

To plug this ‘funding gap’, the critical period between the time that an app developer chalks up an app sale or in-app purchase and the actual date that app stores pay out, app developers are faced with a tough choice. They can either deploy their venture funding to acquire more users, or they can watch as their leading app slips into the ranks of the ‘also-rans’.

Both are suboptimal outcomes since it’s common sense that spending VC cash, rather than unlocking app store revenues, to acquire users for apps is a risky business. For VCs, it’s an inefficient way to deploy capital. For startups, it’s an approach that is needlessly dilutive, forcing them to hand over more equity (and control) when there are clearly other options.

This is where (and why) app developers would benefit from a new model, one that would allow app developers to unleash receivables to rapidly reinvest in user acquisition campaigns and take their apps to the all-important ‘next level’.

There is now a solution to this problem. One where App developers can partner with firms that will help them access revenues they’ve already earned from the app store within 7 days, rather than the usual 30-60 days. Independent developers often face problems getting credit terms from the ad networks, which means that even if they do have the funds, there are limits on the amount of paid advertising they can purchase through self-serve, especially if they have to purchase with a credit card. To remove these credit barriers, certain firms can work with top ad networks to enable their clients’ to channel their app store revenues directly into user acquisition and help remove these credit barriers.

A more flexible model, one that would allow app developers to reinvest their revenues in user acquisition campaigns, would ultimately permit app developers to prolong their success long past the holiday season, and rise to new heights in 2015.

Author

Becky is the Senior Content Marketing Manager at TUNE. Before TUNE, she handled content strategy and marketing communications at several tech startups in the Bay Area. Becky received her bachelor's degree in English from Wake Forest University. After a decade in San Francisco and Seattle, she has returned home to Charleston, SC, where you can find her strolling through Hampton Park with her pup and enjoying the simple things between adventures with friends and family.

Leave a Reply

You must be logged in to post a comment.